安德瑪庫存水平改善,北美業務仍堪憂

|

上周四,安德瑪發布了一則好消息,公司的庫存水平有所改善,而公司的利潤率也因此得到了保護。

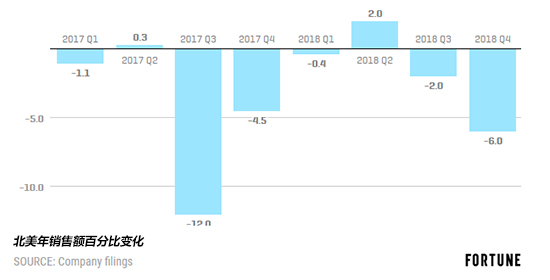

壞消息在于,隨著這家體育用品制造商減少折扣力度,并更加關注銷售的產品和場所,安德瑪的北美銷售業績在第四季度繼續下滑,在截至12月31日的季度下跌了6%,超過了安德瑪近幾個季度的跌幅。這個業績與耐克相比可謂是十分慘淡,因為耐克在最近截至11月30日的季度斬獲了9%的增幅。北美市場是安德瑪目前最大的市場,占公司總業務量的71%。

安德瑪正努力恢復其北美業務的增長

這家體育產品公司正想法設法解決北美本土業務存在的問題。 |

The good news from Under Armour (uaa, -3.56%) on Tuesday was that it is getting a better handle on inventory levels, and by extension, protecting profit margins.

The bad news is that sales in North America—its biggest market by far, generating about 71% of Under Armour’s total business—continued to fall in the fourth quarter, as the sports gear maker reins in discounting and is more selective about what it sells and where, slipping 6% in the quarter ended December 31. That was a deeper fall than Under Armour’s declines in recent quarters, and a dismal performance compared to Nike (nke, +1.21%), where it rose 9% in its most recent quarter, one that ended November 30.

Under Armour Is Struggling to Get Back to Growth in N. America

The sports company is looking to fix its business at home. |

|

但北美的業績源于安德瑪為挽回其頹勢而喝下的一劑猛藥。根據2017年公布的重組計劃(隨后修訂過幾次),安德瑪一直在通過重組業務來控制成本,降低庫存,并加速其產品上市時間以更快地根據需求進行調整,同時收斂了對利潤率有負面影響的折扣舉措。

從這一方面來講,安德瑪已經取得了一些成果:第四季度,總利潤率增長了1.6個百分點,達到了銷售額的45%,幫助公司扭虧為盈。公司第四季度凈收益達到了420萬美元,作為對比,公司去年同期虧損了8800萬美元。第四季度總銷售額增長了1.5%,達到了13.9億美元,得益于歐洲和亞洲銷售額的大幅增長抵消了北美的業務頹勢。

但安德瑪依然面臨著比利潤問題更加嚴重的營收問題,而且其煩惱根植于自己的故土北美。公司預計今年北美銷售額不會發生變化或最多出現4%的增長。盡管這個增幅依然算不上有多出眾,但考慮到當前的趨勢,耐克和阿迪達斯的強勢增長,以及Lululemon Athleta在運動裝備領域的持續走紅,要實現這一點也絕非易事。

安德瑪首席執行官凱文·普蘭克對分析師明確表示,他認為成功秘訣在于,公司應專注于為裝備配備有助于提升運動員表現的技術,以及品牌的原創理念,而不是跟風模仿任何競爭對手。

他對華爾街的分析師說:“公司今天的弱點實際上將成為我們未來最大的優勢。世界并不需要另一個品牌的翻版,哪怕這種模仿在眼下可能依然行得通。”安德瑪的股價上漲了5%,顯示了投資者開始對公司重拾信心。盡管如此,公司目前21美元的股價還不到4年前的五分之一,而這也預示了安德瑪未來道路的艱辛。(財富中文網) 譯者:Pessy 審校:夏林 |

But the North American results stem from the tough medicine Under Armour has been taking to right its business. Under a restructuring plan unveiled in 2017, which it has tweaked a few times, Under Armour has sought to restructure operations to rein in costs, keep leaner inventories and speed up its time to product to adjust more quickly to demand, and rein in margin-harming discounts.

And on that front, Under Armour has scored some points: In the fourth quarter, gross margin profit rose 1.6 percentage points to 45% of sales, helping it return to profit. The company posted a net income of $4.2 million for the quarter, compared to an $88 million loss a year earlier. Total sales during the quarter rose 1.5% to $1.39 billion, lifted by big gains in Europe and Asia that offset weakness at home.

But Under Armour faces a top line problem, much more than a bottom line one. And its troubles reside firmly at home. The company expects sales in North America to be unchanged to up as much as 4% this year, still tepid. But that won’t be easy, considering its current trends, and the strong growth at Nike and Adidas, not to mention the ongoing success of Lululemon Athleta in athletic gear. (lulu, +5.10%)

Under Armour CEO Kevin Plank made it clear to analysts that in his mind, the path to success will be to focus on the technical aspects of its gear that enhance an athlete’s performance, the original raison d’être of the brand, rather than becoming a pale version of any rival.

“Weakness for us today is actually going to be our greatest strength,” he told Wall Street analysts. “The world doesn’t need another version of a brand that may be working today.” Under Armour shares rose 5%, showing the renewed faith investors are starting to develop. Then again, at $21, shares are barely one-fifth where they were four years ago, confirming the tough slog ahead for Under Armour. |