科技業(yè)下一波浪潮:當(dāng)大數(shù)據(jù)遇上生物學(xué)

|

去年12月,CVS提出以690億美元收購安進保險公司。今年1月,又有三大巨頭——亞馬遜、摩根大通和伯克謝爾哈撒韋表示要成立合資公司,降低共100萬左右員工的醫(yī)療成本并提高效果。之后3月,信諾保險表示將出資超過500億美元收購醫(yī)藥福利管理機構(gòu)Express Scripts。 為何近來醫(yī)療領(lǐng)域交易如此熱鬧?猛一看你可能以為是為了追求量級。也就是管理學(xué)中常說的“規(guī)模”。但實際上有個強大的催化劑,一種無限大又無限小的東西似乎能回答所有問題。答案就是數(shù)據(jù)。 更確切地說,是你的數(shù)據(jù):個體生物信息、病史、健康不斷波動的情況,以及去過何處、消費習(xí)慣、睡眠狀況,飲食和排泄等等。日常生活中產(chǎn)生的數(shù)據(jù),實驗室檢測結(jié)果、醫(yī)學(xué)影像、基因檔案、液體活檢、心電圖……這些都只是一小部分,但已涵蓋大量數(shù)據(jù)。再加上醫(yī)療索賠、臨床實驗、處方和學(xué)術(shù)研究等等,每天產(chǎn)生的數(shù)據(jù)約750萬億字節(jié),約占全世界數(shù)據(jù)量的30%。 海量數(shù)據(jù)已存在許久,多虧現(xiàn)在層出不窮的新科技,先進的測量儀器,無處不在的連接和云技術(shù),再加上人工智能,企業(yè)終于可以利用這些數(shù)據(jù)。“收集數(shù)據(jù)只是一方面。”斯克利普斯研究所主任埃里克·托普爾表示。“但更重要的是分析。就在三五年前,數(shù)據(jù)還只能閑置,現(xiàn)在已經(jīng)可以分析解讀。這是醫(yī)療領(lǐng)域最大的變化。” |

It Began in December, with CVS’s proposed $69 billion buyout of insurer Aetna. In January, three more corporate behemoths—Amazon JPMorgan Chase , and Berkshire Hathaway —said they were forming a joint venture aimed at reducing health care costs and improving outcomes for their combined 1 million or so employees. Then, in March, Cigna said it would buy pharmacy benefits manager Express Scripts for more than $50 billion. What’s driving this frenzy of health care–related dealmaking? On first glance you might think it’s merely the pursuit of mass itself. Of “scale,” as management types like to say. But in truth, there’s a more powerful catalyst—one so gargantuan and infinitesimal at the same time that it sounds like the answer to a riddle. And that’s data. More specifically, it’s your data: your individual biology, your health history and ever-fluctuating state of well-being, where you go, what you spend, how you sleep, what you put in your body and what comes out. The amount of data you slough off everyday—in lab tests, medical images, genetic profiles, liquid biopsies, electrocardiograms, to name just a few—is overwhelming by itself. Throw in the stuff from medical claims, clinical trials, prescriptions, academic research, and more, and the yield is something on the order of 750 quadrillion bytes every day—or some 30% of the world’s data production. These massive storehouses of information have always been there. But now, thanks to a slew of novel technologies, sophisticated measuring devices, ubiquitous connectivity and the cloud, and yes, artificial intelligence, companies can harness and make sense of this data as never before. “It’s not the data,” says Eric Topol, director of the Scripps Translational Science Institute. “It’s the analytics. Up until three-to-five years ago, all that data was just sitting there. Now it’s being analyzed and interpreted. It’s the most radical change happening in health care.” |

|

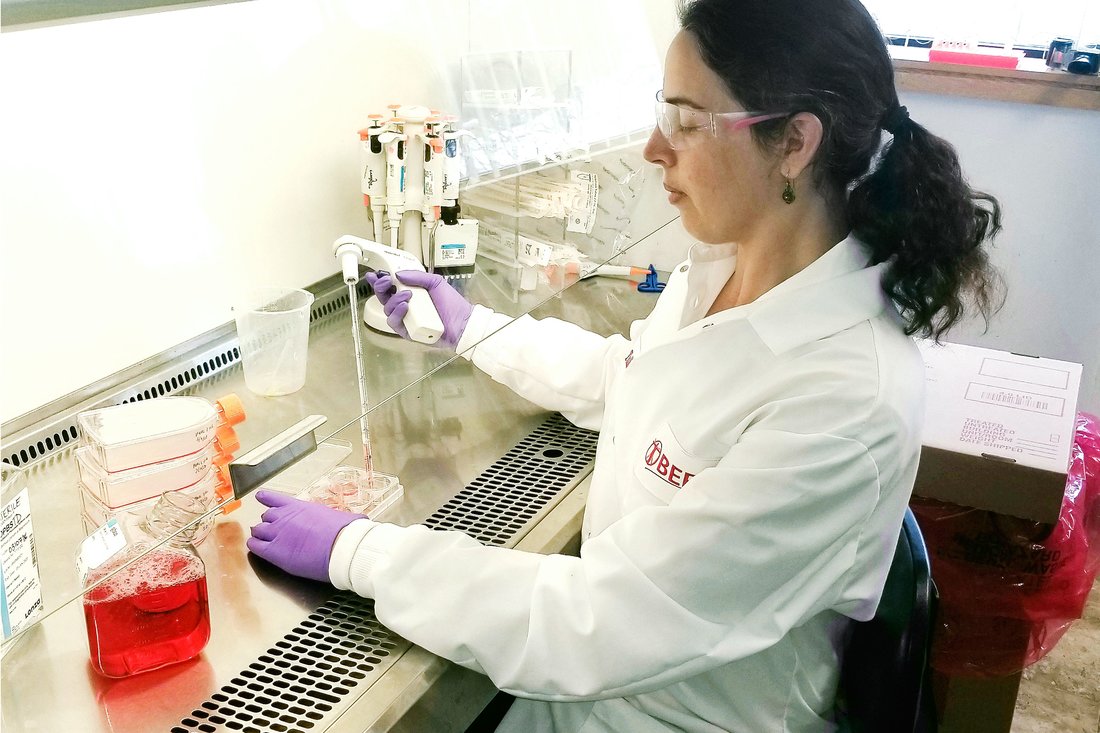

因此,獲取、分析并利用數(shù)據(jù)已成為新的淘金潮。一群科技大鱷,還有一幫熱門初創(chuàng)公司都在積極試水。 谷歌母公司Alphabet旗下的生物科技公司Verily就在追蹤10000名志愿者提供的生物特征信息,努力制定人類健康“基準(zhǔn)”(流言稱其對醫(yī)療保險行業(yè)也有興趣)。蘋果剛宣布了iPhone上的新功能,可以立即對接幾家大醫(yī)療系統(tǒng),上傳醫(yī)療數(shù)據(jù),此外蘋果還與斯坦福大學(xué)進行心臟領(lǐng)域研究,測試可穿戴設(shè)備是否能檢測嚴(yán)重的心臟疾病。 根據(jù)醫(yī)療保險和醫(yī)療補助服務(wù)中心的數(shù)據(jù),合理利用數(shù)據(jù)最終可以提升患者健康水平并降低醫(yī)療成本,僅2018年醫(yī)療成本就預(yù)計增長5.3%。 當(dāng)然,這是遠(yuǎn)期理想。但最起碼能帶動潛在的相關(guān)業(yè)務(wù)。BDO董事總經(jīng)理大衛(wèi)·弗蘭德指出,坐享海量數(shù)據(jù)的Facebook和谷歌通過廣告賺錢,他估計相關(guān)業(yè)務(wù)價值2000億美元。“醫(yī)療行業(yè)規(guī)模要大15倍,”他表示。“醫(yī)療支出達3萬億美元。理論上說,如果路走對了就能打造15個Facebook和15個谷歌。這就是競爭激烈的原因。” 也正因如此,從醫(yī)院到保險公司到福利管理機構(gòu),再到醫(yī)療和儀器制造商,如此多傳統(tǒng)醫(yī)療公司都在急切地重組創(chuàng)新,要知道相關(guān)行業(yè)體量可達經(jīng)濟總量五分之一。行業(yè)重組不僅意味著企業(yè)層面重新劃定醫(yī)療行業(yè)版圖,也會影響到每個人。 埃森哲首席技術(shù)和創(chuàng)新官保羅·多爾蒂比較樂觀,他估計由于“信息不對稱”存在,掌握自身生物數(shù)據(jù)的病人會從中受益,享受更多紅利。 為了更好地了解未來如何實現(xiàn)權(quán)力均衡,也為了更深入探究目前的情況,《財富》雜志采訪了三十幾位涉及醫(yī)療行業(yè)各細(xì)分領(lǐng)域的高管,以及企業(yè)家、醫(yī)生、病人和其他專家。以下就是大數(shù)據(jù)革命在促進醫(yī)藥行業(yè)方面的各種說法。 數(shù)據(jù)藥丸:病患診斷新范式 雅各比八歲生日前后,林德賽·阿莫斯開始注意兒子的異常。雅各比很活潑,經(jīng)常打冰球和長曲棍球,但突然變得有些懶洋洋,而且總想去洗手間。醫(yī)生測量雅各比的血糖后,通知家人趕緊送孩子去急診。路上孩子開始意識模糊。阿莫斯后來才知道,當(dāng)時雅各比的血糖水平高達735毫克/分升,而健康范圍是70-140毫克/分升。幸運的是,雅各比病情沒有發(fā)展到糖尿病酮酸血癥,簡稱DKA。DKA是一種可能致命的并發(fā)癥,由于血糖水平持續(xù)升高,血液變酸性,導(dǎo)致器官衰竭。 阿莫斯一家住在丹佛郊區(qū),可怕事件發(fā)生后醫(yī)生給出的應(yīng)對方案卻極為隨意,也不明確。她的家人上了速成課程學(xué)習(xí)1型糖尿病,了解高血糖和低血糖如何危及生命。他們得知要計算雅各比的糖分?jǐn)z入,一天里要多次檢查血糖,刺破手指用糖尿病測試條,然后手寫記錄在日志中。 壓力,訓(xùn)練,胰島素,各種食物……再加上各項的影響因素相互作用,導(dǎo)致血糖水平出了名的難掌控,要把雅各比的血糖水平保持在健康范圍內(nèi)讓人精疲力盡也很可怕。阿莫斯處處小心計算,但效果不佳,雅各比的血糖就像坐過山車,時而飆升到極高水平(他會感覺疲勞),時而又會降到極低(他會頭暈)。 但雅各比的生死就看這些數(shù)字。阿莫斯希望能時刻了解血糖水平,雅各比診斷后幾個星期,她用盡一切努力測試兒子的血糖,一天能測20多次,遠(yuǎn)遠(yuǎn)超過保險覆蓋的次數(shù)。 |

The quest to retrieve, analyze, and leverage that data has become the new gold rush. And a vanguard of tech titans—not to mention a bevy of hot startups—are on the hunt for it. Alphabet life sciences arm Verily is aiming to create a “baseline” of human health by tracking all kinds of biometric information from 10,000 volunteers (and is rumored to have an interest in the health insurance business). Apple just released an iPhone feature offering users in several big health systems instant access to their own medical record—an effort that joins its ongoing heart study with Stanford, testing if wearables can detect serious cardiac conditions. Tapping this reservoir, say many, will ultimately improve patient health and decrease medical costs, which are projected to rise 5.3% in 2018 alone, according to the Centers for Medicare & Medicaid Services. That’s a noble aspiration, certainly. But not lost on anyone is that it’s sure to make for a potentially blockbuster business too. David Friend, managing director at BDO, points out that data-rich Facebook and Google make their money on advertising—a business worth $200 billion, he estimates. “Health care is 15 times bigger than that,” he says. “We spend $3 trillion. In theory, if this is done right, you’ll have 15 Facebooks and 15 Googles. That’s what’s up for grabs.” Which is why so many old-guard health care companies, from hospitals and insurers to benefits managers and drug and device makers—which together account for one-fifth of the economy—are hastily recombining and reinventing themselves. The realignment promises not only to drastically reshape the health care landscape for companies overall, but for you as well. Optimists, like Accenture’s chief technology and innovation officer Paul Daugherty, predict that the “information asymmetry” will soon favor patients whose ownership of their own biological data will give them new power. To see what the new balance of power will look like in the coming years—and what it looks like right now—Fortune interviewed more than three dozen executives at companies across the health care continuum, along with entrepreneurs, doctors, patients, and other experts. Here’s how the big-data revolution is—and isn’t—transforming medicine. The Data Pill: A New Paradigm for Patients Right around his eighth birthday, Lindsay Amos noticed her son Jacoby seemed not quite himself. The usually active boy who played hockey and lacrosse was sluggish, and he seemed to be going to the bathroom a lot. When the boy’s doctor took a reading of Jacoby’s blood sugar, the family was told to rush to the ER. On the drive there, the eight-year-old drifted in and out of consciousness. Jacoby’s blood sugar, Amos later learned, was 735 mg/dL, compared with a healthy range of 70–140 mg/dL. The boy was lucky not to have developed diabetic ketoacidosis, or DKA, a sometimes fatal complication in which, owing to prolonged elevated glucose levels, the blood becomes acidic, and organs begin to shut down. The resolution to those terrifying events struck Amos, who lives in the Denver suburbs, as startlingly casual and vague. Her family received a crash course on Type 1 diabetes, and the life-threatening consequences of both dangerously high and low blood sugar. They were told to count Jacoby’s carbohydrates and check his blood sugar throughout the day—a process that involves pricking a finger and using a diabetes test strip—and to record this all manually in a logbook. The dance between stress, exercise, insulin, various kinds of food—and what impact all those factors and more have on blood sugar—is notoriously hard to master, and trying to keep Jacoby in a healthy range was both exhausting and frightening. She’d dutifully do the math, but it didn’t seem to matter. Jacoby was on a roller coaster: His glucose level swinging unpredictably to alarming highs (when he’d feel fatigued) to dangerous lows (when he’d feel dizzy). His life depended on this number. Amos wanted to have an idea of where it stood at all times and for the first few weeks after Jacoby’s diagnosis, she did her best—testing her son’s glucose levels 20 or so times a day, far exceeding the number of test strips their insurance provider covered. |

|

每年都有數(shù)百萬美國家庭遇到類似疾病沖擊;但2015年開始,新出現(xiàn)的智能手機技術(shù)部分緩解了擔(dān)憂。加州一家名叫Dexcom的公司將血糖持續(xù)監(jiān)測儀(已經(jīng)問世十多年)與智能手機(或智能手表)無線連接,用戶可以監(jiān)測,繪制并分享血糖數(shù)據(jù),每隔五分鐘即可獲得最新數(shù)據(jù),全天待命,血糖達到危險水平時還能發(fā)出警報。 一些專家認(rèn)為,隨時在線的設(shè)備會告訴病人太多信息,但阿莫斯半開玩笑地介紹自己如何“跟蹤”兒子血糖水平時說,這種儀器堪稱救生員。她說,雅各比現(xiàn)在可以正常地讀小學(xué)三年級,只要注意看看Apple Watch上的血糖數(shù)據(jù)就可以,不用再一天跑很多趟校醫(yī)院。(阿摩斯也在iPhone上隨時盯著。)而且現(xiàn)在雅各比可以安心睡整晚,不用隔幾個小時就起床扎手指測血糖。 設(shè)備提供的還不僅僅是安心,其收集的數(shù)據(jù)確實可以幫阿莫斯和雅各比了解糖尿病情況以及如何控制。他們能發(fā)現(xiàn)哪些食物導(dǎo)致血糖飆升,以及何時注射胰島素能更好地控制比薩之類復(fù)雜碳水化合物。是的,他的糖尿病沒有治愈。但現(xiàn)在至少可以預(yù)測,很少出現(xiàn)意外。很明顯,這項技術(shù)已經(jīng)完全融入他們的日常生活。“跟汽車安全帶和自行車頭盔沒有區(qū)別。”阿莫斯表示。 這只是智能手機和聯(lián)網(wǎng)設(shè)備改變病人與健康數(shù)據(jù)關(guān)系的方式之一,過程中也能幫助病人改善健康狀況。 Virta和Omada Health之類數(shù)字糖尿病預(yù)防和治療平臺還連接起社區(qū)和健康教練,教練可以遠(yuǎn)程監(jiān)控體重、血糖、飲食和服藥等情況。現(xiàn)在還有Proteus Digital Health可食入傳感器,都值得《黑鏡》拍一集了,這種傳感器可以幫助患者(以及醫(yī)生和家屬)隨時查看是否服藥。Froedtert醫(yī)院及威斯康星醫(yī)療網(wǎng)絡(luò)醫(yī)學(xué)院首席創(chuàng)新和數(shù)字官邁克爾·安德烈斯介紹,每粒藥片接觸胃酸時都會啟動應(yīng)用程序,傳感器把整個過程顯示得像游戲一樣。根據(jù)Froedtert測試,丙肝患者服用Gilead Harvoni等昂貴藥物期間,配合傳感器按時服藥比例達98.6%。按時服藥不僅有利于治愈疾病,還能省下不少錢,因為多吃一個月藥費用會多出數(shù)萬美元。這就是Froedtert(而不是患者)支付傳感器費用的原因。 |

This everyday trauma affected millions of American families each year; then, in 2015, a bit of smartphone technology took away some of the worry. A California company called Dexcom connected a continuous glucose monitor (a device that had been around for more than a decade) wirelessly to a smartphone (or smart watch), allowing the user to read, plot, and share blood sugar levels with anyone, at five-minute intervals, all day long—and sending an alert when patients were at risk. While some experts believe such always-on devices can leave patients with too much information, Amos—who half-jokingly speaks of “stalking” her son’s glucose levels—says it’s a lifesaver. Jacoby is now just another normal third-grader, she says. Rather than leaving class to go to the nurse’s office multiple times a day, he discreetly monitors his blood sugar on his Apple Watch. (Amos watches too, on her iPhone.) And instead of waking every few hours to have his finger pricked, he sleeps through the night. But the device offers more than just peace of mind. The data it generates has actually helped Amos and Jacoby understand his diabetes and how to manage it. It lets them see what foods make his blood sugar soar and how best to time his insulin shots around complex carbs like pizza. No, his diabetes isn’t cured. But his blood sugar is now predictable and rarely triggers an alarm. It’s remarkable how unremarkable the technology now is in their lives. “It’s no different than a seat belt or a bicycle helmet,” she says. This is but one way in which smartphones and connected devices are changing the relationship between patients and their health data—and enabling them to improve their health in the process. Digital diabetes prevention and treatment platforms such as Virta and Omada Health connect users with support communities and health coaches—who can remotely monitor things like weight, blood sugar, diet, and medicine intake. Then there’s Proteus Digital Health’s ingestible sensor, which—with a technology worthy of an episode of Black Mirror—helps patients (and, if they want, their doctors and family members) keep tabs on whether or not they’re taking their meds. By pinging an app every time a pill hits stomach acid, the sensor gamifies the prescription process, as Michael Anderes, the chief innovation and digital officer at Froedtert and the Medical College of Wisconsin Health Network, puts it. Hepatitis C patients on expensive drugs like Gilead’s Harvoni were 98.6% compliant in taking the medicine at the right time when using the sensors, in Froedtert’s experience. That’s not just critical for curing the disease, it’s also a major money saver because an extra month of medication would cost tens of thousands of dollars. Which is why Froedtert (not its patients) foots the bill for the sensor. |

|

流行的Apple Watch或Android系統(tǒng)可穿戴健康設(shè)備已經(jīng)普及,提醒各種健康事項,從睡眠呼吸暫停到高血壓,甚至是嚴(yán)重心律失常。人們越發(fā)關(guān)注自己的基因組,希望預(yù)測患上某些疾病(如癌癥和阿爾茨海默病)的風(fēng)險,有些暫時還無法實現(xiàn),有些技術(shù)尚不完備(并且有爭議)。消費者開始利用Colour Genomics和23andMe等公司非常便宜又方便的基因檢測試劑盒,檢測結(jié)果會提示罹患某些疾病幾率較高。支持者認(rèn)為,了解風(fēng)險有時可以幫人們采取相應(yīng)預(yù)防措施,從而降低風(fēng)險。 突然之間,類似家庭基因測試變成必需品:最近的黑色星期五,23andMe的標(biāo)準(zhǔn)DNA測試銷量躋身亞馬遜前五,差點趕上亞馬遜自家出品的智能音箱Echo Dot和多功能高壓鍋“Instant Pot”。 所有革新技術(shù)的賣點都很簡單:消費者主導(dǎo)。 一些大型保險公司甚至發(fā)現(xiàn),讓患者參與數(shù)據(jù)有助于改善結(jié)果和控制成本。這也是安泰保險首席執(zhí)行官個馬克·貝爾托里尼下的賭注。貝爾托里尼正爭取與CVS達成合作,他認(rèn)為,如果企業(yè)能明確告知消費者享受的益處,消費者就可能甚至?xí)e極共享數(shù)據(jù)。“我們制定了各種規(guī)則保護數(shù)據(jù),”貝爾托里尼表示,“但如果換個角度告訴客戶,‘如果我們能掌握有關(guān)你的信息,服務(wù)起來更方便,’他或她就會愿意提供數(shù)據(jù)。這也是社交媒體作用很大的原因。” 掌握個性化數(shù)據(jù)后,公司可以與患者共同制定健康計劃,貝爾托里尼說:“我們會告訴患者,如果一起制定計劃就可以免除共同支付金額,也不必再授權(quán),就因為計劃是一起制定的。” 指揮中心:通過數(shù)據(jù)實現(xiàn)更好決策 疼痛來襲時,羅德尼·M正在給妻子挑選生日禮物。這位52歲的公關(guān)公司首席執(zhí)行官抓緊胸口,掙扎著做在椅子上,腰部以上都失去了知覺,只感到麻木。他感覺就像“被卡車撞了一樣”。 兩年前羅德尼剛治療過癌癥,又患上一種新重病——為身體輸送血液的關(guān)鍵動脈撕裂導(dǎo)致的“主動脈夾層”。 他還算幸運,急救車及時趕到把他送到馬里蘭州哥倫比亞市的霍華德縣總醫(yī)院,五分之一罹患動脈夾層的病人送到醫(yī)院之前就去世了。這還沒折騰完,幾分鐘內(nèi)羅德尼又被飛機送到巴爾的摩的約翰霍普金斯醫(yī)院,經(jīng)過七個小時的復(fù)雜手術(shù)終于活了下來。 當(dāng)時他并不知道,其實是霍普金斯醫(yī)院人工智能驅(qū)動的數(shù)據(jù)“指揮中心”救了他的命。“41分鐘。從監(jiān)控系統(tǒng)報警到飛機從醫(yī)院起飛只用了41分鐘。”首席行政官吉姆·舒?zhèn)惐硎荆?fù)責(zé)醫(yī)療中心不斷擴大的急診部門。 指揮中心從十幾個數(shù)據(jù)流中實時提取信息,包括病歷、緊急調(diào)度服務(wù)更新、實驗檢測結(jié)果,以及在特定時間醫(yī)院有多少張病床。然后通過人工改進的算法,系統(tǒng)可以瞬間完成患者分級并根據(jù)需要進行安排,例如在羅德尼的案例中提前安排好外科手術(shù)團隊。 對于醫(yī)院來說,數(shù)據(jù)管理產(chǎn)生的經(jīng)濟效益無可爭議。“霍普金斯醫(yī)院指揮中心2016年啟動以來,收治復(fù)雜癌癥患者的能力增加了約60%,急診室等床時間(等待住院病床)減少了25%以上,而手術(shù)室的等候時間減少了60%,“霍普金斯指揮中心設(shè)計方——通用電氣醫(yī)療該項目負(fù)責(zé)人杰夫·特里說。霍普金斯醫(yī)院的舒?zhèn)惐硎荆瑧?yīng)用該技術(shù)后,相當(dāng)于醫(yī)院不用實際投入,而收治能力增加15到16張病床。今年通用電氣計劃宣布新成立10個指揮中心,覆蓋30家不同的醫(yī)院。特里稱,未來五年里醫(yī)療中心的投資回報率可達近4比1。 電子病歷(EHR)也是近期大數(shù)據(jù)最新突破,可能沒那么吸睛,但同樣具有革新性。 電子病歷是醫(yī)療圈少有人人討厭的技術(shù)。醫(yī)生抱怨稱浪費的時間太多,跟其他醫(yī)療記錄系統(tǒng)也沒法順利協(xié)作,并且其中大部分患者都讀不懂。2015年以來,至少有593篇學(xué)術(shù)論文和一條說唱視頻吐槽過該技術(shù)導(dǎo)致醫(yī)生耗盡精力。如果大數(shù)據(jù)真能革新行業(yè),機會可能就在這,應(yīng)該將電子病歷從耗時工作轉(zhuǎn)變?yōu)榭尚械难芯抗ぞ摺? 密歇根州西南部一個非盈利社區(qū)衛(wèi)生系統(tǒng)Lakeland Health里,大數(shù)據(jù)確實發(fā)揮了作用。2012年,Lakeland開始啟用電子病歷系統(tǒng),但基本由紙和筆組成。護士先在圖表里記錄每個病人的生命體征,回到電腦邊再手動重新輸入醫(yī)院的電子系統(tǒng),這一轉(zhuǎn)錄過程需要15到20分鐘,并且經(jīng)常出現(xiàn)錯誤。2016年中,醫(yī)院啟動全新流程,通過患者的腕帶自動上傳,或護士利用手持設(shè)備的床邊輸入數(shù)據(jù)。 Lakeland首席護理信息官阿瑟·巴拉奇表示,從一開始就有個明顯變化:護士們花在輸入數(shù)據(jù)上的時間減少,有更多時間照顧患者。但更徹底也令人驚訝的變化是“藍(lán)色警報”下降:即患者心臟和呼吸停止。自英荷健康巨頭飛利浦開發(fā)的新系統(tǒng)于2016年6月推出后,藍(lán)色警報已下降56%。為什么?部分原因是警報系統(tǒng)嵌入了人工智能技術(shù),不僅能檢測生命體征的細(xì)微變化,還能根據(jù)病情打出風(fēng)險評分,方便護士優(yōu)先照顧病情更危急的病人。 “重要的是誠實地認(rèn)識現(xiàn)狀。”飛利浦戰(zhàn)略與創(chuàng)新首席醫(yī)療官羅伊·史麥斯表示。許多新數(shù)字和數(shù)據(jù)工具關(guān)注的重點不是護理,而是如何使護理更高效、更智能、更精確地實現(xiàn)。 史麥斯跟《財富》雜志采訪的許多位專家觀點一致,即使是對數(shù)字健康極感興趣的人。他們都警告不要過度使用新醫(yī)療技術(shù)。 “我們過度承諾,真正實現(xiàn)的不多。”西達斯西奈醫(yī)學(xué)中心醫(yī)生兼健康服務(wù)研究主任布倫南·斯皮格爾表示。“我認(rèn)為自己是對技術(shù)保持懷疑的技術(shù)狂。但硅谷這個“回聲室”里有太多人從來沒接觸過病人,也不理解數(shù)字醫(yī)療多么困難。“斯皮格爾還在加州洛杉磯分校擔(dān)任醫(yī)學(xué)和公共健康教授,他舉了親身經(jīng)歷的失敗案例為證,包括2015年西達斯西奈想通過Fitbit、Apple Watch、Withings等可穿戴設(shè)備將病人與電子病歷連接起來,結(jié)果一敗涂地。“我們沒能給病人適合的信息,也沒誠摯邀請他們參與項目。”潛在參與者沒什么理由參與連接和項目,因為項目沒有明確的價值主張。“數(shù)字健康不是計算機科學(xué)或工程科學(xué),而是社會科學(xué)和行為科學(xué)。” 斯科利普斯研究所的埃里克·托普爾同時也是一位著名的心臟病專家,他也提出了類似警告。“承諾很多,但大部分沒實現(xiàn)。”他表示原因是存在各種系統(tǒng)性障礙。挑戰(zhàn)之一便是美國僵化又“長期存在”的醫(yī)療機構(gòu)。美國醫(yī)生有半數(shù)超過50歲,他們抗拒改變,“除非獲得更多補償。” 對抗“故障問題” 按照安進公司的說法,大數(shù)據(jù)已然顛覆加州生物醫(yī)藥研發(fā)過程,還大大影響了研發(fā)階段新藥。事情是2011年開始的,時任研發(fā)主管的肖恩·哈珀前往冰島旅行。他的目的是解決公司面臨的“故障問題”,也是行業(yè)的問題。簡單來說,90%的研發(fā)新藥都沒法進入市場。 研發(fā)新藥非常昂貴而且低效。企業(yè)經(jīng)常投資數(shù)十億美元,花很多年努力驗證可能有希望的科學(xué)假設(shè)。藥品科學(xué)家渴望化學(xué)試驗時突降好運,實際上并沒完全理解努力追求的生物復(fù)雜性,也不明白為何某些藥在白鼠身上作用明顯,對人類卻不起作用。 對哈珀來說,冰島似乎可以提供一些獨特的醫(yī)療數(shù)據(jù)。數(shù)據(jù)由冰島政府提供,包括16萬公民的基因排序信息,還有醫(yī)療和家譜,數(shù)據(jù)由總部位于雷克雅未克的人類基因設(shè)備公司deCode存儲分析。該公司1996年成立,一直在苦苦經(jīng)營。 盡管償付能力存在問題,但deCode在基因探索領(lǐng)域成果豐碩。其擁有的大量數(shù)據(jù)可以用來挖掘遺傳變異人群,并將變異與癌癥到精神分裂癥等疾病的臨床結(jié)果聯(lián)系起來。隨著計算機處理能力提升,測序成本大幅下降,哈珀發(fā)現(xiàn)該公司對藥物研發(fā)來說是價值低估的資產(chǎn),于是2012年安進公司以4.15億美元將其收入囊中。 此次收購徹底改變了安進的研發(fā)過程。收購之前,安進候選分子中只有15%針對特定的遺傳目標(biāo)進行了驗證。收購?fù)瓿珊螅策M開始利用deCode的數(shù)據(jù)庫評估所有候選藥物。審核發(fā)現(xiàn)了一些明顯不起作用的藥物。證據(jù)顯示,有5%的候選分子沒有療效。管理層立刻關(guān)停相關(guān)項目(包括一種非常受期待的冠狀動脈藥物,而且即將進入人體試驗階段),轉(zhuǎn)而優(yōu)先考慮基因靶點明確的藥物。經(jīng)deCode基因數(shù)據(jù)庫確認(rèn)后,安進也通過了十多種藥物。 哈珀表示,現(xiàn)在安進公司四分之三的研發(fā)產(chǎn)品都會參考基因數(shù)據(jù),大部分都來自deCode數(shù)據(jù)庫,如今收購成本早已收回。 盡管對藥物靶點進行基因驗證并不能保證最后成功,但科學(xué)家們還是得弄清楚如何安全有效地給藥,應(yīng)對大量生物學(xué)上的挑戰(zhàn),確實開了個好頭。哈珀表示,“如果回報率能提高50%,變化已經(jīng)很大。” 生物科技公司再生元也曾想與deCode合作,跟安進公司收購deCode時間差不多,其策略也跟安進類似。最終再生元沒有尋求收購,而是以再生元遺傳學(xué)中心(RGC)的形式建立自己的研究中心,花費四年給大量外顯組完成測序(蛋白質(zhì)編碼部分的基因組)盡可能與病歷配對,并加速藥物研發(fā)。 再生元基因組生物信息學(xué)負(fù)責(zé)人杰夫·里德表示,很多人在討論藥品研發(fā)時利用基因技術(shù),“卻沒有提前設(shè)計樣本流。”簡單來說:他們沒有數(shù)據(jù)。后來里德得知再生元與蓋辛格公司有合作,便加入了再生元(參見《基礎(chǔ)護理》),蓋辛格是位于賓夕法尼亞州的健康管理系統(tǒng),計劃從10萬名病歷完整的患者中收集樣本并對完成測序。“他們希望獲得數(shù)據(jù)后能切實改善對患者的護理。”再生元遺傳學(xué)中心負(fù)責(zé)人阿里斯·巴拉斯說。 如今再生元合作方已超過60個,包括已招募50萬名參與者的英國生物銀行。巴拉斯和里德說,其掌握的數(shù)據(jù)規(guī)模和多樣性都不斷發(fā)展,內(nèi)部研究數(shù)據(jù)能力也不斷增強,這點至關(guān)重要。迄今為止已啟動50個靶點生物學(xué)項目。 隱藏的數(shù)字:病歷未盡之用 腫瘤科醫(yī)生和前杜克大學(xué)教授艾米·阿伯內(nèi)西認(rèn)為,雜亂的健康信息沒什么意義,除非符合兩個關(guān)鍵標(biāo)準(zhǔn):質(zhì)量和背景。“不了解醫(yī)學(xué)實踐核心的人都不知道到底多么混亂。”四年前擔(dān)任Flatiron Health首席醫(yī)療官的阿伯內(nèi)西表示,這家創(chuàng)業(yè)公司由谷歌風(fēng)投(GV)投資。 以Flatiron專長的癌癥病歷為例。腫瘤學(xué)電子病歷中的許多重要信息(實際上約一半)可能都在醫(yī)生的筆記中,但筆記沒法組成特定的數(shù)據(jù)字段。各種觀察結(jié)果沒法按類整理在表格中。 “過去電子病歷只是收費和收藏工具,醫(yī)生按規(guī)矩撰寫才能保住工作。”田納西腫瘤中心的醫(yī)生兼首席執(zhí)行官杰弗里·巴頓解釋說。田納西腫瘤中心是基于社區(qū)的醫(yī)療機構(gòu),收治了該州大部分癌癥患者,也是數(shù)百個使用Flatiron系統(tǒng)的社區(qū)癌癥中心之一。 諷刺的是,F(xiàn)latiron的真正賣點是人類。遇到此類數(shù)據(jù),人類往往能發(fā)現(xiàn)計算機系統(tǒng)可能錯過的細(xì)節(jié)。阿伯內(nèi)西說,真正的挑戰(zhàn)不是收集數(shù)據(jù),而是要“清理干凈”。“如果不理解相關(guān)背景真的很難做到。” Flatiron現(xiàn)在掌握美國20%主動治療的癌癥患者數(shù)據(jù),“數(shù)據(jù)結(jié)構(gòu)很清晰。”羅氏制藥公司首席執(zhí)行官丹尼爾·奧蒂表示,今年2月羅氏出資19億美元收購了Flatiron公司。“Flatiron特別之處在于能整理出符合監(jiān)管要求的真實數(shù)據(jù)。”奧蒂告訴《財富》。他表示,F(xiàn)latiron的數(shù)據(jù)非常完備,“理論上可以取代羅氏為癌癥免疫治療藥物Tecentriq設(shè)置的臨床試驗‘對照組’之一”。 理論上,F(xiàn)latiron的數(shù)據(jù)系統(tǒng)可能對臨床試驗招募產(chǎn)生更廣泛的影響。數(shù)十年來,癌癥藥物研究中病人招募都是最大挑戰(zhàn)之一。舉例來說,如果招募順利就更容易根據(jù)病人情況匹配適合的藥物。 IBM沃森在該領(lǐng)域初見成效。梅奧診所今年3月報告稱,使用IBM先進的認(rèn)知計算系統(tǒng)后,乳腺癌臨床試驗參與人數(shù)增加了80%。 “沃森幫我們更快更準(zhǔn)確地匹配患者與潛在的臨床試驗,以往腫瘤醫(yī)生很難做到。”梅奧診所首席信息官克里斯托弗·羅斯接受貿(mào)易出版物MobiHealthNews采訪時表示。 即使是以前很少有機會接觸患者的機構(gòu),例如藥房福利管理結(jié)構(gòu),由于掌握海量數(shù)據(jù),也可能為改善人類健康和降低成本貢獻力量。 以密蘇里州的藥房福利管理結(jié)構(gòu)Express Scripts為例,今年 3月剛剛由信諾保險收購。Express Scripts每年為1億美國人管理14億個處方,人們什么時候不按時吃藥都知道。不遵醫(yī)囑服藥每年導(dǎo)致的成本達1000億美元至3000億美元,數(shù)字差異是由于測算方式不同。成本出現(xiàn)的原因是患者不遵醫(yī)囑出現(xiàn)并發(fā)癥,引起后續(xù)治療。 Express Scripts首席數(shù)據(jù)官湯姆·亨利表示,已經(jīng)發(fā)現(xiàn)300種可能讓病人放棄照處方配藥的因素。各項因素包括從基本的人口統(tǒng)計數(shù)據(jù)(收入水平和郵政編碼)到行為數(shù)據(jù)(根據(jù)患者不取處方藥后的調(diào)查問卷,判斷患者健忘程度和拖延傾向)再到直觀性較低的因素,如開藥者和患者的性別(接受女性醫(yī)生診治的男性不遵從醫(yī)囑可能性更大)。該公司稱,算法準(zhǔn)確率達到94%,可以用算法為患者風(fēng)險評分,并采取不同的提醒服務(wù)。亨利稱提醒服藥的方式“比較溫和,不會強迫”。總之,Express Scripts稱不遵醫(yī)囑服藥現(xiàn)象減少了37%,為客戶節(jié)省了1.8億美元。 與其他領(lǐng)域的革命一樣,許多人沒考慮清楚下一步,也沒準(zhǔn)備好承擔(dān)相應(yīng)后果便紛紛涌入。在醫(yī)療大數(shù)據(jù)社交實驗中問題也有多方面,從病人隱私到警告人們有些風(fēng)險無法避免時的道德困境等。對許多數(shù)字醫(yī)療支持者來說,大數(shù)據(jù)仿佛是苦苦等待的一粒“魔術(shù)子彈”。問題是這顆子彈究竟往哪里打。(財富中文) 本文另一版本發(fā)表于2018年4月《財富》雜志,標(biāo)題為《當(dāng)大數(shù)據(jù)遇上生物學(xué)》。 譯者:Pessy 審校:夏林 |

Wearable health trackers like the popular Apple Watch or Android-based devices are now alerting their owners to everything from sleep apnea to hypertension to even serious cardiac arrhythmias. And increasingly, that self-awareness is drilling into our own genomes, helping people—if for now, imperfectly (and controversially)—gauge their risk of developing certain diseases, such as cancer and Alzheimer’s. Consumers are turning to ever-cheaper, spit-and-send genetic test kits offered by companies like Color Genomics and 23andMe, to forewarn them of specific genetic susceptibilities—an awareness that, boosters say, can sometimes enable individuals to take preventive action that may mitigate those risks. Out of the blue, such at-home gene tests have become consumer must-haves: On the most recent Black Friday, 23andMe’s standard DNA test was one of Amazon’s top five sellers—barely trailing Amazon’s own Echo Dot and the “Instant Pot.” The selling point for all of these transformative technologies is a simple one: The consumer is in the driver’s seat. Some big insurers are even discovering that engaging patients with their data is a good way to improve outcomes and control costs. That’s what Mark Bertolini is betting on. Bertolini, the CEO of Aetna, which is looking to combine forces with CVS , believes that consumers can be—and would actively want to be—data-sharing partners, if companies can demonstrate how consumers can benefit from that cooperation. “We have all these rules about protecting data,” says Bertolini. “But if you turn it around and say to the customer, ‘If we have this information about you, we can make this a lot more convenient for you,’ he or she will give you the data. That’s why social media works the way it does.” With that personalized data, then, the company can build a health plan in concert with those patients, says Bertolini: “We want to say to them, if we build a plan together, there are no copays and there are no authorizations because we built it together.” Command Central: Better Decisions Through Data Rodney M. was picking up a birthday present for his wife when the pain hit. The 52-year-old CEO of a communications firm clutched his chest and scrambled to a seat. He felt numb, paralyzed from the waist down. It felt like he’d been “hit by a truck.” Already a cancer survivor in remission for two years, Rodney had just suffered a whole new kind of medical nightmare—an “aortic dissection,” caused by a tear in the critical artery that supplies the body’s lifeblood. He was lucky when the ambulance arrived quickly to take him to Howard County General Hospital, in Columbia, Md.—one in five aortic dissection patients dies before reaching a hospital. But his journey didn’t end there: Within minutes, Rodney was being airlifted to Johns Hopkins in Baltimore—and after a complex, seven-hour surgery, survived. He didn’t know it at the time, but an artificial intelligence-powered data “command center” at Hopkins helped save his life. “Forty-one minutes. That’s how long it took to get wheels up from the hospital,” says Jim Scheulen, the chief administrative officer tasked with overseeing the medical center’s sprawling emergency medicine unit. The command center pulls in information from more than a dozen data streams in real time, including patient health records, emergency dispatch service updates, lab results, and tabs on how many hospital beds are available at any given time. Then, through its human-trained algorithms, it makes split-second decisions on triaging patients and getting them where they need to go—prepping the surgical team ahead of time in cases like Rodney’s. For the hospital, the financial benefits of all this data management are unmistakable. “At Hopkins, there’s been about a 60% increase in the ability to accept complex cancer patients, an over 25% reduction in emergency room boarding [those waiting for an inpatient bed], and a 60% reduction in operating room holds with the command center since its launch in February 2016,” says Jeff Terry, who oversees such projects for GEHealthcare, which built the Hopkins command center. Hopkins’s Scheulen says the technology functionally expanded the hospital’s capacity by 15 or 16 beds without the need to add, well, actual beds. This year, GE plans to announce 10 new command centers covering 30 different hospitals—which, over five years, Terry claims, should yield those medical centers a roughly 4 to 1 return on their investment. Far less whizbang, but likely more transformative, are recent upgrades to last generation’s big-data breakthrough: the electronic health record (EHR). It’s hard to find a medical technology more universally hated than the EHR. Doctors complain that it consumes too much of their time, that they don’t work well with other medical records systems, and that they’re still largely indecipherable to patients. The technology’s role in physician burnout has been explored in no less than 593 scholarly articles and one rap video since 2015. But if the big-data mission has found a worthy calling, it is here—transforming electronic health records from a time suck to a viable research tool. That’s what happened at Lakeland Health, a not-for-profit community health system in southwest Michigan. Lakeland got an EHR system in 2012—but it might as well have been composed of paper and pen. Nurses there recorded vital signs of every patient on charts—and once back at their workstation, would manually reenter the stats into the hospital’s electronic system, a transcription process that ate up 15 to 20 minutes and often resulted in errors. Then, in mid-2016, they switched to a new process that enabled data to be automatically uploaded from patient wristbands or entered by nurses at their bedside on handheld devices. One change was obvious from the start: Nurses spent less time on data entry and more time tending to patients, says Arthur Bairagee, Lakeland’s chief nursing informatics officer. But more radical—and surprising—was the drop in “code blues”: the warnings that patients were in cardiac and respiratory arrest. They’ve dropped a mammoth 56% since the new system, developed by Anglo-Dutch health giant Philips, was introduced in June 2016. Why? In part, the A.I.-driven warning system built into the monitoring technology, which not only picks up on even subtle changes in vital signs, but also assigns patients risk scores that help nurses prioritize their attention. “It’s important to be honest and pragmatic about where we are now,” says Roy Smythe, chief medical officer for strategy and innovation at Philips. Many of the new digital and data tools aren’t so much about providing care, but rather about making that care more efficient, smarter, and precisely delivered. Like so many experts Fortune interviewed—even those who are gung ho about digital health—Smythe cautions against overhyping the new med tech. “We have overpromised and under–delivered,” says Brennan Spiegel, a physician and director of health services research at the Cedars-Sinai health system. “I consider myself a techno-skeptical techno-philiac. But there are way too many people in the Silicon Valley echo chamber who have never touched hands on a patient and don’t understand how hard digital health is.” Spiegel, who is also a professor of medicine and public health at UCLA, points to high-profile failures he’s personally experienced in the field—including a 2015 Cedars-Sinai project to connect patients, through wearables like Fitbit, Apple Watch, Withings, and others, to electronic health records, which flopped spectacularly. “We didn’t give patients the optimal messaging, and we didn’t invite them in the most compelling way.” So potential participants had little personal rationale to connect and stay engaged with the program because it didn’t present a tangible value proposition. “Digital health is not a computer science or an engineering science; it’s a social science and a behavioral science.” Eric Topol, at Scripps, who’s also a renowned cardiologist, sounds a similar cautionary note. “There’s a tremendous amount of promise, but so much is unfulfilled,” he says, owing to a variety of systemic roadblocks. Among the challenges, he says, are America’s rigid and “l(fā)ong in the tooth” medical establishment—half of U.S. doctors are over 50—which is resistant to changing its ways “unless it’s going to lead to higher compensation.” Fighting the “Failure Problem” To hear the folks at Amgen tell it, big data has upended the California biotech’s drug development process and significantly reshaped its pipeline. That story begins in 2011, when R&D chief Sean Harper, started making trips to Iceland. He was trying to solve his company’s—which is also the industry’s—“failure problem,” which is summed up by the fact that 90% of drug candidates fail to make it to market. Discovering new medicines is a wildly expensive and inefficient endeavor. Companies will often invest billions of dollars and many years chasing a promising scientific hypothesis. Pharmaceutical scientists hope for a moment of chemical serendipity, despite often not fully understanding the complexity of the biological mechanisms they’re targeting—or why something might fail in humans when it works so neatly in a mouse model. For Harper, Iceland seemed to offer an unparalleled pool of health-related data. The collection of that data—the genetic sequences of 160,000 citizens, along with their medical and genealogical records—was made possible by the Icelandic government, and the storage and analysis of that data was overseen by deCode, a Reykjavík-based human genetics outfit that, since its founding in 1996, had struggled to stay afloat financially. Despite its solvency issues, deCode had become a prolific publisher of genetic discovery. Its trove of data allowed the company to mine the population for genetic variants and connect those variants to clinical outcomes in diseases ranging from cancer to schizophrenia. As the cost of sequencing plummeted in sync with the rise of computer processing power, Harper saw an undervalued asset for drug discovery: Amgen bought the company in 2012 for $415 million. That purchase has utterly transformed Amgen’s R&D process. Prior to the deCode acquisition, only 15% of Amgen candidate molecules had been validated against specific genetic targets. After the purchase, Amgen began evaluating all of its drug candidates against deCode’s database. The review exposed some clear losers; in the case of 5% of its candidate molecules, there was evidence the agent wouldn’t work. Managers killed those programs (including one highly anticipated drug aimed at coronary disorders that was about to head into human trials) and prioritized others where there was a clear genetic target for the drug. Amgen also green-lighted more than a dozen drugs for which it found confirmation in deCode’s genetic data. Today, three-quarters of Amgen’s pipeline is based on genetic insights largely gleaned from the database, says Harper, and the company has more than earned its investment back. While having genetic validation for a target is no guarantee of success—scientists still have to figure out how to drug the target safely and effectively, and meet myriad other biological challenges—it does offer a head start. Says Harper, “If you can increase your rate of return by 50%, that’s enormous.” Regeneron, a biotech that was looking to partner with deCode around the same time Amgen bought it, has a similar strategy. But rather than buying up a genetic research outfit, it decided to build its own in the form of the Regeneron Genetics Center (RGC), an ambitious four-year old effort to sequence as many exomes (the protein-encoding part of the genome) as possible, pair them with medical records, and accelerate drug development. Lots of people talk about the promise of using genetics in pharma R&D, says Jeff Reid, Regeneron’s chief of genome bioinformatics, “but they don’t have a vision for sample flow.” Translation: They don’t have the data. Reid joined Regeneron when he learned the company had partnered with Geisinger (see “Keystone Care”), a Pennsylvania-based health care system with which it planned to collect and sequence samples from 100,000 consenting patients who also have comprehensive medical records. “They wanted to take this data and actually improve the care of patients,” says Aris Baras, who heads up the RGC. The company has since partnered with more than 60 other sources including the UK Biobank, which has recruited 500,000 participants. Baras and Reid say the scale and diversity of its growing data set, along with the ability to make all of these discoveries in-house, are critical. The work has so far spawned 50 target biology programs. Hidden Figures: The Untapped Value of Medical Records A random assortment of health information doesn’t mean much if it doesn’t meet at least two critical criteria, says oncologist and former Duke professor Amy Abernethy: quality and context. “Anyone who doesn’t understand the core aspects of practicing medicine can’t understand how messy it is,” says Abernethy, who four years ago became the chief medical officer at Flatiron Health, a startup backed by Google Ventures (GV). Take cancer records—Flatiron’s specialty—as an example. Many of the most useful nuggets in an oncology EHR (about half, in fact) may reside in doctors’ notes that aren’t structured into specific data fields. These are the sorts of observations that can’t be neatly packaged into categories on a form. “Historically, these electronic records are billing and collection tools, documentation we have to comply with to get paid,” explains Jeffrey Patton, a physician and CEO of Tennessee Oncology, a community-based health system that treats the largest number of cancer patients in the state and is one of hundreds of community cancer centers that now uses Flatiron’s system. Flatiron’s selling point, ironically, is humans. When it comes to this type of data, it seems, people can figure out things a purely computer-driven system might miss. The real challenge isn’t to gather the data, but to “clean it up,” says Abernethy. “And that’s really hard without an understanding of context.” Flatiron now has data from 20% of active cancer patients in the U.S., “and it’s extremely well structured,” says Daniel O’Day, CEO of Roche Pharmaceuticals, a unit of Roche Holding AG, which snapped up Flatiron in a $1.9 billion deal announced in February. “What set Flatiron apart was that it was able to create regulatory grade, real-world data,” O’Day tells Fortune—data that O’Day claims is so well curated, that it “could have theoretically replaced the ‘control’ arm” of one of Roche’s own clinical trials for the cancer immunotherapy drug Tecentriq. In theory, Flatiron’s system could have a broader impact on clinical trials accrual—for generations, one of the most stubborn challenges in cancer drug research—making it easier, for example, to match up specific patients with appropriate drug studies. That, indeed, is an area where IBM Watson has already found some success. In March, the Mayo Clinic reported that using Big Blue’s advanced cognitive computing system increased enrollment in clinical trials for breast cancer by 80%. “Watson is able to give us faster, better matching of patients to potential clinical trials that our oncologists wouldn’t have otherwise been able to see,” Mayo Clinic CIO Christopher Ross told the trade publication MobiHealthNews. Even organizations which previously only had distant relationships with patients—pharmacy benefit managers, for instance—are, because of the vast kingdoms of data they oversee, well positioned to draw insights that might improve population health and lower costs. Consider Express Scripts, the Missouri-based PBM that just announced its sale to insurer Cigna in March. Express Scripts administers 1.4 billion prescriptions for 100 million Americans each year—and it knows when you don’t take your meds. Such nonadherence costs between $100 billion and $300 billion a year, depending on which estimate one believes. That cost comes when patients suffer complications from not following the doctor’s orders. The company has identified 300 different factors that can help determine the likelihood that a patient will not fill a prescription says Express Scripts’ chief data officer Tom Henry. They range from that basic demographic data (income level and zip code) to behavioral data (one’s level of forgetfulness and tendency to procrastinate, gleaned from surveys the company does after patients fail to pick up their prescriptions) to less intuitive things like the genders of the prescriber and patient (men with a woman physician are more likely to not follow orders). The company uses the algorithm, which it says is validated and 94% accurate, to assign risk scores to patients and target them with varying modes of outreach—Henry says those efforts are “soft touch, nothing Orwellian.” Nonetheless, Express Scripts claims this work has reduced nonadherence by 37% and saved its clients more than $180 million. As with any revolution, many rush into action without considering weighty questions about what comes next and what unintended consequences may arise. In this social experiment, those questions cover everything from patient privacy to the ethical dilemma of warning someone about a risk they can’t avoid. To many digital health evangelists, big data is the “magic bullet” we’ve been waiting for. The question is, where exactly that bullet strikes. A version of this article appears in the April 2018 issue of Fortune with the headline “Big Data Meets Biology.” |

-

熱讀文章

-

熱門視頻