人工智能越來越熱,誰能賺大錢?

|

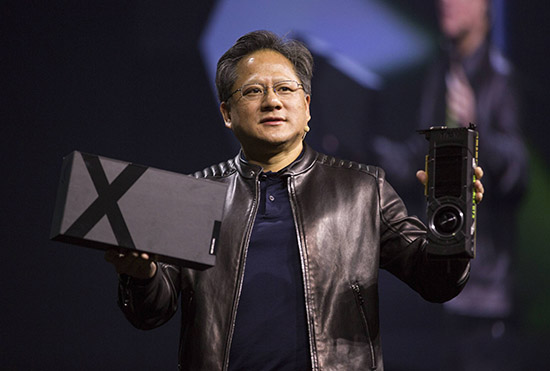

每一波重大的科技浪潮襲來時(shí),都會(huì)產(chǎn)生幾家非常有價(jià)值的科技公司,有的市值甚至?xí)_(dá)到幾千億美元。不過在這股浪潮襲來之初,通常很難判斷誰才會(huì)成為“大贏家”。 然而只要你研究過科技史,你就會(huì)發(fā)現(xiàn),當(dāng)這些技術(shù)浪潮襲來時(shí),有兩類公司的價(jià)值和收入增長得最快:一類是生產(chǎn)底層系統(tǒng)和半導(dǎo)體硬件的公司,另一類是生產(chǎn)終端軟件或應(yīng)用的公司。 比如在PC時(shí)代,最有價(jià)值和盈利最多的“大贏家”是搞半導(dǎo)體的英特爾和做垂直應(yīng)用的微軟。(半導(dǎo)體就是計(jì)算機(jī)芯片,垂直應(yīng)用就是為特定用途設(shè)計(jì)的軟件。)到了移動(dòng)時(shí)代,半導(dǎo)體和硬件端的大贏家是高通和ARM,重直應(yīng)用端的大贏家則是Uber、WhatsApp和Instagram等等,它們都有了幾百億美元的市值。其它幾次技術(shù)浪潮也各自催生出了自己的弄潮兒,比如網(wǎng)絡(luò)領(lǐng)域的博通和游戲領(lǐng)域的英偉達(dá)等等。 現(xiàn)在,一股新的科技浪潮正在席卷世界,它就是機(jī)器學(xué)習(xí)和人工智能。它跟以往的技術(shù)浪潮大同小異,也會(huì)在半導(dǎo)體和終端用戶垂直應(yīng)用領(lǐng)域里催生出一批新的“大贏家”。 現(xiàn)在看來,在人工智能技術(shù)上,半導(dǎo)體領(lǐng)域的頭號玩家是英偉達(dá),它的圖形處理芯片已經(jīng)被人工智能界廣泛采用。不過英偉達(dá)的芯片并未專門針對人工智能應(yīng)用進(jìn)行優(yōu)化。除了英偉達(dá)之外,還有Cerebras、Graphcore和Groq等公司也在該領(lǐng)域發(fā)力,有望開辟出一個(gè)全新的細(xì)分市場。 然而正如英特爾在移動(dòng)領(lǐng)域建樹有限,英偉達(dá)也有可能錯(cuò)過這一新的市場趨勢,畢竟它的現(xiàn)有芯片架構(gòu)是針對其他用途(如視頻游戲和其他圖形處理功能)優(yōu)化的。從歷史經(jīng)驗(yàn)來看,這一細(xì)分市場必然會(huì)出現(xiàn)一家市值幾十億美元的創(chuàng)業(yè)公司。從風(fēng)險(xiǎn)投資的角度看,相比于人工智能的發(fā)展前景,這一領(lǐng)域的投資依然是相對不足的。 而在軟件方面,也必然會(huì)出現(xiàn)幾個(gè)垂直應(yīng)用領(lǐng)域的“大贏家”。雖然目前也有一些“橫向”的公司試圖構(gòu)建通用的人工智能解決方案,但從短期市場來看,他們不大可能取得成功。短期最有可能成功的很可能是那些針對特定終端用戶應(yīng)用場景的公司。 在應(yīng)用領(lǐng)域,很可能會(huì)有三類“大贏家”: 首先,一些擁有海量數(shù)據(jù)的互聯(lián)網(wǎng)巨頭很可能成為行業(yè)的主導(dǎo)者。比如谷歌、Facebook、亞馬遜和蘋果都等公司都大規(guī)模地部署了自己的人工智能程序,用于廣告定位、搜索和語音識別等方面。這些科技巨頭在人工智能領(lǐng)域里處于遙遙領(lǐng)先地位,此外他們還擁有大量專有數(shù)據(jù),必然能給用戶帶來有價(jià)值的應(yīng)用。 其次,目前一些新的垂直應(yīng)用創(chuàng)業(yè)公司也正在興起。很多公司都在利用人工智能技術(shù)在不同市場上開發(fā)新的應(yīng)用,比如無人汽車領(lǐng)域的Cruise和Waymo、貨運(yùn)物流領(lǐng)域的Samsara、醫(yī)療領(lǐng)域的Color Genomics和Athelas、金融科技領(lǐng)域的Affirm和Stripe等等。很多公司開發(fā)的產(chǎn)品已顯著好于目前的主流產(chǎn)品,因?yàn)槿斯ぶ悄苷沁@些產(chǎn)品的核心特色。 第三,有些非科技領(lǐng)域的傳統(tǒng)企業(yè)可能會(huì)利用人工智能技術(shù)釋放他們的數(shù)據(jù)潛能,這些公司也非常值得關(guān)注。各個(gè)企業(yè)的大公司都坐擁海量的數(shù)據(jù)。比如喜達(dá)屋酒店及度假村集團(tuán)在房地產(chǎn)和酒店領(lǐng)域擁有龐大的業(yè)務(wù),如果用人工智能技術(shù)挖掘這些數(shù)據(jù)的潛力,必然會(huì)在定價(jià)、信用檢查、出租業(yè)務(wù)等多個(gè)方面對公司更有裨益。同理,Visa、萬事達(dá)和美國運(yùn)通等企業(yè)也都擁有海量的數(shù)據(jù),可用于電商和信貸等多種用途。 可以想見,如果企業(yè)能夠合理利用這些數(shù)據(jù),就不難產(chǎn)生新的收入流。這很可能產(chǎn)生一種新的私有股權(quán)模式,即私募機(jī)構(gòu)或大型風(fēng)投公司買斷一些傳統(tǒng)公司,只是為了將這些公司的數(shù)據(jù)用于新的用途。 總之,與之前的幾波科技浪潮一樣,人工智能的真正價(jià)值應(yīng)該也會(huì)集中在兩類公司:一類是那些做底層硬件系統(tǒng)和半導(dǎo)體的公司,一類是那些做人工智能垂直應(yīng)用的公司。這種整合很可能引起整個(gè)科技行業(yè)的連鎖反應(yīng)。估計(jì)在不久的未來,就會(huì)有私人投資者加倍下注那些做半導(dǎo)體和做AI垂直應(yīng)用的公司,同時(shí)也會(huì)有一些私募公司瞄準(zhǔn)那些坐擁大量數(shù)據(jù)的傳統(tǒng)企業(yè)。 人工智能行業(yè)可能不會(huì)出現(xiàn)很多“大贏家”,而真正捕捉到這次商機(jī)的人則會(huì)實(shí)現(xiàn)顯著的利潤。(財(cái)富中文網(wǎng)) 本文作者埃拉德·吉爾是一位連續(xù)創(chuàng)業(yè)人、科技行業(yè)經(jīng)理人和天使投資人。他也是Color Genomics的聯(lián)合創(chuàng)始人之一,還是Athelas、Groq、Cerebras和Stripe等公司的投資者之一。 譯者:樸成奎 |

Every major technology wave yields a small number of extremely valuable companies worth tens to hundreds of billions of dollars. Often it’s difficult to predict who the big winners will be when a major new technology emerges. However, if one studies the history of technology, the value and revenue of most technology waves tend to accumulate in two types of companies: those that produce underlying systems or semiconductors, and those that make end-user software or applications. For example, in the PC-era, Intel, which manufactured semiconductors, and Microsoft, which created vertical applications such as Microsoft Office, were the most valuable and profitable winners. (Semiconductors are computer chips and vertical applications are software designed for customized purposes.) In the mobile era, Qualcomm and ARM benefited on the semiconductor and hardware side, while vertical applications like Uber, WhatsApp, and Instagram emerged as companies valued in the tens of billions. Other technology waves that created major semiconductor companies include networking (Broadcom) and gaming (Nvidia). A new technology wave is currently sweeping the world—that of machine learning and artificial intelligence (A.I.). This new technology is likely to follow a similar course, in that the winners in the market will include both semiconductor companies and end-user vertical application companies. Right now, the dominant player in semiconductors for A.I. is Nvidia, whose graphic processing chips have been mostly adopted by the A.I. community. However, Nvidia chips are not optimized for A.I. applications, and a raft of new players, including Cerebras, Graphcore, and Groq, have risen to challenge the incumbent and to carve out a whole new market segment. Just as Intel never quite got its footing in mobile, it is possible Nvidia will also miss the new market trends due to its existing chip architecture being optimized for different purposes (video game and other graphics processing). If history is a guide, a startup will emerge with tens of billions of dollars of market capitalization in this segment. This area is underinvested in from a venture capital perspective, relative to its potential upside. On the software side, vertical applications should win again as well. While there are a number of “horizontal” companies trying to build general purpose A.I., they are likely to fail in the short-term market. The most probable winners in A.I. in the short run are likely to be companies that harness its power for specific end-user applications. There are likely to be three types of winners: First, expect large, data-rich Internet incumbents to dominate. Companies like Google, Facebook, Amazon, and Apple have already been deploying A.I. at scale for ad targeting, search, and voice recognition. These technology companies are far ahead of the curve and have proprietary datasets that they can use to find valuable applications for users. Second, new vertical application startups are emerging. Companies are using A.I. to build new types of applications in various markets, including autonomous vehicles (such as Cruise and Waymo), trucking and logistics (Samsara), health care (Color Genomics, Athelas), and fintech (Affirm, Stripe). A number of these companies will create products significantly better than those of existing vertical incumbents, since A.I. will be at the core of their offerings, versus tacked on. Third, look out for non-tech incumbents adopting A.I. tech to unlock their data. Large companies spanning industries are sitting on treasure troves of data. For example, Starwood Hotels & Resorts has an amazing footprint in real estate and hotels, and can use that dataset smartly for everything from pricing to credit checks on leases. Similarly, Visa, Mastercard, and American Express are sitting on massive datasets that can be applied to various consumer uses in e-commerce and credit. One can imagine these datasets generating new revenue streams if properly leveraged. This may lead to a new private equity model in which PE or large venture firms buy out incumbent companies with the idea of unlocking their data for new uses. As in prior technology waves, the real value should accumulate into a handful of companies: those building the underlying hardware systems and semiconductors and those far building vertical applications of A.I.. This consolidation will likely have ripple effects across the tech industry. Look for private investors to double down on companies producing semiconductors and A.I.-driven applications, and for PE companies to target large incumbents harboring considerable amounts of data. The A.I. wave may have few winners, but those who do catch it are likely to profit considerably. Elad Gil is a serial entrepreneur, technology executive, and angel investor. He is a co-founder of Color Genomics, and an investor in Athelas, Groq, Cerebras, and Stripe. |

-

熱讀文章

-

熱門視頻