沒戲了!兩位億萬富翁聯手扼殺施樂與富士的合并交易

|

卡爾·伊坎是一位典型的獨行俠。這位企業收購界的黑暗王子并不會像其競爭對手激進投資者一樣,集結一批外部律師、投行家和公關公司,然后再發起進攻,而是依靠一支不到12人的內部金融分析師和律師團隊,這支智囊團位于曼哈頓通用汽車大廈47樓,與這位82歲的老板一道不辭辛勞地工作著。但這僅僅是他的支持團隊。至于合作伙伴,呵呵,有這個必要嗎? 伊坎的公司Icahn Enterprises在今年的《財富》美國500強榜單上名列第136位,在財力方面基本上無需任何支持。他以現金和證券的形式握持著300多億美元的戰爭基金。在策略方面,他也無需同行的任何諫言。令伊坎引以為自豪的是,他向董事會發送的那些臭名昭著的攻擊信件都由他親自執筆,而且會在信中大肆地對那些鴕鳥般“不敢面對現實”的董事或那些為了“蠅頭小利”而同意出售公司的董事進行冷嘲熱諷。 |

Carl Icahn typically works alone. The dark prince of corporate raiders shuns the usual clutch of outside attorneys, investment bankers, and PR firms that rival activists assemble for their assaults. Instead, Icahn relies on an in-house team of fewer than a dozen financial analysts and lawyers, a brain trust that toils alongside their controversial, 82-year-old boss on the 47th floor of Manhattan’s General Motors Building. But that’s just his support staff. As for partners, well, what’s the point? Icahn, whose Icahn Enterprises ranks No. 136 on this year’s Fortune 500, hardly needs any financial backing. He commands a war chest in cash and securities of more than $30 billion. Neither does he crave any counsel from peers on strategy. Icahn prides himself on personally composing the notorious attack letters he sends to boards of directors, piling on outraged barbs to skewer “ostrich” directors “with their heads in the sand” or those who’ve agreed to sell their companies “for a bowl of porridge.” |

|

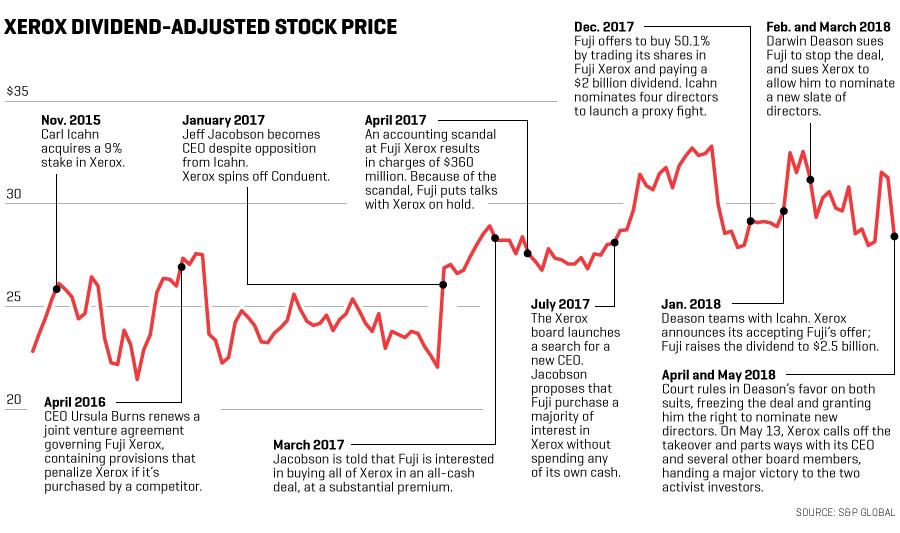

2015年底,當施樂成為伊坎的目標時,他無疑是打算再次啟用孤軍作戰的戰術。這家輝煌一時的企業對于伊坎來說是一個完美的候選目標。施樂由兩個毫不相關的業務組成,而且它們的業績均不盡如人意,一項業務是其傳統的辦公產品;另一項則是一個名為業務流程外包(BPO)的龐大部門,為公司和政府提供后臺賬單支付和數據處理服務。伊坎認為,他可以通過勸說施樂剝離其BPO業務來收拾這個殘局。施樂目前是一個沒人想買的爛攤子,但它可以分拆成兩家專業公司,而這兩個公司都可能會成為擁有高溢價的收購對象。如果拆分后仍沒有買家立即拋出橄欖枝,伊坎認為他可以通過更換管理層來改善業績,并通過抬升兩家公司的股價來改善盈利。 伊坎向《財富》雜志透露:“施樂是我所見過的經營最差的公司之一。公司的兩大業務均存在管理不善的問題。稍微有點頭腦的人都會將其拆分,并聘請新管理層。施樂在利用自身強大的品牌方面毫無建樹,有多少家公司的品牌還能夠作為人們所熟知的動詞(xerox的動詞意思為“用靜電復印法復印”——譯注)來用?” 伊坎在2017年初實現了其目標,當時,施樂剝離了其BPO業務,后者成立了一家名為Conduent的新公司。事實證明,這筆交易的一半到目前為止已經大獲成功:Conduent呈現出了一片欣欣向榮的景象,其穩健的股票業績為伊坎帶來了超過1億美元的回報。 |

It was certainly Icahn’s intention to go it alone again when, in late 2015, he identified Xerox as a target. The once-great company was an ideal candidate for Icahn. It consisted of two divergent businesses, both of which were performing poorly—its traditional office products franchise, and a large division that provided back-office bill-paying and data processing services to companies and governments, a field called business process outsourcing (BPO). Icahn reckoned that he could clean up by prodding Xerox to spin off its BPO arm. Instead of a muddled mass no one wanted to buy, Xerox would split into two pure-play companies—either of which could be a takeover target at a fat premium. If buyers didn’t show up right away, Icahn figured he could improve performance by installing new management and profit by driving up each company’s stock price. “Xerox was one of the worst-run companies I ever saw,” Icahn tells Fortune. “Both sides of the business were being mismanaged. It was a no-brainer to split it up and bring in new management. Xerox was doing nothing with a great brand—how many companies have a name that doubles as a famous verb?” Icahn got his way when, at the beginning of 2017, Xerox spun off the BPO business as a new company called Conduent. And so far that half of the deal has proved a winner: Conduent has flourished, and its solid stock performance has generated a return of more than $100 million for Icahn. |

|

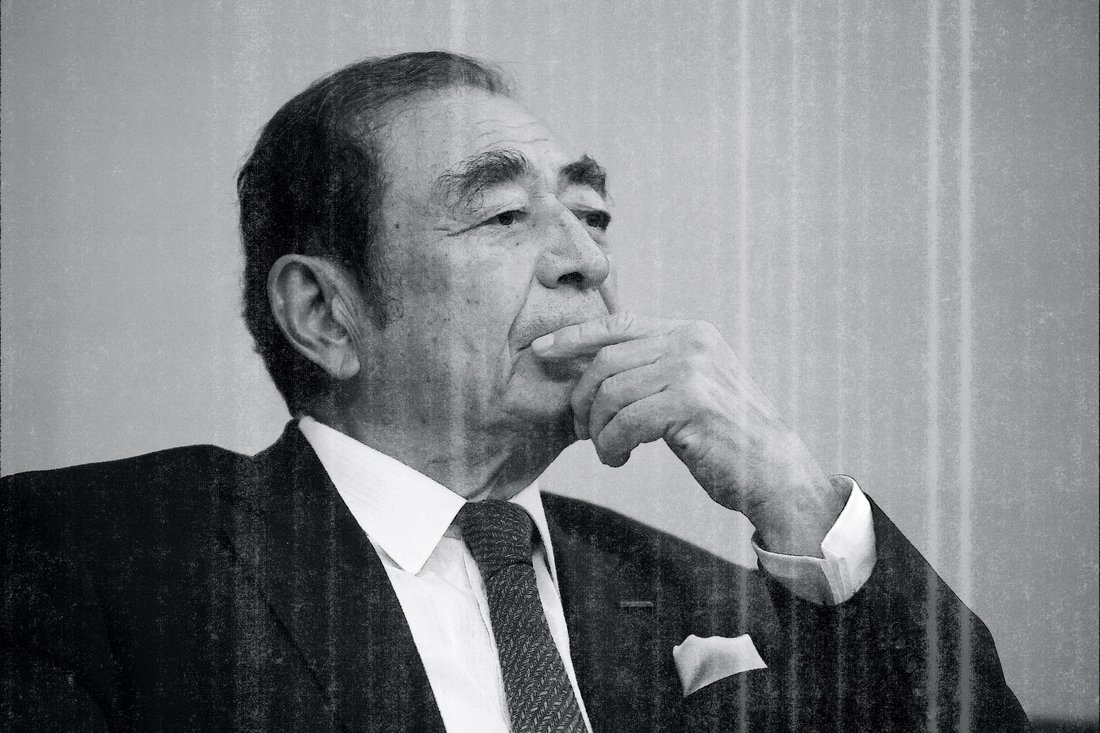

伊坎目前持有施樂9.2%的股份,是公司最大的單個股東。然而事實表明,伊坎靠施樂生財的征途已經成為了其50年職業生涯以來最為復雜的交易之一。事實上,這項交易是如此之艱難,伊坎打破了以往的慣例,與另一名合作伙伴開展合作。這名合作伙伴便是78歲高齡但依然充滿活力的達爾文·迪森。達爾文于2010年以64億美元出售了施樂的外包業務(構成了Conduent公司的主體),而且依然是施樂的第三大股東。除了在年齡和財富方面相仿之外,這對男士可謂是一個最古怪的組合。盡管畢業于普林斯頓大學,身高1.93的伊坎一直保留著其濃重的皇后區口音,而且作為經過華爾街歷練的人士,他是一個典型的交易狂人。塊頭不大的迪森有著斗牛犬般的韌勁和長相,成長于阿肯色州農場的他是一個業務創建型人士。這對組合的年齡總和超過了160歲,共計持有施樂15.2%的股份,著實令人生畏。 伊坎和迪森共同發力,阻礙了一個在他們看來非常不劃算的交易:日本富士計劃以61億美元收購施樂。5月13日,他們取得了這場斗爭的重大勝利,當時,施樂董事會宣布將撤銷此前同意的與富士公司的合并。在阻礙這一收購交易的過程中,他們的手腕似乎比對手更加高明,而這個對手便是富士首席執行官兼董事長古森重隆,后者就權力和能力而言與他們不相上下。在伊坎和迪森組隊之前,78歲的古森似乎想把廉價收購這家美國知名企業作為其職業生涯的收官之作。古森在東京大學曾是美式橄欖球隊的球員,稱自己為“商業武士”,他是日本首相安倍晉三的密友之一,也是安倍最鐘愛的高爾夫球友之一。 施樂董事會退出合并的決定只不過是近些年來華爾街眾多最瘋狂、最難以預料的對決所上演的最新劇情反轉之一。富士稱將對這一決定予以抗議。這場爭斗的一些細節信息,也就是法庭記錄和主要參與方的證詞中廣泛披露的信息,最為直接地暴露了施樂歷史上所存在的企業治理失敗問題。這一點的證實。在這場為期兩年的鬧劇中,董事會和前首席執行官產生了重大分歧,而就在這位首席執行官即將被炒魷魚的前幾天,他送上了一份對日本巨頭富士極為有利且難以抗拒的交易大禮,并似乎借此保住了自己的工作。然而最終,他只能眼睜睜看著這份協議在伊坎和迪森的施壓之下化為泡影。 伊坎說:“施樂交易幕后所發生的事情異常瘋狂,完全可以與電視劇《億萬》(Billions)的劇情媲美。在最終結果出來之前,我以為輸定了。” 似乎具有諷刺意味的是,被時間遺忘的美國知名企業施樂在這場本世紀以來最具爭議的收購戰中成為了被爭奪的主體對象。然而,在巨大的1800億美元全球打印和文件市場中,施樂依然是一名重量級參與者。即便在剝離了Conduent之后,施樂龐大的規模足以讓其躋身今年《財富》美國500強榜單第291位的位置,其銷售額達到了103億美元。同時,由于其品牌依然頗具號召力,而且公司也有能力進軍快速發展的工業打印市場,施樂仍有可能東山再起。 根據被伊坎和迪森扼殺的這場交易,施樂將向現存的富士施樂公司(由施樂與富士組建的合資公司)出售其大部分權益。富士施樂專業從事在亞洲生產和銷售施樂產品,并負責生產施樂在世界其他地區銷售的大部分復印機。施樂股東將持有新富士施樂公司49.9%的權益,而富士將持有50.1%的控股權。富士無需利用任何自有現金來支付此次交易,只不過是貢獻了它在現有合資企業富士施樂的大部分股權罷了。施樂股東將收到25億美元一次性的股利,但并非由富士支付,而是由新富士施樂通過背負等額債務來支付。 伊坎和迪森的想法是正確的,這一復雜的交易將讓富士完全控制施樂,而且只需支付的少量的溢價或零溢價。這對于富士股東來說是個好消息,但對于施樂股東來說卻不盡然。大多數收購會帶來至少20%-30%的“控股權溢價”。將控股權拱手讓給富士意味著施樂股東將無法左右管理層的決策。在伊坎看來,這是一個無法令人接受的結果。伊坎說:“對于富士來說,它并不僅僅是私下交易那么簡單,而是讓施樂這家了不起的公司用100%的所有權來換取永久性的少數權益。無論富士在今后做出什么樣的決策,持有49.9%權益的施樂也只能干瞪眼。” |

But Icahn’s crusade to cash in on Xerox, where he’s the largest individual shareholder with 9.2% of the stock, has proved to be one of the most complicated of his half-century career. It’s been so challenging, in fact, that Icahn has made an exception to his usual rule and teamed up with a partner: Darwin Deason, a feisty 78-year-old who sold the outsourcing business that now constitutes most of Conduent to Xerox in 2010 for $6.4 billion and remains Xerox’s third largest shareholder. Except in age and wealth, the two men are the oddest of pairings. The 6-foot-4 Icahn, who’s never lost his thick Queens accent despite a Princeton education, is a creature of Wall Street, and the quintessential deal junkie. The compact Deason—who in both tenacity and appearance resembles a bulldog—is a business builder who grew up on a farm in Arkansas. With a combined age of 160 and combined Xerox holdings of 15.2%, they make a formidable duo. Icahn and Deason joined forces to block what each regarded as a terrible deal: the planned $6.1 billion acquisition of Xerox by Japan’s Fujifilm. And on May 13, they won a significant victory in their battle when the Xerox board announced that it was pulling out of the agreed-upon merger with Fuji. In blocking the purchase, they appear to have outmaneuvered a foe whose power and savvy rivals theirs—Shigetaka Komori, Fujifilm’s CEO and chairman. Until Icahn and Deason teamed up, it appeared that Komori, 78, would cap his career by capturing an American icon on the cheap. Komori, who played American-style football at the University of Tokyo, is a self-described business “warrior” who’s one of Prime Minister Shinzo Abe’s closest friends and favorite golfing companions. The Xerox board’s decision to back out of the merger—a move that Fujifilm says it will contest—is just the latest twist in one of the wildest, most unpredictable Wall Street showdowns in years. And the anatomy of the conflict, extensively revealed in court records as well as testimony at trial by the main participants, exposes one of the most naked accounts of governance gone awry in corporate history. This two-year melodrama features a bitterly divided board and a former CEO who, days before he was scheduled to be fired, appeared to have saved his job by delivering a deal so favorable to Fuji that the Japanese giant could hardly say no—only to see the agreement fall apart under pressure from Icahn and Deason. “The stuff that went on behind the scenes at Xerox is so crazy you’d be amazed to see it on [the TV series] Billions,” says Icahn. “If it hadn’t actually happened, I wouldn’t have thought it was possible.” It might seem ironic that Xerox, an American icon that time forgot, stands at the center of one of the most contentious takeover battles of the current millennium. But Xerox remains a big player in a giant industry—the $180 billion worldwide printing and documents field. Even after spinning off Conduent, Xerox is still big enough to rank No. 291 on this year’s Fortune 500 list with $10.3 billion in sales. And its still-powerful brand and potential to expand into the fast-growing business of industrial printing give Xerox viable turnaround prospects. The deal for the company nixed by Icahn and Deason amounted to the sale of the majority ownership in Xerox to an existing joint venture with FujiFilm called Fuji Xerox—a business that exclusively makes and sells Xerox products in Asia, and manufactures most of the office copiers that Xerox sells in the rest of the world. Xerox shareholders would have held 49.9% of the new Fuji Xerox, and Fuji would have held the controlling 50.1% stake. Fuji would have put none of its own cash into the deal. Rather, it would have merely contributed its majority share in the existing joint venture. Xerox shareholders would have received a $2.5 billion one-time dividend—not paid by Fuji, but financed by adding the equivalent amount of debt to the new Fuji Xerox. Icahn and Deason charged, correctly, that this complex transaction would have enabled Fuji to take full control of Xerox while paying little or no premium. Great for Fuji—not so great for Xerox shareholders. Most takeovers include a “control premium” of at least 20% to 30%. And ceding control to Fuji meant that Xerox’s owners would have no sway over management decisions—an unacceptable outcome for Icahn. “It was not just a sweetheart deal for Fuji,” says Icahn. “You’d be trading full ownership of this great company to be in the minority forever. No matter what Fuji did with the business, your 49.9% is going to be completely powerless.” |

|

這兩名義憤填膺的億萬富翁以自己的方式扼殺了這場交易。伊坎采用了他慣用的攻擊方案——股權代理戰。迪森則為伊坎提名的四名新董事提供了鼎力支持,同時也拿出了其所擅長的招數——打官司。他通過自己在King & Spalding律所的律師于2月和3月發起了兩場聲勢浩大的訴訟。第一個訴訟稱,由于施樂隱瞞了反兼并條款,因此公司有義務滿足迪森延長董事提名截止日期的要求,這樣,他便可以替換整個董事會。第二個訴訟則將施樂和富士都告上了法庭,指控施樂董事會和首席執行官因協商有利于其自身利益的交易,并讓施樂股東繼續執行不利交易,公然違反了其信托義務。該訴訟還指控富士密謀籌劃交換條件,也就是施樂首席執行官為富士提供廉價收購施樂的機會,而富士則讓其執掌新富士施樂。 伊坎并未參與迪森的訴訟。他向《財富》透露:“起訴董事會并不符合我的行事作風。一旦我們入主董事會之后,我們會努力與其他董事進行合作。”然而,正是因為其戰友迪森在紐約法庭上的發力才讓事情的內幕大白于天下。法庭記錄披露了一批令人震驚的頻繁往來郵件、文本、證詞以及來自于施樂高管、董事和金融顧問以及富士高層經理的內部報告。 法院決定合并兩項訴訟并同時裁決。在4月底于曼哈頓開展的為期兩天的庭審當中,施樂時任首席執行官杰夫·雅各布森、董事長羅伯特·齊根(一位持不同意見的董事)和公司的投行高管均在發誓后提供了廣泛的證詞。本文記者參與了這一庭審,并查看了700多份由法官開封的證據。《財富》還廣泛采訪了伊坎和迪森的代理人。施樂和富士均以訴訟為由,拒絕對其高管或董事進行采訪,但證詞、口供和郵件卻為我們提供了一扇窺探各方動機和想法的難得窗口。 在庭審結束之際,法官巴利·奧斯特雷格(此前亦是一名知名的并購訴訟律師,在私人執業領域有著40多年的經驗)提供了一份言辭犀利的意見,最終讓迪森在這兩場訴訟中大獲全勝。他還強烈抨擊了雅各布森、齊根和施樂董事在這一過程中所扮演的角色,稱雅各布森與富士進行協商存在重大的利益沖突,因為這一私下交易的條件便是保留其職務。最終,奧斯特雷格寫道,雅各布森違背了其信托義務,齊根亦是如此。 在法律文件中,施樂和富士給出了一個理直氣壯的理由,這一點在雅各布森和齊根的證詞中也有所體現。他們的律師認為,在雅各布森、齊根和董事會所開展的這項交易中,富士是唯一一個合理的買家,而且其他買家對此次交易均不感興趣。富士認為,公司并未向雅各布森許諾首席執行官一職(這一觀點遭到了董事的反駁),而且他只是這一職務的首要人選,因為“這位才華橫溢的高管完全有條件實現新公司的協同效應,從而造福富士和施樂的股東”。施樂的律師認為,齊根完全有權力派遣首席執行官去進行交易談判,而且齊根在證詞中提到,他曾建議董事會撤銷其解聘雅各布森的決定,因為雅各布森的業績在2017年底突然出現了改觀。雅各布森在自己的證詞中指出,這種讓他將自身或富士的利益置于公司股東利益之前的建議,是違背良心的,也是不合情理的。 這一有利于迪森的一邊倒式判決引發了一場持續了兩周的清算鬧劇:施樂一開始宣布與伊坎和迪森達成和解,然后又撤銷了這一決定,轉而與富士進行協商,結果不歡而散。隨后在5月13日,施樂董事會再次改變了其之前做出的決定,并與伊坎和迪森達成協議,并宣布終止并購,同時炒了雅各布森的魷魚。齊根與其他四名董事也離開了董事會,取而代之的是由伊坎和迪森挑選的高管。新任首席執行官是數據處理領域的專家約翰·維森丁,因幫助企業東山再起而聞名。 如今,施樂稱公司將公布所有意向收購方的要約信息。與此同時,富士仍在力爭重啟最初達成的收購交易,并在施樂退出后發布了一份帶有挑釁意味的聲明:“我們認為,施樂無權終止這一協議,而且我們正在審視可用的一切方法,包括通過訴訟來索賠損失。”這兩家公司為何走到了今天這個地步?我們不妨先了解一下它們之間的歷史淵源。 2015年底伊坎將施樂當成目標時,施樂業績已連續數十年衰退。1906年施樂在紐約州羅切斯特創立,剛開始做照相紙,上世紀40年代末推出了全世界首個高速復印機,隨著其硬件成為大公司、律師事務所和政府機關文件室里的主力機器,公司業績也節節上升。但上世紀80年代開始,個人電腦逐漸普及,紙質文件打印和復印需求大為減少。關鍵專利到期后,施樂面臨著日本競爭對手理光和佳能的激烈競爭,還有美國的惠普。 為了應對不斷衰退的核心業務,施樂(現在總部位于康涅狄格州諾瓦克)向其他領域拓展,包括金融服務,最近的動作是2010年收購迪森創立的外包服務公司Affiliated Computer Services。但新業務跟原本制造出售打印機復印機的業務相差太遠,后來施樂退出了大部分,期間進行了一輪又一輪重組。值得注意的是,施樂旗下的打印專營服務,即向大公司提供全套硬件、耗材和維修服務,雖然不斷縮減,但利潤豐厚,再加上不斷削減成本,所以其現金流水平一直保持健康。因此現在的施樂不過是座逐漸融化的冰山,談不上災難。 施樂與富士從1962年就開始合作,當時施樂跟富士合作在富士大本營日本制造并銷售施樂的辦公設備。之后39年里,施樂跟富士平等合作,兩家各持有50%股份。2000年情況發生變化。施樂銷售部門重組失敗,收入受到重創,深陷債務之中。由于施樂瀕臨破產,首席執行官保羅·阿萊爾急忙出售資產籌集資金。施樂首先將獨家擁有的中國經營權出售給富士施樂,作價5.5億美元。2001年初,施樂出售富士施樂的25%股份換得13億美元,由此富士持有合資公司75%股份,掌握控股權。現在合資公司在亞洲和環太平洋市場350億美元規模的市場里出售產品,施樂卻僅握有四分之一股權。施樂實力逐漸減弱,富士卻不斷變強。在古森領導下,富士沒有像柯達一樣沒落,而是成功由膠片制造商轉向不斷增長的領域,例如醫療設備和化妝品。股權轉讓后,雖然富士施樂主要依靠施樂的專利和工程技術,富士卻能隨著亞洲不斷發展享受更多收益。 不過施樂蒙受的打擊還不只是銷售和利潤比例下降。2001年的交易包括一項新協議 ,叫合資企業協議或簡稱JEC,規定了合作雙方的治理權,還對出售施樂規定了嚴重的處罰條款。合資企業協議和另一項協議——技術協議或簡稱TA將施樂牢牢掌控住。每一次簽訂技術協議生效五年,目前這份由前首席執行官烏蘇拉·伯恩斯于2016年簽訂,2021年3月失效。根據兩份協議規定,如果施樂業務遭出售,將失去治理權,技術協議失效前無法在亞洲地區重新使用品牌名稱,且技術協議失效后還要兩年才可回收品牌。 |

The two angry billionaires fought the deal in their own ways. Icahn deployed his preferred plan of attack, the proxy battle. Deason pledged to back Icahn’s slate of four new directors, but also went his own way by fighting in the courts. He brought two sweeping lawsuits through his attorneys at King & Spalding, unveiled in February and March. The first claimed that because Xerox had concealed a poison pill provision, the company was obligated to grant Deason’s demand to extend the nominating deadline so that he could replace the entire board. The second, brought against both Xerox and Fuji, charged that Xerox’s board and CEO blatantly violated their fiduciary duties by negotiating a deal that promoted their own interests, while sticking Xerox shareholders with a bad deal, and accused Fuji of conspiring in a quid pro quo—the CEO delivers a bargain price, and Fuji puts him in charge of the new Fuji Xerox. Icahn didn’t join Deason’s suits. “I find suing boards distasteful,” he tells Fortune. “Once we’re inside the boardroom, we try to work collaboratively with other directors.” But it was his partner’s assault in the New York courts that laid bare the inside story. The court records exposed a trove of frequently shocking emails, texts, depositions, and internal reports from executives, directors, and financial advisers at Xerox, and top managers at Fuji. At a trial in Manhattan over two days in late April—the two lawsuits were consolidated and decided together—Xerox’s then-CEO Jeff Jacobson, its chairman Robert Keegan, a dissident director, and its investment banker all gave extensive testimony under oath. This reporter attended the trial and reviewed the more than 700 exhibits, all unsealed by the judge. Fortune also talked extensively with Icahn and representatives for Deason. Xerox and Fuji both declined to make any of their executives or directors available for interviews, citing the litigation. But the testimony, depositions, and emails provide a rare window into the motives and thinking of all the players. At the conclusion of the trial, Judge Barry Ostrager—himself an esteemed former M&A litigator with more than 40 years in private practice—issued a scalding opinion that granted Deason big wins on both of his suits. He also delivered a stinging condemnation of the role of Jacobson, Keegan, and Xerox’s directors, stating that Jacobson was “massively conflicted” in his negotiations with Fuji because delivering a sweetheart deal promised to save his job. As a result, Ostrager wrote, Jacobson was “in breach of his fiduciary duties,” as was Keegan. In their legal filings, Xerox and Fuji present a righteous scenario that echoed in the testimony from Jacobson and Keegan. Their attorneys argue that Jacobson, Keegan, and the board pursued a deal with the only logical buyer, when no other acquirers were interested. Fuji argues that Jacobson wasn’t promised the CEO job—a view contradicted by directors—but was simply its top choice as “a talented executive well-suited to achieving the synergies that will benefit shareholders of Fuji and Xerox alike.” Keegan was fully justified in assigning the CEO to negotiate a deal without the full board’s approval, argued Xerox’s attorneys, and Keegan testified that he encouraged the board to reverse its decision to fire Jacobson because his performance suddenly improved in late 2017. In his testimony, Jacobson called the suggestion that he put his or Fujifilm’s interests before those of his shareholders “reprehensible and unconscionable.” The overwhelmingly pro-Deason decisions kicked off a tumultuous two-week period of reckoning: Xerox first announced a settlement with Icahn and Deason, then withdrew from it and engaged in talks with Fujifilm that turned acrimonious. Then, on May 13, Xerox’s board reversed itself again—coming to terms with Icahn and Deason and announcing that the merger was terminated and Jacobson was out as CEO. Keegan and four other directors also departed, to be replaced with execs chosen by Icahn and Deason. The new CEO is John Visentin, a well-regarded turnaround expert in data processing. Xerox now says it will field offers from all interested bidders. Meanwhile, Fuji is still battling to revive the original deal and released a defiant statement after Xerox pulled out: “We do not believe that Xerox has the legal right to terminate our agreement, and we are reviewing all of our available options, including bringing a legal action to seek damages.” To understand how the two companies reached such an impasse, it helps to review the history between them. By the time Icahn zeroed in on Xerox in late 2015, the company had been shrinking for decades. Started as a photographic-paper maker in Rochester, N.Y., in 1906, the company introduced the world’s first high-speed copiers in the late 1940s, and thrived as its hardware formed the essential engine room for document production inside big companies, law firms, and government agencies. But starting in the 1980s, mass adoption of the personal computer sharply curtailed the need for paper printing and copying. As its key patents expired, Xerox faced stiff competition from Japanese rivals Ricoh and Canon, as well as Hewlett-?Packard in the U.S. To counteract flagging sales in its core franchise, Xerox (now based in Norwalk, Conn.) diversified into such fields as financial services, and most recently, the 2010 purchase of Affiliated Computer Services, the outsourcing outfit founded by Deason. Those businesses fit poorly with making and selling printers and copiers, and Xerox exited most of them—while at the same time engaging in round after round of restructuring. Remarkably, Xerox’s highly lucrative, if shrinking, managed print services franchise—in which it furnishes a full package of hardware, supplies, and maintenance to big companies—combined with constant cost-cutting have kept free cash flow at healthy levels. Hence, Xerox is today a gradually melting iceberg, but far from a catastrophe. Xerox’s partnership with Fujifilm dates to 1962, when Xerox and Fuji formed an alliance to manufacture and sell Xerox office products in Fuji’s home market of Japan. For 39 years, Xerox and Fuji were equal partners, each holding 50% of the shares. Then came a pivotal moment in the year 2000. A botched restructuring of its sales force hammered Xerox’s revenues, and it was drowning in debt. As Xerox stood on the brink of bankruptcy, CEO Paul Allaire rushed to raise cash by selling assets. First, Xerox sold its China franchise, which it owned independently, to Fuji Xerox for $550 million. Then in early 2001, it pocketed $1.3 billion in exchange for 25% of Fuji Xerox—giving Fuji a 75%, controlling stake in the joint venture. As a result, Xerox now owns just one-fourth of the vehicle with exclusive rights to make and sell its products in the $35 billion Asia and the Pacific Rim markets. And as Xerox weakened, Fuji got stronger. Under Komori, it avoided Kodak’s fate by successfully diversifying from photographic film into such growth fields as medical equipment and cosmetics. The sales assured that Fuji would benefit disproportionately from growth in Asia, even though Fuji Xerox relied heavily on Xerox’s patents and engineering. The damage to Xerox, however, extended far beyond its diminished share of sales and profits. The 2001 transaction included a new agreement called the Joint Enterprise Contract or JEC, that outlined the governance rights of the two partners, and established severe penalties that would be triggered by a sale of Xerox. It’s the combination of the JEC, and a second pact—the Technology Agreement or TA—that puts Xerox in a real bind. Each TA runs for five years; the current one, approved by former CEO Ursula Burns in 2016, expires in March 2021. Under the two agreements, if Xerox is sold, it not only loses its governance rights, it can’t regain its brand name in Asia until the TA expires, and doesn’t get it back exclusively for another two years. |

|

這對潛在買家來說意味著什么?如果無法撤銷合資企業協議和技術協議,收購施樂的競爭對手或私募股權公司對富士施樂經營毫無話語權,且2023年以前都不可在亞洲完全獨立制造和銷售施樂的產品。 兩份協議組成了一份對施樂影響嚴重的所謂毒丸計劃,想出售給富士之外的第三方極其困難。神奇的是,相關條款從未公布于世,直到1月31日施樂和富士宣布合并人們才知道。伊坎和迪森聽說之后勃然大怒。 伊坎剛開始買入施樂股票時就想更換管理層。“我希望Conduent和施樂都能有全新稱職的管理層,”伊坎表示。“我直接告訴伯恩斯,兩家公司她一家也管不好。”(伯恩斯拒絕為本文發表評論。)2016年中,伊坎與施樂董事會達成協議,以順利從外部提名首席執行官。他簽署了一份“凍結”協議,承諾代理戰期間不會影響施樂董事會,還簽署了保密文件,承諾保密前提下獲知內部信息。為了爭取這些讓步,施樂同意任命伊坎的副手約翰遜·克里斯托多洛擔任董事會觀察員,2016年中開始擔任正式成員。但6月伯恩斯宣布二號人物杰夫·雅各布森接替自己擔任首席執行官。伊坎非常不希望出現這種局面。“雅各布森是伯恩斯的助手,”伊坎說。“他是嚴重拖累施樂發展的管理層一員。” 不過起初看起來,雅各布森2017年1月1日接手伯恩斯之后有可能按照伊坎希望的方向推動交易。以下情況在法庭記錄里有詳細記錄。3月初雅各布森第一次前往東京的富士總部時,古森和總裁助野健兒表示有意以全現金方式收購施樂100%股份,且表示接受超過施樂30美元現價30%的溢價。3月16日,雅各布森與董事會商量后寫信給富士,表示施樂愿意接受支付“合理溢價”的全現金交易,而且施樂在單獨制定很有前景的計劃,可以“推動增速超過同行”,所以并不著急交易。 為什么富士獲得富士施樂絕大部分收益,之前也從未承諾全盤收購施樂,突然要提出100%收購?原因可能是富士擔心富士拆分后只剩下紙面管理,可能有其他收購者趁虛而入。合資公司可以提供保護,但仍可能被繞過。 關于交易的討論很快受到爭議干擾。2017年4月20日,富士公開披露富士施樂內部一起重大的財務丑聞,而且宣稱該事件會導致富士和施樂蒙受巨大損失(不過當時沒有宣布具體金額)。富士掌控著富士施樂管理層,83年歷史上第一次延遲發布季報。由于該次丑聞,富士通知施樂,要專心處理富士施樂內部問題,所以收購一事無法繼續。 施樂董事會也面臨危機,即領導層出現問題。董事們對新任首席執行官失去信心。丑聞爆發當天的董事電話會上,有幾位董事指責雅各布森之前的表現。很快接替伯恩斯擔任總裁的齊根在提交法庭的書面說明中表示,董事們指責雅各布森“學習速度太慢”、“喜歡抱怨”、“過于自負”,而且“不愿意傾聽”。齊根還記下當時一個預言般的問題,“我們真需要他來完成‘果汁’計劃么?”“果汁”是富士施樂股權交易的代號。 |

What would this mean for a potential buyer? If the JEC and TA went unchallenged, a rival or private equity firm that buys Xerox would have no say in running Fuji Xerox and would be unable to independently and exclusively make and sell Xerox products in Asia until early 2023. Together, the two agreements add up to a crippling so-called poison pill for Xerox—making a sale to a partner other than Fuji extremely difficult. Incredibly, the existence of the provisions was never disclosed publicly until Xerox and Fujifilm announced that they were merging on Jan. 31. By that time, Icahn and Deason were already fuming. Icahn had been trying to install new leadership since he first got into Xerox’s stock. “I wanted new, competent management at both Conduent and Xerox,” says Icahn. “I told Burns I didn’t believe she should run either one.” (Burns declined to comment for this story.) In mid-2016, Icahn reached an agreement with the Xerox board that he reckoned would smooth the way to naming an outside CEO. He signed both a “standstill” pact, under which he pledged not to challenge the Xerox board in a proxy fight, and a nondisclosure document that entitled him to inside information that he was obligated to keep secret. In exchange for those concessions, Xerox agreed to name an Icahn lieutenant, Jonathan Christodoro, first as an observer to the board, then as a full member starting in mid-2016. But in June, Burns announced that her No. 2, Jeff Jacobson, would succeed her as CEO. He was exactly what Icahn didn’t want. “Jacobson was an acolyte of Burns,” says Icahn. “He was part of the team that badly hurt Xerox.” At first, however, it appeared that Jacobson, who took over for Burns on Jan. 1, 2017, might deliver the kind of deal that Icahn wanted. The following account is extensively documented in the court records. During Jacobson’s first visit to Fuji’s Tokyo headquarters in early March, Komori and president Kenji Sukeno expressed interest in purchasing 100% of Xerox in an all-cash transaction, and noted that they understood that a typical premium would amount to 30% over Xerox’s current price of $30. On March 16, Jacobson, after consulting with the board, wrote a letter to Fuji confirming that Xerox wanted only an all-cash transaction at an “appropriate premium,” and had no need to do a deal since it was pursuing a highly promising standalone plan that would “drive growth well above our peers.” Why did Fuji suddenly suggest a 100% deal when it already got most of the benefits from Fuji Xerox, and had never before proposed buying all of Xerox? The answer is probably that Fuji was concerned that, with Xerox now a pure-play in document management post-split, other suitors might pounce. The joint venture agreements provided protection, but it was also possible that they could be circumvented. But the deal talks were soon derailed by controversy. On April 20, 2017, Fujifilm publicly disclosed a gigantic accounting scandal at Fuji Xerox that, it revealed, would saddle Fuji and Xerox with big losses (although it didn’t disclose an amount at the time). Fuji, who controlled management of Fuji Xerox, delayed filing its quarterly statements for the first time in its 83-year history. Because of the scandal, Fuji informed Xerox that it needed to concentrate on fixing Fuji Xerox and couldn’t proceed with an acquisition. Meanwhile, Xerox’s board was facing another crisis—of leadership. The directors were already losing confidence in the company’s new CEO. At a board meeting the day the scandal broke, held on the phone, a number of directors skewered Jacobson’s early performance. In his handwritten notes from the meeting that were later submitted to the court, Keegan, soon to replace Burns as chairman, recorded complaints that Jacobson was “too slow on the learning curve,” “a whiner,” “overconfident,” and exhibited “poor listening skills.” Keegan also jotted down a prophetic question, “Do we need him to complete ‘Juice’?” referring to the code name for a Fuji-Xerox transaction. |

|

此時迪森正在加勒比海上,乘著203英尺長意大利造的游艇觀察局勢,他有點擔心了。迪森并不清楚毒丸條款,但已經開始懷疑富士使用什么手段控制施樂。迪森的膽識不輸伊坎。高中畢業第二天,迪森就留離開長大的農場,去塔爾薩的海灣石油公司郵件收發處謀得一份工作。他經常跟做數據處理的人們交流。后來他搬到德州,開始幫銀行處理ATM交易。1988年他創立Affiliated Computer Services,其中一個大客戶是快易通電子收費系統E-ZPass。他介紹自己做事方式時說,“如果跑步機的時速是每小時100英里,而你只能跑80,就會被甩出去。關鍵是自我約束。” 5月底,迪森私下寫信給施樂提醒道,根據協議中隱含的條款,“公司控制權如果發生變更,施樂可能遭受巨大損失。”施樂回應迪森稱,迪森簽署保密協議后才愿意公布協議。迪森表示拒絕,之后沒怎么聯系過施樂,直到1月《華爾街日報》報道稱富士的交易可能失敗。 雅各布森在法庭上表示,直到5月中旬他都不知道董事會對他不滿。但他很快就知道自己跟伊坎的立場。因為伊坎邀請雅各布森去曼哈頓現代藝術博物館旁邊的頂層豪宅吃飯,兩人坦誠聊了聊。根據《財富》對伊坎和雅各布森的采訪以及法庭證詞,伊坎告訴雅各布森他希望出售施樂,如果雅各布森不愿意,伊坎就會想辦法換掉他。雅各布森對受到威脅很不滿。“我告訴他,就算你趕走我,頂多就是我回家陪伴美麗的老婆和家人,”雅各布森的證詞稱。(雅各布森拒絕為本文接受采訪。)伊坎對雅各布森的增長“長期計劃”表示非常失望,該方案打算未來五年每股盈余僅提升8%。“我告訴他,‘我們很懂財務數字,’”伊坎說,“這種計劃對股東來說毫無價值。” 伊坎告訴齊根,他很不看好雅各布森,還有下一步策略。據齊根證詞,他很快就認為董事會面前只有一條路。施樂“得盡快賣掉”。 雅各布森接手工作,努力跟富士重啟談判。為了給對方施加壓力,他還提到來自伊坎的威脅,尤其是伊坎可能以財務丑聞為借口撤出合資公司。6月底,雅各布森給齊根發郵件稱,“我用伊坎說事確實是因為需要點緊迫感,他們(富士)也能理解。” 同樣在6月,富士對富士施樂的財務丑聞發布了獨立的調查報告,稱損失共3.6億美元,其中施樂一方承受9000萬美元。報告中還指責富士施樂的“隱瞞文化”,抨擊富士疏于監管。6月12日的業績通報會上,古森為財務丑聞一事鞠躬致歉。 7月有兩個關鍵時刻。首先是7月10日雅各布森和富士兩位高管在施樂一方銀行Centerview Partners曼哈頓辦事處會面。富士陣營拋出了重磅炸彈,稱不可能收購施樂100%股份,因為施樂太貴。該說法有點令人費解,因為當時施樂股價比富士3月表示要100%收購時還低3%。但施樂并沒有堅持長期以來的立場,即100%股份以及全現金交易,而是主動提出令人驚訝的建議:Centerview建議富士收購剛好超過50%施樂股份,而且不需要現金。 以前Centerview也用同樣的策略促成H.J.亨氏-卡夫合并,當時亨氏股東掌握新公司卡夫亨氏51%股份。目前并不清楚是Centerview還是雅各布森提出該方案;雅各布森宣稱是Centerview提出該想法。但雅各布森接受了。同一天,他給齊根和董事安·里斯發信息稱“這次算是孤注一擲。門已經打開,我們可能還有一線機會。”但他也徹底放棄了全現金買斷股份的方案。 由于伊坎簽署了保密協議,也能收到克里斯托多洛的報告,所以很快知曉了49.9%少數股權的方案,他很生氣。伊坎的想法是,要么富士支付“真金白銀”,要么用伊坎的話說,“我們要逐漸從富士施樂撤出業務,最后結束合資公司,在亞洲奪回施樂品牌,”顯然富士不希望這樣。 雖然伊坎一再要求,但直到10月中旬談判才重新開始。在雅各布森推動下,富士終于聘請摩根士丹利當財務顧問。雖然談判期間施樂唯一出現的是雅各布森,但10月底董事會做出關鍵決定:由約翰·維森丁接替雅各布森的職位,維森丁曾在IBM工作多年,之前成功帶領文檔外包商Novitex走出困境,也是伊坎強烈支持的人選。12月11日維森丁正式開始工作,也是伊坎提出爭奪代理權的截止日期。 董事會還一致決定雅各布森應該停止與富士談判。兩位董事證詞顯示,董事會決定應由維森丁負責談判。11月10日,剛從腳部手術恢復的齊根在韋斯切斯特縣機場與維森丁負責會面,還提醒說董事會打算找人替他的位子。雙方均表示,齊根告訴雅各布森尚未最終決定。 然而克里斯托多洛和董事謝麗爾·克朗加德堅稱董事會已明確表示要換人。 但雅各布森手里還有一張王牌。按照計劃,11月14日富士高層要在紐約討論交易事宜,而雅各布森預計在11月21日與古森會面。雅各布森告訴富士計劃主管河村隆(音譯)會面要取消,河村的回復是如果無法如期會面,首席執行官古森會“非常失望”,雙方“交易可能無法順利進行”。雅各布森如此轉告了齊根。 事情發生出人意料的轉折:齊根推翻了董事會的一致決定,允許雅各布森繼續與富士談判。“我做了個戰場決策,” 齊根在證詞中稱。齊根的備忘顯示,他堅信不管雅各布森有多少弱點,但對促成合并至關重要。齊根只告訴了Centerview的銀行家和一位董事安·里斯,允許即將被解雇的雅各布森繼續負責這筆交易。 雅各布森一方面得到總裁支持,另一方面也得到富士的支持和鼓勵。 川村發給首席執行官雅各布森的信息顯得關系相當親密,吹噓雙方結成聯盟對抗伊坎。“我們應該組成團隊,對抗共同的敵人。”11月12日川村發給雅各布森的信息稱。“朋友,我們在同一陣線。”雅各布森回復道。雅各布森會見古森的前一天,川村向雅各布森發送的信息里強烈暗示,古森希望幫雅各布森保住工作。他表示古森“會認真傾聽你的現狀,看看我們能做什么。”隨后雅各布森發信息給Centerview的赫斯,“河村說如果沒我在,交易就做不成。”11月21日與古森會面時,雅各布森提議富士公司提供20億美元的一次性股息,加在交易條款中,但數量并不算大。 留下雅各布森后,齊根嚴重激怒了最大的個人股東。伊坎不斷找齊根,讓他任命維森丁為首席執行官,而且伊坎表示,齊根總說很快就調整。“齊根只是口頭說啊說,”伊坎表示。“他一直說維森丁很快就能接任,但并沒有動作。與此同時,雅各布森卻在幕后搞小動作。真希望他經營公司的本事能有背后搗鬼一半強。否則他早就幫我賺很多錢了。” 11月30日,富士向施樂提出正式要約,按照之前7月的約定,施樂持有富士施樂49.9%股份,此外提供雅各布森提議的20億美元股息。12月4日,齊根在董事會宣布了交易條款,此時除了齊根和里斯,其他董事基本上都不知道雅各布森在跟富士接觸。其中幾位表示非常震驚,三周前董事會就一致同意禁止雅各布森與富士商談,他居然還能參與談判交易。 由于已簽署保密協議,伊坎可以了解董事會審議情況,很快便知道雅各布森與富士談判的擬議條款。“當時我火冒三丈,”伊坎說。“齊根一直說,‘相信我。’結果我看到交易條款,對他說,‘你就弄出這些來?瘋了么?’他就是騙我!我們都知道雅各布森連施樂都管不好,怎么可能管好兩倍規模的公司?” 克里斯托多洛表示抗議,12月8日從董事會辭職。他離開后伊坎也不必再遵守凍結協議,伊坎有權任命四位董事,12月11日周一伊坎就行使了權利。法律文件顯示,雅各布森、齊根和富士高管都希望相關條款令伊坎滿意,但都清楚知道伊坎可能發起代理權戰爭。 Centerview向董事會介紹時宣稱,與富士交易是施樂擺脫伊坎的絕好機會。因為提出交易的董事會幾乎從未在股東投票中輸過。根據計劃,選舉董事和對交易投票將在年度股東大會上連續進行。Centerview表示,股東只有反對交易時才會支持伊坎一方,但可能性很小。所以伊坎很有可能在投票之前賣出股份,要么就等著在年度股東大會上輸掉。 1月,隨著交易日期臨近,雅各布森在新富士施樂公司的首席執行官一職也似乎日漸穩固。1月16日,川村發信息給雅各布森稱,“我明確請古森告訴齊根,他希望杰夫擔任首席執行官。”事實上,古森并未提出該要求。古森只提到聯系首席執行官,其中要有一名由富士指定。齊根反對后,古森便放棄了。雅各布森堅稱自己當首席執行官不是達成協議的條件。但根據董事會成員克朗加德的證詞,Centerview和外部顧問公司Paul Weiss Rifkind Wharton & Garrison都告訴董事會,一定要讓雅各布森當首席執行官。4月27日,Centerview的大衛·赫斯在證人席上被問到“Centerview有沒有建議董事會由雅各布森擔任首席執行官,才能繼續推進交易,”他簡單回答道,“是的。” 1月31日,施樂和富士宣布合并。經過齊根在最后一刻的游說,古森同意稍微增加股息,加到25億美元。一開始施樂股價略有上升,但投資者研究交易細節后股價急轉直下。作為信息披露一部分,施樂首次公布了完整的合資公司協議,也包括毒丸計劃。迪森大怒,立刻開始準備訴訟。 另一項披露的信息也影響了最終合并。為了趕著完成交易,施樂和富士決定不等富士施樂提交審計后的財務報表,最終報表會統計出財務丑聞導致的準確虧損數據。施樂表示,交易條款規定如果虧損遠超未經審計報表中的統計,施樂有權取消合并。4月24日,富士施樂終于宣布審計后的數據,虧損由之前預計的3.6美元左右確定為4.7億美元,增加了31%。施樂承擔的損失由之前的9000萬美元增加到1.18億美元。最終施樂也確實以財務糾紛為由取消交易。 合并最終取消之前,還發生了些小插曲。5月13日施樂發給富士的終止協議里披露了一個情況。施樂稱由于發生財務丑聞,其有權取消交易,因為富士施樂沒有按時提交經審計數據,也因為最終數據與最初估計差得太多。 但文件也第一次顯示,雅各布森做了很多努力爭取更好的條件并挽救交易,雖然施樂公開宣稱達成的協議對股東很有利。3月和4月,雅各布森兩次前往東京跟古森談判時,都在爭取更好的價格。審判開始兩天前的4月24日,齊根通過視頻電話會向古森提出請求。奧斯特雷格法官宣布有利迪森的判決第二天,齊根在寫給古森的信中進一步懇求。5月9日和10日,施樂的銀行家和律師們與富士一方的代理達成協議。施樂要求:富士增加12.5億美元股息,不能通過富士施樂舉更多債,要從富士自己的現金流中提供。如果實現,股東每股可多獲得5美元股息,增幅約17%。 古森并沒有買賬。他告訴齊根5月21日那周之前沒法談任何新條款。雙方分歧越來越大,5月10日富士發布新聞稿稱,雖然施樂一直在爭取更多股息才愿意繼續交易,但并未收到施樂新提議。施樂在終止通知中稱,“富士的聲明顯然是錯的。根本站不住腳,由此可見富士缺乏誠意。” 富士發怒的同時,伊坎和迪森卻在法庭上和董事會里慶祝勝利。維森丁終于就任首席執行官,他們希望施樂的業績會止跌回升。合并告吹后,他們希望能真正開始剝離業務。如果富士想通過毒丸計劃阻止交易,伊坎和迪森也可能以財務丑聞為理由在法庭上提出質疑。 與此同時,兩位合作伙伴還有個私人賭局要結算。《財富》得知伊坎和迪森賭了5萬美元現金,賭注是迪森會輸掉訴訟,沒法推遲提名董事的期限,德州佬迪森愉快地下了注。“我賭博一般很少輸。估計因為這點人們都說千萬別跟卡爾·伊坎對賭,”伊坎笑著說。“但這次如果我輸了,反而很高興。”現在他跟迪森的賭注是,全力合作能否通過施樂大賺一筆。(財富中文網) 本文原刊于2018年6月1日出版的《財富》雜志。 譯者:馮豐 審稿:夏林 |

Monitoring the situation from his sumptuous 203-foot, Italian-built yacht in the Caribbean, Deason was getting worried. He didn’t know about the poison pill provisions, but he was suspicious that Fuji had some kind of a string on Xerox. Deason is every bit Icahn’s match in grit. The day after his high school graduation, he left the farm where he was raised for a job in the mailroom at Gulf Oil in Tulsa. There he hung out with the data processing folks. Moving to Texas, he pioneered the processing of ATM transactions for banks. In 1988 he founded Affiliated Computer Services—a major customer was E-ZPass. He describes the way he ran things thusly: “You’re on a treadmill going 100 mph, so if you’re just going 80, you get thrown off. It’s self-policing.” In late May, Deason wrote a private letter to Xerox expressing alarm that conditions hidden in the agreements threaten “a potentially major loss in value for Xerox in any change in control of the company.” In response to Deason’s request, Xerox stated that it would only release the agreements if Deason would sign his own NDA. Deason refused, and had little contact with Xerox until January when reports of a possible Fuji deal broke in the Wall Street Journal. Jacobson claimed in his testimony at trial that, until mid-May, he had no idea the board was dissatisfied with his performance. But he soon learned where he stood with Icahn. The activist invited Jacobson to his penthouse apartment adjacent to Manhattan’s Museum of Modern Art for dinner and some frank talk. According to both Fortune’s interviews with Icahn and Jacobson’s notes and testimony, Icahn told Jacobson that he wanted Xerox sold—and if Jacobson couldn’t sell it, Icahn would push to have him replaced. Jacobson took umbrage with the threat. “I told him the worst thing you can do to me is that I go back to my beautiful wife and beautiful family,” Jacobson testified. (Jacobson declined to be interviewed for this story.) Icahn also expressed extreme disappointment in Jacobson’s “Long Range Plan” for growth, which was targeted at raising EPS by a mere 8% over five years. “I told him, ‘We understand numbers,’?” says Icahn. “This plan produces no value for shareholders.” Icahn shared his dim view of Jacobson and his strategy with Keegan. And soon after Keegan decided, according to his testimony, that only one path remained for the board. Xerox “needed to sell post haste.” Jacobson grabbed the baton, and pushed hard with Fuji to restart talks. To ratchet up the pressure, he invoked the looming threat of Icahn—especially the idea that Icahn might try to end the joint venture, using the accounting scandal as an out. In late June, Jacobson emailed Keegan, “I did play the Icahn card as a reason we need a sense of urgency and they [Fuji] appreciate this.” Also in June, Fuji released an independent report on the Fuji Xerox accounting scandal that put the total losses at $360 million, including a $90 million hit to Xerox. The report also assailed a “culture of concealment” at Fuji Xerox, and slammed Fuji for lax oversight. At an earnings briefing on June 12, Komori bowed and apologized for the scandal. Two watershed moments came in July. The first was a meeting on July 10 at the Manhattan offices of Centerview Partners, Xerox’s bankers, between Jacobson and two leading executives from Fuji. The Fuji camp dropped what should have been a bombshell, stating that a deal for 100% of Xerox was now impossible because Xerox was too expensive—a puzzling assertion, since its stock price was 3% lower than when Fuji expressed interest in a 100% acquisition in March. But instead of maintaining its long-held position that only a 100%, all-cash transaction would work, the Xerox camp voluntarily advanced an extraordinary proposal: Centerview suggested that Fuji purchase just over 50% of Xerox in a deal that, the bankers said, would require no cash outlay. Centerview had used a similar formula in H.J. Heinz–Kraft Foods merger under which Heinz shareholders owned 51% of the new company, Kraft Heinz. It’s not clear if the idea came from Centerview or Jacobson; Jacobson claims that Centerview introduced the concept. But Jacobson embraced it. The same day, he texted Keegan and director Ann Reese that “I threw a Hail Mary pass. The door is open and we may have a chance.” But he had effectively taken the all-cash buyout proposal off the table. Because he’d signed an NDA, and could get reports from Christodoro, Icahn soon learned about the 49.9% minority proposal, and he was anything but happy. Icahn’s position was that either Fuji paid what he called “real money,” or as Icahn puts it, “We’d gradually take business away from Fuji Xerox and eventually terminate the joint venture and take back the Xerox name in Asia,” a prospect Fuji obviously dreaded. Despite Icahn’s constant demands, it wasn’t until mid-October that talks resumed in earnest. At Jacobson’s prodding, Fuji finally hired a financial adviser, Morgan Stanley. Although Jacobson had been Xerox’s sole face in the negotiations, the board made a pivotal decision in late October: It would replace Jacobson with John Visentin, an IBM veteran who’d revitalized document outsourcer Novitex, and whom Icahn strongly endorsed. Vistentin, in fact, was to start work on Dec. 11, the deadline for Icahn to file for a proxy fight. The board also unanimously decided that Jacobson should halt all negotiations with Fuji. According to testimony from two directors, the board determined that talks should be conducted by Visentin when he took charge. On Nov. 10, Keegan, who’d just recovered from foot surgery, met with Jacobson at Westchester County Airport and told him that the board was seriously considering replacing him. According to both parties, Keegan told Jacobson that no final decision had been made. Christodoro and director Cheryl Krongard, however, insist that the board had indeed spoken. But Jacobson had an ace to play. Top executives from Fuji were scheduled for a meeting to discuss a deal on Nov. 14 in New York, and Jacobson was slated to meet with Komori in Japan on Nov. 21. When Jacobson informed Takashi Kawamura, Fujifilm’s chief of planning, that the meetings had to be canceled, Kawamura texted back that CEO Komori ”would be very disappointed” if the meetings didn’t go forward, and that the two sides “may lose the momentum of the deal.” Jacobson relayed the news to Keegan. Then came another shocking twist: Keegan reversed the unanimous decision of the board and allowed Jacobson to keep talking to Fuji. “I made a battlefield decision,” said Keegan in his testimony. Keegan’s notes show that he clearly believed that, whatever his weaknesses, Jacobson was critical to clinching the merger. Keegan told only the bankers from Centerview and one director, Ann Reese, that he’d allowed the soon-to-be-fired Jacobson to remain point man on the deal. Given a reprieve by his chairman, Jacobson was getting support and encouragement from Fujifilm. Kawamura sent chummy messages to the CEO touting their alliance against Icahn. “We should be the one team to fight against our mutual enemy,” Kawamura texted to Jacobson on Nov. 12. “We are aligned my friend,” replied Jacobson. The day before Jacobson’s meeting Komuri, Kawamura sent Jacobson a text strongly implying that Komori wanted to help protect Jacobson’s job—writing that Komori “would focus on hearing current situation surrounding you and what we can do.” Jacobson then texted Centerview’s Hess, “Kawamura told me that there is no deal without me.” At his meeting with Komori on Nov. 21, Jacobson proposed that Fuji offer a one-time dividend of $2 billion as part of the deal, hardly a big number. By keeping Jacobson, Keegan was severely antagonizing his biggest individual shareholder. Icahn was constantly calling Keegan to deliver on installing Visentin as CEO, and according to Icahn, Keegan kept saying the change was imminent. “Keegan talked and talked,” says Icahn. “He kept saying that Visentin was about to take over, but he was just stalling. Meanwhile, Jacobson is conniving behind the scenes. I wish he were half as good at running the company as he was at conniving. I’d have made a lot of money.” On Nov. 30, Fuji sent Xerox its formal offer, echoing the structure proposed in July, giving Xerox 49.9% of Fuji Xerox, and in addition, the $2 billion dividend Jacobson had suggested. Keegan presented the offer at a board meeting on Dec. 4. Most—if not all—of the directors besides Keegan and Reese were unaware that Jacobson had been meeting with Fujifilm. Several expressed shock that Jacobson had negotiated a transaction when the board had unanimously barred him from even talking to Fuji three weeks before. Because of his NDA, Icahn was cleared to track board deliberations and he quickly learned of the proposed terms of the deal Jacobson had negotiated with Fujifilm. “That’s when I blew up,” says Icahn. “Keegan keeps saying, ‘Trust me.’ Then I see the deal and say, ‘You came up with this? Are you crazy?’ He tried to flimflam me! We all agreed Jacobson couldn’t run Xerox. How’s he going to run a company twice that size?” Christodoro resigned from the board in protest on Friday, Dec. 8. His departure freed Icahn from his standstill agreement, and allowed Icahn to name a slate of four directors, which he did on Monday, Dec. 11. According to court documents, Jacobson, Keegan, and executives at Fuji were hoping that the terms would satisfy Icahn, but were also keenly aware he might bolt and launch a proxy battle. In its presentations to the board, Centerview argued that the transaction presented an excellent opportunity for Xerox to rid itself of Icahn. That’s because transactions recommended by a board almost never lose a shareholder vote. The plan was to hold both the election for directors and the vote on the deal back-to-back at the annual meeting. Shareholders would only support the Icahn slate if they opposed the deal, and according to Centerview, that was highly unlikely. Hence, the best bet was that Icahn would sell his shares before the vote, or face defeat at the annual meeting. As the proposed transaction careened forward in January, Jacobson appeared to cement his hold on the CEO post of the new Fuji Xerox. On Jan. 16, Kawamura texted Jacobson, “I clearly told Komori to tell Keegan that he wants Jeff to be CEO.” In reality, that’s not quite what Komori requested. Komori had suggested co-CEOs, one to be named by Fuji. But when Keegan demurred, Komori dropped the request. Jacobson maintains that his becoming CEO was not a condition of the deal. But in her testimony, board member Krongard stated that both Centerview and outside counsel Paul Weiss Rifkind Wharton & Garrison told the board that making Jacobson CEO was indeed a requirement. On the witness stand on April 27, Centerview’s David Hess, when he was asked “whether it’s correct Centerview advised the board about whether Mr. Jacobson had to be CEO of the combined company for the deal to proceed,” answered simply, “Yes.” Xerox and Fujifilm announced the merger on Jan. 31. After last-minute lobbying by Keegan, Komori had agreed to raise the dividend modestly, to $2.5 billion. Xerox’s stock traded up modestly at first, then drifted back down as investors drilled into the details. As part of the deal disclosures, Xerox for the first time published the full joint venture agreements—the poison pill. Deason went ballistic and began preparing his lawsuits. Another disclosure, too, would come back to undermine the merger. In the mad rush to complete the deal, Xerox and Fuji decided not to wait until Fuji Xerox submitted audited financial statements that put a final number on its losses from the accounting scandal. According to Xerox, the transaction’s terms stipulated that if the losses far exceeded those in the unaudited statements, Xerox could cancel the merger. On April 24, Fuji Xerox finally unveiled the audited numbers—and they showed that the losses had jumped from a preliminary estimate of $360 million to a definitive $470 million, a difference of 31%. Xerox’s loss ballooned from $90 million to $118 million. And indeed, Xerox ultimately cited the accounting imbroglio as the basis for nixing the deal. There was a final bit of drama before the merger agreement fell apart. The narrative is disclosed in the Notice of Termination that Xerox sent to Fuji on May 13. Xerox states that the accounting debacle gave it the right to cancel the deal, because Fuji Xerox both missed the deadline for submitting the audited numbers, and because those numbers diverged sharply from the original estimates. But the filing also reveals, for the first time, efforts by Jacobson to salvage the deal by getting better terms—even though Xerox was arguing publicly that the existing deal was a winner for shareholders. Jacobson lobbied for a better price during two meetings with Komori in Tokyo during March and April. And Keegan appealed to Komori by videoconference on April 24, two days before the trial began. The day after Judge Ostrager issued his decisions in favor of Deason, Keegan made further entreaties in a letter to his Komori. And on May 9 and 10, Xerox’s bankers and lawyers made their case to their counterparts from Fuji. Xerox’s request: that Fuji add $1.25 billion to the dividend, not by piling more debt on Fuji Xerox, but from Fuji’s own cash horde. That increase would have handed shareholders an extra $5 a share, or around 17%. Komori wouldn’t bite. He told Keegan he wouldn’t be available to discuss any new terms until the week of May 21. The rift grew deeper when Fuji issued a press release on May 10, stating that it had received no new proposal from Xerox, even though Xerox had been championing the extra dividend as the deal’s salvation. As Xerox states in the Notice of Termination, “That statement was clearly false. It does establish, however, Fuji’s lack of good faith.” While Fuji fumes, Icahn and Deason are celebrating their victories in court and on the board. With Visentin in place as CEO, they’re hopeful that Xerox’s results will start to improve. And with the merger off, they hope to see a true auction process for the company. If Fujifilm tries to enforce the poison pill to block a deal, it’s likely that Icahn and Deason would use the accounting scandal to challenge the move in court. Meanwhile, the two partners have a bet to settle. Fortune has learned that Icahn and Deason wagered $50,000—in cash—that Deason would lose his lawsuit to push back the deadline for nominating directors, and the Texan gladly took the bet. “I generally don’t lose a lot of bets. I guess that’s why people say never bet against Carl Icahn,” says Icahn, chuckling. “But I’m happy to lose this one.” Now he and Deason are wagering that together they can finally win big with Xerox. This article originally appeared in the June 1, 2018 issue of Fortune. |