美國經(jīng)濟是否健康,請密切關注這9大指標

|

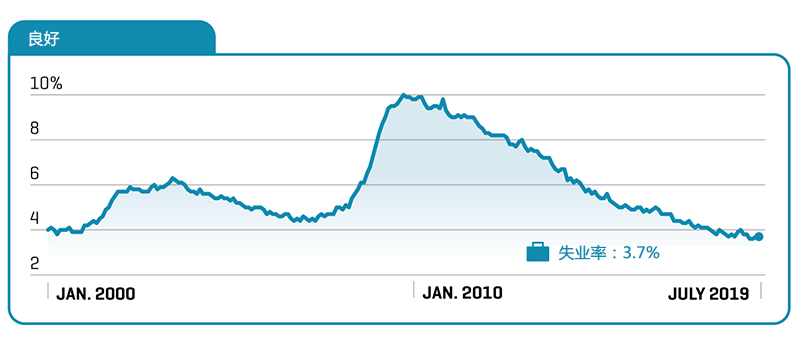

今年7月下旬,美聯(lián)儲(Federal Reserve)時隔11年終于再次降息,這究竟是對美國經(jīng)濟關切擔憂的回應,還是對政治壓力的屈服?眾說紛紜。不過經(jīng)濟衰退的警告標志已經(jīng)顯現(xiàn),多數(shù)經(jīng)濟學家如今認為下次降息將會發(fā)生在2020年美國大選之前。我們正在密切關注以下九大指標,借此判斷經(jīng)濟的健康狀況。 失業(yè)率 美國失業(yè)率處于歷史低點,而且仍然有下行趨勢。 |

Opinions are split on whether the Federal Reserve responded to genuine concerns for the U.S. economy in cutting interest rates for the first time in 11 years in late July, or simply bowed to political pressure. But the warning signs of recession are showing themselves—and a majority of economists now believe the next cuts will come before the 2020 elections. We’re keeping an eye on these nine key metrics to judge the health of the economy. Unemployment Rate The U.S. unemployment rate is at historically low levels and is still trending downward. |

|

消費者信心 消費者保持著樂觀態(tài)度,而且還在越來越樂觀。 |

Consumer Confidence Consumers are bullish, and they’re getting more so. |

|

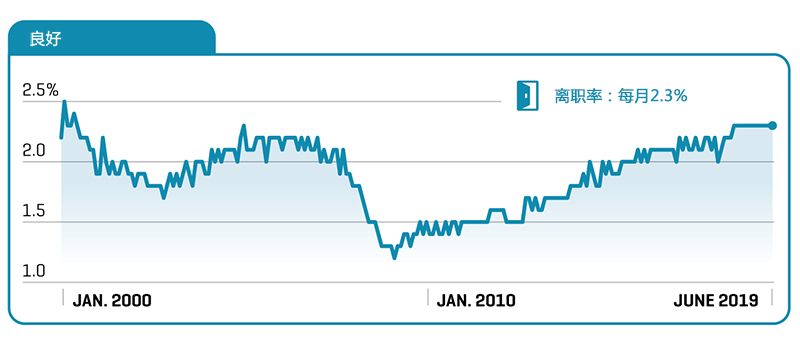

離職率 更多美國人在主動離職,這是對經(jīng)濟前景抱有信心的標志。 |

Quits Rate More Americans are leaving their jobs voluntarily, a mark of economic confidence. |

|

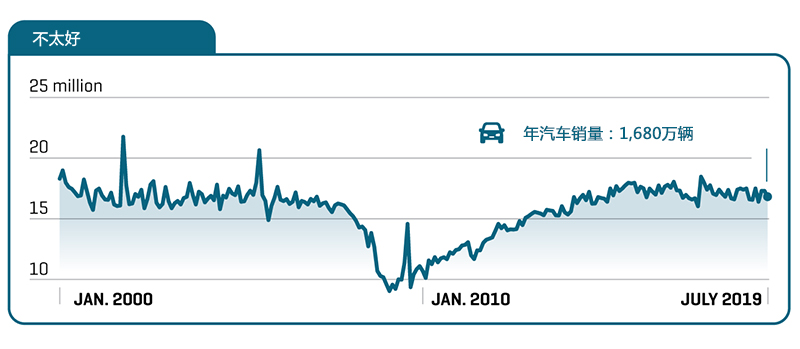

汽車銷量 汽車銷量在美國是一個核心經(jīng)濟指標,它在2017年達到頂峰,并開始逐漸下滑。 |

Vehicles Sold U.S. auto sales, a core economic indicator, peaked in 2017 and are trending down. |

|

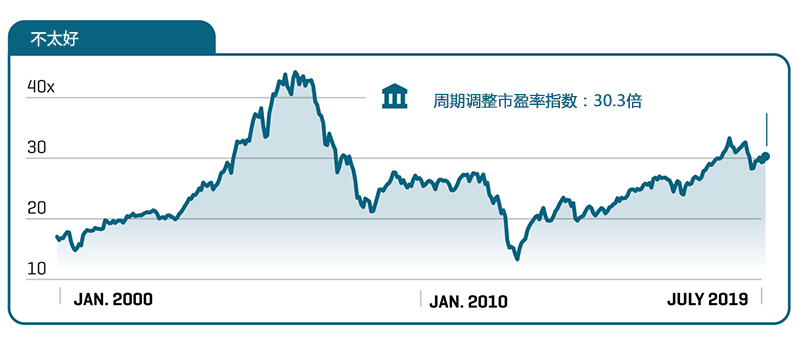

股票估值 羅伯特·席勒的周期調(diào)整市盈率指數(shù)表明未來的回報率較低。 |

Stock-Price Valuation Robert Shiller’s cyclically adjusted P/E ratio index indicates low future returns. |

|

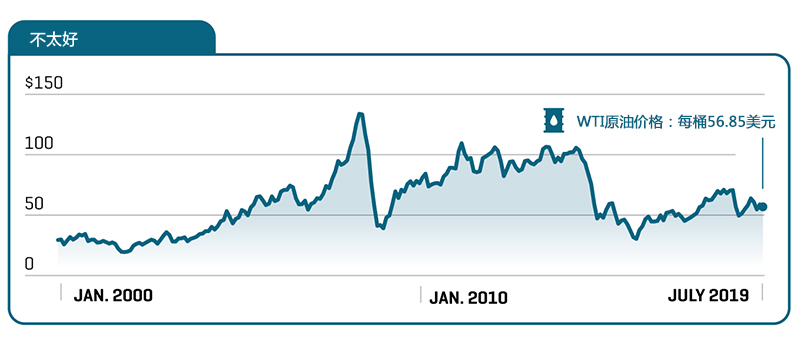

原油價格 低迷的原油價格表明工業(yè)需求疲軟,這一信號令人擔憂。 |

Oil Prices Anemic oil prices reflect weak industrial demand—a concerning sign. |

|

新建筑許可 新的房屋建設停滯不前,從未恢復到金融危機之前的水平。 |

New Building Permits New housing construction is stalling—and never reached pre-crisis levels. |

|

ISM制造業(yè)指數(shù) 該指數(shù)已經(jīng)逼近50。在這一基準線以下容易出現(xiàn)衰退。 |

ISM Manufacturing Index The index is approaching 50. Recessions tend to happen below that level. |

|

收益曲線 長期債券的利率已經(jīng)低于短期債券,這是衰退的另一個跡象。(財富中文網(wǎng)) |

The Yield Curve Long-term bond rates are below short-term rates, another recession indicator. |

|

來源:美國人口統(tǒng)計局;美國勞工統(tǒng)計局;世界大型企業(yè)聯(lián)合會;彭博社;羅伯特·席勒;美國供應管理協(xié)會 本文另一版本登載于《財富》雜志2019年9月刊,標題為《經(jīng)濟黃色警報》。 譯者:嚴匡正 |

Sources: Census Bureau; Bureau of Labor Statistics; The Conference Board; Bloomberg; Robert Shiller; Institute for Supply Management A version of this article appears in the September 2019 issue of Fortune with the headline “Code Yellow for the Economy.” |