美國已出現(xiàn)經(jīng)濟(jì)衰退指標(biāo),市場下行還有多遠(yuǎn)

|

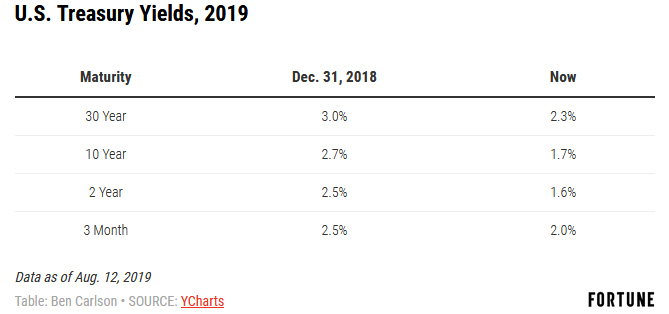

對于金融市場的參與者來說,今年的最大意外之一,就是利率的大幅下降。《華爾街日報》今年1月曾經(jīng)對69名經(jīng)濟(jì)學(xué)家進(jìn)行過調(diào)查,沒有一個人預(yù)見到10年期國債利率到6月時會跌破2.5%(實際上,6月的10年期國債利率已經(jīng)迫近2%)。這些專家的平均預(yù)測值是3%。實際上,它目前已經(jīng)逼近了1.7%。 10年期國債利率是人們衡量利率環(huán)境時最經(jīng)常使用的一個指標(biāo)。不過當(dāng)它出現(xiàn)變動時,其它期限的國債收益率并不會以平行的方式跟著變動。所以雖然今年10年期國債的利率出現(xiàn)了跳水,但是其他國債的利率并未呈現(xiàn)同等劇烈的波動,特別是那些短期國債。現(xiàn)在就讓我們來看看,2019年年初以來,美國不同期限的國債的利率的變動情況: |

One of the biggest surprises to market participants this year has been the big move lower in interest rates. When the Wall Street Journal polled 69 economists in January, not a single one predicted 10 year treasury rates would fall below 2.5% by June (the actual rate was closer to 2% by then). The average forecast from this group of experts was 3%. The 10 year is currently yielding close to 1.7%. The 10 year is the benchmark most people look at when gauging the interest rate environment but when yields move they never do so in a parallel manner across the different maturities. So even as the 10 year has dropped like a rock in 2019, other parts of the yield curve haven't moved as much, most notably, rates that are shorter in duration. Here is a look at how various maturities in U.S. treasuries have changed from the start of 2019: |

|

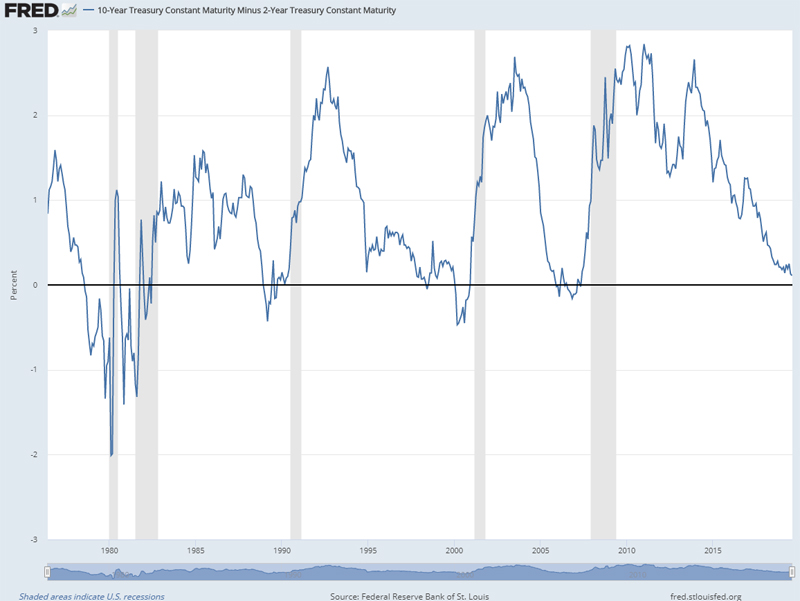

從上圖中我們可以注意到,3個月的短期國債收益率已經(jīng)超過了10年期和2年期國債的利率,而30年期國債正在迅速逼近2%大關(guān)。大家都知道,在“正常”環(huán)境下,長期國債利率必然高于短期,原因很簡單,持有的時間長了,投資者就必然要承擔(dān)更多的風(fēng)險和更大的波動。 長期國債利率和短期國債利率之間的差異又被稱為收益率曲線。在一個健康的經(jīng)濟(jì)環(huán)境中,這條曲線應(yīng)該是向上傾斜的。而當(dāng)債券投資者對經(jīng)濟(jì)放緩感到擔(dān)憂時,這條曲線就會發(fā)生翻轉(zhuǎn),即短期國債的收益率高于長期國債。早在20世紀(jì)70年代末,收益率曲線翻轉(zhuǎn)就被當(dāng)作預(yù)示經(jīng)濟(jì)衰退即將來臨的一個可靠指標(biāo)了。 |

You’ll notice 3 month t-bills yields now exceed the 10 year and 2 year rates while the 30 year is fast approaching the 2% threshold. In a “normal” environment we would expect longer-term rates to be higher than short-term rates for the simple fact that investors must accept more duration risk, or volatility, in their bonds by going further out on the maturity spectrum. The difference between long-term rates and short-term rates is called the yield curve. In a healthy economic environment, it should be upward sloping. When bond investors become worried about the economy slowing, it tends to invert, where short-term bonds yield more than long-term bonds. Going back to the late-1970s, an inverted yield curve has been a reliable indicator of a coming recession: |

|

那么,這個信號一旦出現(xiàn),多久后便會發(fā)生經(jīng)濟(jì)衰退呢?這個倒不一定,只不過每次發(fā)生了10年國債利率低于2年國債利率的情況,經(jīng)濟(jì)衰退最終總會發(fā)生。從收益率曲線反轉(zhuǎn)到衰退開始發(fā)生,平均間隔時間大約為17個月左右,具體到每一次的時間則稍有不同。 |

This signal hasn’t worked on a set schedule but every time the 10 year treasury has yielded less than the 2 year treasury, a recession has shown up eventually. The average lag time is roughly 17 months from the time the yield curve inverts until the onset of a recession, but the timing of the results can vary. |

|

在經(jīng)濟(jì)衰退時期,股市的表現(xiàn)自然好不到哪去,所以每次短期國債利率超過長期國債利率時,投資者都想知道這對他們的股票意味著什么。 尤金·法瑪和肯·弗蘭奇最近發(fā)表了一篇題為《反向收益率曲線與預(yù)期股票回報》的研究論文。作者在此研究中收集的數(shù)據(jù)可以回溯到1975年,涵蓋了11個主要的股票和債券市場,以確定當(dāng)收益率曲線翻轉(zhuǎn)時,證券市場的表現(xiàn)是否還不如短期國債(短期國債幾乎可以算作現(xiàn)金的一種替代模式)。他們比較了6種不同的收益率曲線,當(dāng)任何一條收益率曲線翻轉(zhuǎn)時,就將股市資金抽出投入國債。然后他們會對未來1年、2年、3年和5年進(jìn)行觀察,看看從股市轉(zhuǎn)移到國債市場后會發(fā)生什么。 兩名作者的結(jié)論是:“我們未發(fā)現(xiàn)有證據(jù)表明當(dāng)反向收益率曲線出現(xiàn)時,股市表現(xiàn)在1年、2年、3年和5年的預(yù)測周期內(nèi)會遜于美國國債。”他們選取了三個廣域市場進(jìn)行對比,分別是美國股市、全球股市,以及除了美國之外的全球股市。在美國股市和全球股市的全部24個反向收益率曲線的案例中,從股票轉(zhuǎn)向國債(現(xiàn)金)的策略,都不如“買入+持有”的做多策略。在除美國之外的全球市場的24個收益率曲線反轉(zhuǎn)的案例中,也有19個案例出現(xiàn)了同樣的結(jié)果。 沒有人知道將來收益率曲線是否會成為一個可靠的經(jīng)濟(jì)指標(biāo)。畢竟信心才是市場的基石,光是投資者知道了有這么一個信號的簡單事實,就有可能改變其未來的預(yù)測作用。 不過即便有事實表明反向收益率曲線真的是預(yù)測經(jīng)濟(jì)衰退的一個可靠指標(biāo),它也不太可能幫助你在股市里撈到一筆。股市和經(jīng)濟(jì)的步調(diào)很少是一致的。因此,盡管反向收益率曲線的出現(xiàn),意味著未來幾年很可能會出現(xiàn)經(jīng)濟(jì)衰退,但這并不意味著你可以用它來判斷進(jìn)入股市的時機(jī)。(財富中文網(wǎng)) 本文作者本·卡爾森(Ben Carlson)是里薩茲財富管理公司(Ritholtz Wealth Management)的機(jī)構(gòu)資產(chǎn)管理總監(jiān)、注冊金融分析師。 譯者:樸成奎 |

Recessionary periods typically aren’t great for the stock market so as we enter an environment where short-term bonds yield more than long-term bonds, investors are wondering what this means for their stocks. Eugene Fama and Ken French recently published a research paper on the topic called Inverted Yield Curve and Expected Stock Returns. Fama and French took their dataset back to 1975, across 11 major stock and bond markets to determine if an inverted yield curve could predict the stock market underperforming short-term treasury bills (a proxy for cash). They compared six different yield spreads, switching from stocks to t-bills when any of these yield curves inverted. Then they looked out over the next one, two, three, and five year periods to see what happened when switching from stocks to cash. The duo’s conclusion states that, “We find no evidence that inverted yield curves predict stocks will underperform Treasury bills for forecast periods of one, two, three, and five years.” They compared three broad market indexes, using the U.S. stock market, the World stock market, and the World ex-U.S. stock market. The switching strategy of going from stocks to cash underperformed a long-only buy and hold strategy in all 24 instances using the U.S. and World markets. The yield curve signal also underperformed in 19 of 24 World ex-U.S. backtests. No one knows if the yield curve will work as a reliable economic indicator going forward. It’s possible the simple fact that investors are now aware of this signal could alter its usefulness going forward. But even if an inverted yield curve does prove itself as a reliable recessionary indicator, the data doesn’t necessarily allow you to take advantage in the stock market on a consistent basis. The stock market and the economy rarely move in lock-step with one another. So while an inverted yield curve could mean we see a recession sometime in the next couple of years, that doesn’t make it any easier to time the stock market. Ben Carlson, CFA is the Director of Institutional Asset Management at Ritholtz Wealth Management. |