《財富》經典:34年前,手機是什么樣子

|

購買者爭相以2500美元的價格在車中安裝移動電話。專家們表示,價格必然會下降,而且需求將飆升。 |

Buyers are rushing to get cellular phones in their cars at $2,500 each. Experts say the price is sure to go down — and demand way up. |

|

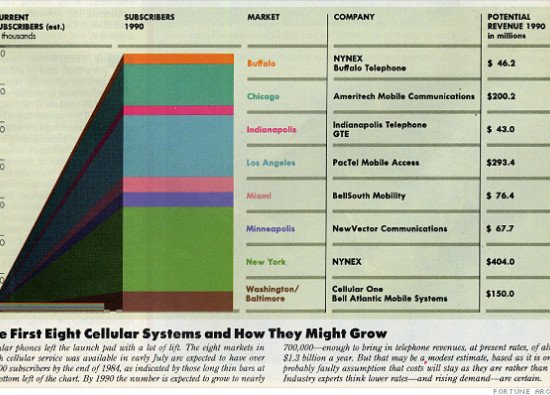

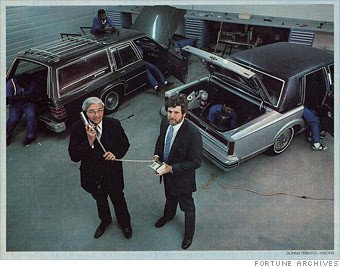

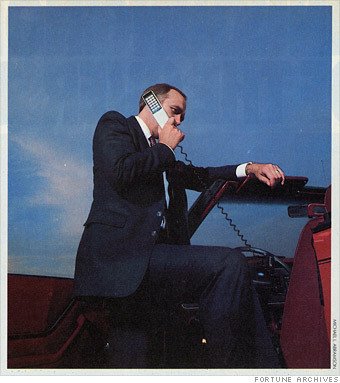

《財富》——如今,美國最熱門的新產業莫過于蜂窩電話——也就是安裝在汽車中的電話。7月初,蜂窩電話系統已在美國8個主要都市區開始運行,包括紐約、洛杉磯、華盛頓-巴爾地摩和芝加哥,而且每周會在一個新城市上馬。就算高昂的入門級電話開通費用并未下降(這種情況不大可能發生),而且在高速公路上打電話如今仍只是少數人的專利,但到1990年,這一數字將增至近100萬。即便如此,這一數字也遠遠不足以說明蜂窩電話的巨大潛力。 到今年年底,蜂窩電話服務將覆蓋美國前30個大都市區。在接下來的10年中,約有60個市場將整裝待發。據估計,10年后蜂窩電話將成為年產值120億美元的產業,其中40億美元來自于通話收入,40億美元為蜂窩電話銷售收入,剩下的40億美元則來自于接收和傳輸系統,包括天線、計算機、建筑和其他部件。 蜂窩電話系統的全球擴張可能會讓這個產業的規模翻上數番。北歐國家和日本已經研制出了蜂窩系統,而且其設備制造商已經進入了美國市場。看好這一新興產業的投資者不僅僅局限于那些服務提供商,這些服務提供商則涵蓋了從電話公司子公司——Nynex、Ameritech和其關聯公司——一直到MCI、華盛頓郵報和西聯銀行。投資者還可以對眾多國際設備供應商中的早期行動者進行投資。總部位于新澤西州的Oki Advanced Communications是日本龐大的Oki Telecom Group的子公司,它在各大蜂窩設備制造商中脫穎而出,與摩托羅拉爭奪美國市場頭把交椅。瑞典的愛立信最近與芝加哥簽訂了一筆系統供應大單,金額估計高達600萬美元。美國設備市場的其他主要參與者包括AT&T、Tandy和NEC。 Lehman Brothers Kuhn Loeb的電信行業分析師約翰·巴恩表示,兩年前,涉足蜂窩電話產業的設備制造公司見證了自家股價的大漲。達拉斯蜂窩設備制造商Communications Systems Inc.的股價從14美元飆升至40美元,其目前的股價約為20美元/股。巴恩說,如今,蜂窩“卻往往是抑郁的代名詞。”這一產業需要巨大的投資,同時需要很長的時間才能產生收益。在這一過程中很多事情都可能會出現問題,包括電話因跌價速度不夠快而失去對消費者的吸引力的風險。另一個可能發生的殘酷事實在于:蜂窩電話是如此之受歡迎,以至于新興的系統暫時無法滿足如此大的需求,從而讓潛在的用戶望而卻步。 如今,只有那些離不開蜂窩電話的有錢人和那些可以報銷的人才能支付得起高昂的蜂窩電話服務費。設備和安裝成本約為2500美元,其中包括安裝在車中的電話、接收和發射裝置,也就是收發器,以及一根天線。話費用因城市而異。在芝加哥,Ameritech Mobile Communications的收費標準為:基本月租費22美元,每分鐘話費22-38美分(取決于通話時段),當然,長途話費得另算。在華盛頓,Bell Atlantic Mobile Systems的收費標準為月租25美元,話費每分鐘27-45美分。 |

FORTUNE — The hottest new U.S. industry right now is cellular telephony — phones in cars. In early July cellular telephone systems were operating in eight major U.S. metropolitan areas, including New York, Los Angeles, Washington-Baltimore, and Chicago, and they are being switched on at the rate of one a week in other cities. By 1990 the handful of subscribers chatting away today on the expressways in those eight cities will have grown to nearly a million — even on the unlikely assumption that costs of subscribing will not have dropped from lofty introductory levels. But that scarcely measures the potential for a cellular explosion. Cellular telephones will be available in most of the top 30 metropolitan areas in the U.S. by the end of the year. Another 60 markets should be hooked up in the ensuing decade. According to some estimates, cellular will be a $12-billion-a-year industry ten years from now-$4 billion in revenues from the calls that are made, $4 billion from sales of equipment to cellular telephone users, and $4 billion for antennas, computers, buildings, and other elements of the receiving and transmitting systems. Worldwide expansion of cellular telephone systems could increase the industry’s girth manyfold. The Scandinavian countries and Japan have already hatched cellular systems, and their equipment manufacturers have leaped into the U.S. market. The investor eyeing this nascent industry is hardly confined to companies that seek to supply the service, which range from telephone company subsidiaries — Nynex, Ameritech, and their kin — to MCI, the Washington Post Co., and Western Union. Investors can also choose from an international menu of early starters among equipment suppliers. Oki Advanced Communications, the New Jersey based cellular subsidiary of Japan’s big Oki Telecom Group, vies with Motorola for first place among makers of cellular equipment. Sweden’s Ericsson recently scooped up a big contract for a Chicago system-an estimated $6 million. Other big players in the U.S. equipment market include AT&T, Tandy, and NEC. The stocks of some manufacturing companies involved in cellular “went berserk” two years ago says John S. Bain, telecommunications analyst with Lehman Brothers Kuhn Loeb. Communications Systems Inc. of Dallas, which makes cellular equipment, saw its stock go from $14 to $40 a share; the price is now riding along at about $20 a share. Right now, Bain says, cellular “is a generally depressed marker.” The business takes huge investment and the payoff will take time. Lost of things could go wrong including threat that prices won’t drop fast enough to make a phone in the car as irresistible as it sounds. Another grim possibility is that cellular might prove so popular that emerging systems would be temporarily swamped, driving potential users away. Right now only well-heeled, must-have-one individuals and those who can write it off can afford the hefty tab of cellular service. Equipment and installation cost about $2,500; that buys the handset in the car, plus the transmitter-receiver — known as a transceiver — and an antenna. Costs of the service vary from city to city. In Chicago, Ameritech Mobile Communications charges $22 per month as a basic fee for access to the system and 22 cents to 38 cents a minute, depending on the time of day. Long-distance tolls; of course, are extra. In Washington, Bell Atlantic Mobile Systems charges $25 a month plus 27 cents to 45 cents a minute. |

|

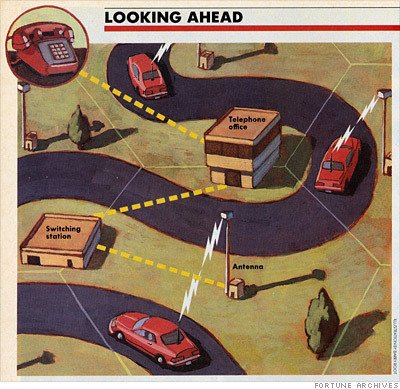

隨著首批不在乎成本的用戶逐漸失去對蜂窩電話的熱情,移動設備制造商將面臨著極大的價格削減壓力。今秋,隨著Tandy Corp.(一家精明的、備受歡迎的企業,通過其全國連鎖店Radio Shack銷售家庭電子設備)推出其首款蜂窩電話,這一壓力將變得更大。Tandy的董事長兼首席執行官約翰·洛奇認為,汽車以外的商品只有在1000美元以下時才能成為熱銷產品。洛奇表示,Tandy的首款蜂窩電話產品標價為“數千美元”。但他還表示,“如果我對市場的預見能夠在未來24個月內發生,在這個基礎上價格下降一半是有可能的。”按照這一說法,設備的成本將非常接近其奇跡般的暢銷價格。洛奇又補充說,“在未來兩年中,我希望看到其價格每個月下降25-30美元。”這一下降幅度將健康地引導需求進一步上漲。 設備和服務的進步還可能會提升電話的銷量。真正的便攜式電話型號(可以放進錢包或口袋,能夠在步行時使用)可能會讓蜂窩電話成為當今有線電話系統的競爭對手。目前唯一能夠邊走邊打電話的蜂窩電話由摩托羅拉制造,其售價超過了4000美元。這部電話的發明者、芝加哥軟件公司Cellular Business Systems的負責人馬丁·庫博認為,便攜式電話的價格在5年內將降至1000美元。 眾多專家預測蜂窩電話還會催生大量的周邊服務需求。移動電話將可以與電腦互聯,接受股票走勢信息、庫存狀況、銷售訂單和其他數據。這些服務可通過使用類似于各種執法車輛所安裝的打印機或傳真機,以影印件的形式提供。 蜂窩電話另一個可能的賣點在于:Oki正在研制一款能夠與汽車電話相連的防盜報警裝置。在停車時,駕駛員會在卡帶上記錄地點,并預設最近的警局管轄區的號碼。如果有人試圖盜車,電話會呼叫警察。Oki預計該設備將于明年面世,售價約500美元。 蜂窩電話服務在排名前90的市場首先推出,這些地區擁有美國74%的人口,但是蜂窩電話最終還是會覆蓋那些在偏遠市場生活和工作的潛在客戶,例如密歇根州的巴特里克市。為了將服務擴張至人口稀疏的農村地區和小城鎮,有人建議使用專用的廣播衛星系統而不是電話線,來連接蜂窩系統。在賓夕法尼亞州的普魯士王市,私營公司Mobile Satellite Corp.副總裁兼聯合創始人羅伊·安德森表示,公司將蜂窩系統與衛星相連的計劃將耗費“幾億美元”。但他已經集結了多個大投資商,包括Associated Communications與通用電氣。他希望該系統能夠在1988年面世。 蜂窩系統的工作原理十分簡單:每個市場區域被劃分為眾多小區(也是蜂窩一詞的來歷);目前,一個小區的縱深可達到16英里,但也可以進一步分割。未來,隨著需求的增長,一個小區可能僅覆蓋某一棟辦公樓。每個小區都有一根天線,能夠同時接收和發射666個通話信號。蜂窩發射器的功率較低,不能遠距離傳輸,因此會不斷地反復占用頻道。 |

Pressure on mobile equipment manufacturers to cut prices will be extreme as the first rush of cost-be-damned buyers subsides. The pressure will increase this fall when Tandy Corp., an adroit mass marketer of home electronic equipment through its nationwide chain of Radio Shack stores, comes out with its first cellular phones. John V. Roach, Tandy’s chairman and chief executive, believes that goods other than automobiles become mass-market items only when they cost under $1,000 each. Tandy’s first cellular products will cast “a couple of thousand,” Roach says. But he adds, “If what I think is going to happen in this market over the next 24 months does happen, half that price is possible.” That would get equipment costs very close to his magic mass-market price. Roach goes on: “In the course of the next two years I’d hope to see monthly costs drop to $25 to $30.” Such a decline should give demand a further healthy kick. Advances in both equipment and service might also hoist consumer sales. Truly portable phones-models that could be toted around in purse or pocket for use on the hoof – might make cellular a rival of today’s wired telephone systems. The only walk around cellular phone now available, made by Motorola, costs more than $4,000. Its developer, Martin Cooper, head of Cellular Business Systems, a Chicago software company, believes portables will be available for as little as $1,000 within five years. Many experts predict a hefty demand for additional over-the-telephone services. Mobile phones will be able to link up with computers to receive information on stock movements, inventory availability, sales orders, and other data. These services could be provided as hard copy, using printers or facsimile machines similar to those already used in various law enforcement vehicles. Another possible cellular attraction: Oki is working on a burglar alarm that can be hooked up to a car phone. On parking a car, the driver records the location on tape and presets the number of the nearest precinct station. If somebody tries to break in, the car calls the cops. Oki expects to put the device on the market next year for about $500. Cellular phone service will become available first in the top 90 markets, which contain about 74 percent of the U.S. population, but cellular may ultimately reach the potential customers who live and work in lesser markets, such as Battle Creek, Michigan. One scheme for spreading service into lightly settled rural areas and small towns and cities would link the cellular system with a direct broadcast satellite system instead of telephone lines. In King of Prussia, Pennsylvania, Roy E. Anderson, vice president and co-founder of Mobile Satellite Corp., a private company, says his company’s plan to link cellular by satellite will cost “a few hundred million.” But he has lined up several big investors, including Associated Communications and General Electric. He hopes to have the system working in 1988. A cellular system works fairly simply: Each market area is divided into cells (hence the name cellular); a cell is an area that at present can measure up to 16 miles across, but can be divided. Someday, as demand builds, a cell may cover only a single office building. Each cell has an antenna — capable of picking up and transmitting 666 calls simultaneously. Cellular transmitters use low power and frequencies that don’t carry far, so channels can be used over and over. |

|

隨著汽車從一個小區移動到另一個小區,與發射器相連的電腦會視情況將信號從一個天線傳輸至另一個天線,以確保信號的強度;這種傳輸不會被人察覺,在不到一秒的時間內就能完成。通過增加發射器的數量和減少小區的面積,蜂窩系統可以處理無限的通話信號。 移動電話已經出現了數十年,但是它們也有缺陷,大多數都源于對該服務所分配無線電頻道數量的限制。在1983年末,紐約市僅有12個頻道,由630位無線電電話用戶共同使用,至少有2000名用戶在排隊等候使用這一服務。即便是這730位幸運的用戶通常也得在通話高峰期經過漫長的等待才能用上免費的通話線路。而且通話質量也很差;有時候呼叫者聽起來就像是在井底打電話一樣。 那些對聯邦通信委員會緩慢的行事節奏并不怎么熟悉的人會驚奇地發現,蜂窩技術在十多年前便已經出現。1971年,貝爾實驗室便已經發明了蜂窩系統。在經歷了近10年的調查和聽證會以及監管機構之間的口角之后,聯邦通信委員會終于授權在兩個市場進行試點,一個在芝加哥,另一個在華盛頓-巴爾地摩市場。在4年的試點工作之后,芝加哥的全套系統已于去年10月開始運行,華盛頓-巴爾地摩已于去年12月開始運行。聯邦通信委員會開始全速批準更多的系統,達拉斯、底特律和密爾沃基很快將加入蜂窩大家庭。 在批準建設蜂窩系統的過程中,聯邦通信委員會強制實施了多個重要的限制。首先,它規定每個市場僅能有兩名運營商,其中一名運營商是當地的電話公司,或稱為有線電話公司。另一名運營商便是“非有線”電話公司,之所以如此命名是因為很多潛在的運營商都擁有無線交互式無線電或傳呼系統方面的背景。 之所以將每個市場或電話公司一分為二,聯邦通信委員會認為,這些電話公司有良好的條件來迅速可靠地運營蜂窩系統。其他反對這種一分為二做法的申請者認為,此舉為電話公司提供了不平等的競爭優勢。多家非有線電話公司曾呼吁聯邦通信委員會撤銷這一規定,但到目前為止卻一再遭到聯邦通信委員會的拒絕。 非有線電話運營商不滿的原因在于,電話公司在所有業務當中都處于壟斷地位,因為所有的蜂窩呼叫都會接入其電話線路中。大型企業MCl’s蜂窩業務子公司正在申請前30強市場中12個市場的牌照,其總裁杰瑞·泰勒將此舉與AT&T曾經在全美電話系統所享受的壟斷待遇進行了對比。他說:“完全是一模一樣的。電話公司希望將蜂窩系統納入其掌控之中。” |

As a car moves from one cell to another, computers linked with the transmitters transfer signals from one antenna to another as needed to keep them strong; the transfers take place unnoticeably, in fractions of seconds. By increasing the number of transmitters and reducing the size of cells, a cellular system could handle unlimited calls. Mobile phones have been around for a couple of decades, but they’ve had a lot of disadvantages — mostly born of the limited number of radio channels assigned for this service. At the end of 1983 there were only 12 channels in New York City to be shared by 630 radiophone subscribers, with a waiting list of at least 2,000. Even the lucky 730 often had long waits for a free circuit during rush hours. And quality was poor; callers sometimes sounded as if they were at the bottom of a well. Those not familiar with the slow pace of life at the federal Communications Commission might find it surprising that cellular technology is already a teenager. Bell Laboratories had developed a cellular system by 1971. After almost a decade of studies and hearings and regulatory wranglings, the FCC finally authorized two trials, one in Chicago, the other in the Washington-Baltimore market. After four years of trials, Chicago’s full-scale system started operating last October, Washington-Baltimore’s in December. The FCC is speeding ahead with approval of still more systems, with Dallas, Detroit, and Milwaukee about ready to join the cellular club. In authorizing cellular systems, the FCC imposed several important restrictions. First, it decided that each market should be limited to only two carriers — the local telephone company, or so-called wire line company, being one. The other carrier was to be a “nonwire” company, so named because many of these would-be carriers have backgrounds in wireless two-way radio or paging systems. In setting aside half o each market or the telephone companies, the FCC reasoned that they are in a good position to get the cellular systems operating quickly and reliably. Other applicants oppose the set-aside rule on the ground that it gives the telephone companies an unfair competitive advantage; several nonwire companies have appealed to the FCC to drop the rule — which the FCC so far has repeatedly refused to do. Nonwire carriers are unhappy that the phone companies enjoy what amounts to a monopoly on all business, because all cellular calls wind up on their wires. Jerry Taylor, president of mighty MCl’s cellular subsidiary, which is applying for licenses in 12 of the top 30 markets, compares this to the monopoly AT&T once enjoyed throughout the U.S. phone system. “It’s exactly the same thing,” he says. “The phone companies would like to make cellular systems subservient to their central offices.” |

|

泰勒認為,蜂窩系統的未來取決于真正的便攜式電話。“這意味著當你從紐約飛到華盛頓時,你可以隨身攜帶電話。”泰勒還認為,所有的蜂窩電話將通過一個全國性的網絡進行互聯,它是一個“自成一派的世界”,在這一網絡中,蜂窩電話將共享單一的區域代碼。為了提升競爭,聯邦通信委員會允許對蜂窩服務進行轉售。例如在紐約,當前提供蜂窩服務的僅有Nynex一家公司。 Mobile Communications和西聯銀行都在推銷其自身的蜂窩服務。西聯銀行將在客戶汽車中安裝由其子公司E.F. Johnson制作的設備,提供電話號碼以及計費服務。雖然最終的服務仍由Nynex提供,但西聯銀行提升了其設備和服務的質量。 租車公司,例如赫茲、阿維斯和Budget等等,也都是轉售商。它們從電話公司購買號碼,在其車中安裝設備,并將之與通話計費儀表相連,然后調高蜂窩電話車輛的租用費,并按照實際呼叫時長收取話費。在印第安納波利斯,Budget額外征收7.5美元/天的費用,以及按50美分/分鐘的價格來計算話費。其他轉售商包括通用汽車的別克品牌部門,以及福特的林肯-水星品牌部門,這兩個廠家在一些車型上將移動電話作為可選配置。 轉售商的回報可能不僅僅是短期的。紐約獨立電視電臺公司LIN Broadcasting Corp.子公司LIN Cellular Communications正在等待聯邦通信委員會批準其在洛杉磯提供蜂窩服務。與此同時,它還是Pacific Telesis(此前Bell公司的母公司,Bell在加州和內華達州均設有公司)子公司Pactel Mobile Access的轉售商。LIN Cellular的總裁理查德·凡爾納指出,其公司與Pactel的合同能夠讓客戶在他們決定從Pactel轉投LIN(在LIN獲得經營批準后)之后依然使用原來的電話號碼。這是一個重要的讓步。獲得移動電話號碼的客戶可能會將其印刷在物品或名片上。如果這一號碼不能從一家公司轉到另一家公司,那么客戶就只能一直使用分配這一號碼的蜂窩服務供應商。 各大電話公司已達成協議,在前30強市場提供服務時不會提交競爭申請,并借此搶占了蜂窩市場的先機。它們同意AT&T的7家運營公司將占據23個30強市場,而General Telephone & Electronics則占據7個。那些想要進入蜂窩領域的非電話公司之間可沒有這么和睦的關系。它們因相互搶奪市場而失去了寶貴的時機。直到最近,像Metromedia, Western Union、Millicom和Maxell Telecom Plus這些在蜂窩熱中涌現的知名公司才成立了它們所稱的“大同盟”。根據同盟的規定,同時在聯邦通信委員會的鼓勵下,只有一位合作伙伴將參與投標,從而在未來60個蜂窩市場的爭奪戰中爭取進入其中的55個市場。 盡管非有線公司仍在相互競爭,但電話公司卻站了出來,并祭出了行業所稱的“需求積壓”策略。客戶對于移動電話異常渴望,哪怕價錢再高,他們都愿意購買。例如在紐約,這樣的人有數千個,很多人在Nynex系統在6月底上線之前便已經安裝了移動電話。當Nynex獲批之后,數百名先知先覺的客戶開始排起了長隊。Potamkin(卡迪拉克和豐田經銷商)曼哈頓分公司的蜂窩電話安裝業務經理巴特·羅賓斯稱,“這座城市成為了一個動物園。”在系統運行后的第一天快要結束時,羅賓斯感到惱火不已。“所有人都想爭當第一。我、我、我。” 運營商也希望成為第一個。在獲批運行蜂窩服務之前,Nynex曾經歷了數次延期。Nynex Mobile的總裁摩根·肯尼迪回憶道,當聯邦通信委員會最終向公司位于紐約珍珠河的總部發話,允許公司開展這一業務時,一名雇員像“保羅·李維爾”那樣一邊喊著新聞,一邊繞著辦公司奔跑。然后所有人都走出了辦公室,并打開了香檳酒。 非有線系統公司Cellular One在華盛頓-巴爾地摩市場搶占了短暫的市場先機,它在那里的競爭對手是Bell Atlantic 子公司Bell Atlantic Mobile Systems。Cellular One董事長維恩·舍勒認為,充當頭鳥相當于“每個月約2%的市場份額”。他說,這一計算結果催生了Cellular One公司,它是處于競爭關系中的非有線電話公司所成立的首個意義非凡的合資公司。 當舍勒在1982年申請華盛頓牌照時,他所執掌的公司更名為American Radio Telephone Service(ARTS)。ARTS最初是一個傳呼機公司,曾作為蜂窩服務試點運營了4年。當時還有四家競爭公司:華盛頓郵報、Metromedia、另一家傳呼機公司Metrocall以及蜂窩咨詢公司Metropolitan Radio Telephone System。 ARTS與Post的蜂窩業務合并了,此舉將競爭對手的數量降到了1個。舍勒說:“我們認為合資企業將我們的經驗與他們不俗的團隊規模以及在通信領域的敬業精神很好地結合起來。”但聯邦通信委員會的動作十分緩慢,同時也在慎重考慮其他三名競爭者的申請。“我開始擔心我們所擁有的優勢,也就是4年的試點,無法與Bell Atlantic所獲得的市場先機相媲美。” 因此,他開始思考進行進一步的整合。9月,他將其在ARTS-Washington Post的股份出售給了Metromedia,以換取現金和其部分業務。Cellular One得以成立,并獲批成為了華盛頓-巴爾地摩市場的非有線運營商。公司的系統于12月開始運行,較Bell Atlantic早了4個月。一場營銷大戰接踵而至,但舍勒稱,他所搶占的市場先機確實帶來了回報,Cellular One斬獲了3000個用戶,而Bell Atlantic大概只有600個。 蜂窩設備制造商同樣面臨著競爭困境。這場競爭將變得尤為激烈,因為產品基本上沒有差異化可言。真正發揮作用的是推銷技巧。移動電話制造界的大哥大摩托羅拉在自家后院丟失了一塊領地,當時,愛立信一舉奪得Rogers Radiocall的轉換站修建合同。Rogers Radiocall是metromedia的子公司,也是Ameritech在芝加哥的競爭對手。 |

Taylor believes that cellular’s future lies with truly portable phones. “That means that when you fly from New York to Washington, you’ll be able to take your phone with you.” Taylor also believes that all cellular phones will be interconnected through a national network — “a universe unto itself’ where cellular phones would share a single area code. To increase competition, the FCC allows resale of cellular service. In New York, for example; where cellular currently is provided only by Nynex. Mobile Communications, Western Union advertises its own cellular service. Western Union will install equipment made by its E.F. Johnson subsidiary in the customer’s car, provide a telephone number, and do the billing. Though the actual service comes through Nynex, Western Union pushes the quality of its equipment and service. Rent-A-Car companies – Hertz, Avis, National, and Budget among others – are also resellers. They buy number from the phone company, install equipment in their cars, and hook up meters that tick away as calls are made – local calls only, thank you, except with telephone credit cars – and then charge customers a premium for the privilege of driving a car with a cellular phone as well as for calls actually made. In Indianapolis, Budget charges a premium of $7.50 a day, plus 50 cents a minute for use of the phone. Other resellers include GM’s Buick division and Ford’s Lincoln-Mercury division, both of which offer mobile phones as optional extras on some models. The resellers’ rewards may be more than short term. LIN Cellular Communications, a subsidiary of New York’s LIN Broadcasting Corp., an independent TV and radio company, is waiting for FCC permission to provide cellular service in Los Angeles. In the meantime, it is whiling away the time as a reseller for Pactel Mobile Access, a subsidiary of Pacific Telesis, parent of the former Bell operating companies in California and Nevada. LIN Cellular President Richard Verne points out that his company’s contract with Pactel allows customers to take their phone numbers with them should they decide to switch from Pactel to LIN after LIN gets the nod to start service. That is an important concession. A customer who gets a mobile number is likely to print it on stationary and business cards. If the number can’t be transferred, the customer is all but handcuffed to the cellular supplier that assigned it. The telephone companies got a head start in cellular by agreeing not to file competing applications to provide service in the top 30 markets. They agreed that AT&T’s seven operating companies would take 23 of these top markets and General Telephone & Electronics seven. No such amity ruled among nontelephone companies wanting to get into cellular, and they lost precious time scrapping with one another for markets. Only recently have such companies as Metromedia, Western Union, Millicom, and Maxell Telecom Plus – all prominent in the rush for cellular – got together in what they call “the grand alliance.” Under this alliance, encouraged by the FCC, only one partner will bid for a place in 55 of the next 60 cellular markets. While the nonwire companies were still scrapping, the telephone companies rushed forth to snare what the industry calls “pent-ups” — customers so eager for mobile phones that they’ll pay almost any price to get them. In New York, for example, there were hundreds of them, many with phones installed weeks before the Nynex system was switched on in late June. When Nynex got approval, hundreds of early-bird customers began to line up. “This city’s a zoo,” exclaimed Bart Robins, manager of cellular installation at a Manhattan branch of Potamkin, a Cadillac and Toyota dealer. By the end of the first day after the switch-on, Robins was exasperated. “Everybody’s got to be first. Me. Me. Me.” The carriers want to be first too. Nynex was subjected to a number of delays before it was allowed to switch on cellular service. When the FCC finally sent word to the company’s Pearl River, New York, headquarters, that it was okay to go ahead, one employee ran around the office shouting out the news “like Paul Revere,” recalls Morgan J. Kennedy, Nynex Mobile’s president. Then everybody went out and drank champagne. Cellular One, a nonwire system, got a brief head start in the Washington-Baltimore market, where it competes with Bell Atlantic Mobile Systems, a subsidiary of Bell Atlantic. Wayne Schelle, chairman of Cellular One, figures being the early bird is worth “about two percentage points of market share a month.” This calculation, he says, led to the formation of Cellular One, the first significant joint venture among competing nonwires. When Schelle bid for the Washington license in 1982, the company he headed was named American Radio Telephone Service. ARTS, originally a beeper company, had operated a trial cellular service for four years. There were four other contenders: the Washington Post Co.; Metromedia; Metrocall, another paging company; and Metropolitan Radio Telephone System, a cellular consulting firm. ARTS and the Post’s cellular business merged, which cut the number of competitors by one. “We thought that the joint venture gave us a good combination, our experience and their big league size and commitment to communications,” says Schelle. But the FCC was moving slowly, ponderously mulling the applications of the three contenders. “I began to worry that the advantage we had, the four-year trial period, would be lost to a head start by Bell Atlantic.” So he began to think of some kind of further merger. In September, he sold the ARTS-Washington Post partnership to Metromedia for cash and part of the business. Cellular One was formed and won approval as the nonwire operator in the Washington Baltimore market. The company’s system began operating in December, four months ahead of Bell Atlantic. A marketing battle has ensued, but Schelle claims that the head start he gained has indeed paid off — Cellular One has 3,000 subscribers to an estimated 600 for Bell Atlantic. Manufacturers of cellular equipment also face a competitive struggle. Competition will be especially tough because there is little to differentiate products. Salesmanship makes the difference. Motorola, the dean of mobile telephony, lost a piece of business in its own backyard when Ericson snatched the contract to build a switching station for Rogers Radiocall, a metromedia subsidiary and Ameritech’s Chicago competitor. |

|

Oki在美國市場將摩托羅拉甩在了身后。Oki美國業務董事長兼首席執行官馬爾·古里安堅持認為,“我們是業界第一”。“我們的市場占有率超過了50%。”摩托羅拉對這一說法持不同意見。然而,Oki在美國的業務做的相當好。公司與紐約Nynex達成了系統設備提供獨家協議,同時還達成了另一項協議,為Southwestern Bell提供99%的設備。公司還與Bell Atlantic和Pactel達成了非獨家協議。事實上,Oki的迅速成功幾乎使自身陷入了困境,有一段時間,公司的供貨無法跟上其產品的需求。如今,古里安表示,Oki的首家美國工廠正在滿負荷運轉,里面滿是機器人,位于喬治亞州的諾克羅斯。 事實上,使用Oki設備的實際客戶數量可能超出了其設想。移動電話行業中的黑市似乎一片欣欣向榮。古里安表示,他不斷地看到和聽到一些有關Oki設備的廣告,“制作這些廣告的廠商我們從來都沒有聽說過。”他說,這些廣告在紐約、邁阿密和洛杉磯到處都是。他還指出,“我試圖找出這些廠家都是從哪獲得的設備,但結果令人抓狂。”當然,能夠在黑市大量出現的產品必然有著不俗的市場前景。(財富中文網) 譯者:馮豐 |

Oki sees itself as outstripping Motorola in the U.S. market. “We’re No. 1,” insists Mal Gurian, chairman and chief executive of Oki’s U.S. operations. “We have more than a 50% market share.” Motorola disputes the claim. But Oki is doing very well. The company has an exclusive agreement to provide New York’s Nynex system with equipment, and another to provide 99% of Southwestern Bell’s. It also has nonexclusive contracts with Bell Atlantic and Pactel. In fact, Oki’s quick success nearly swamped it, and for a while the company was unable to keep pace with demand for its products. Now, Gurian says, Oki’s first U.S. facility, a robot filled factory in Norcross, Georgia, is in full production. In, fact, Oki may be supplying more customers than it wants to. A black market already seems to be flourishing in mobile phones. Gurian says he keeps seeing and hearing advertisements for Oki equipment “place by people we’ve never heard of.” The ads have shown up, he says, in New York, Miami, and Los Angeles. He adds: “It’s driving me crazy trying to find out where they’re getting the equipment.” A product that spawns the black market clearly has good prospects. |