業績持續不振,寶潔走向拆分之路?

|

今年10月寶潔舉行歷史性的股東大會,也經歷了公司治理史上規模最大也最昂貴的一場代理權之爭,最終雙方握手言和。“我們會繼續談,”首席執行官戴懷德(David Tylor)表示,他認為自己稍勝一籌,雖然大概五星期之后詳細計票結果顯示其實他輸了。對此激進投資者納爾遜·佩爾茨回應稱,“‘我們’可以談,但‘我們’不會聽!”(編者注:這里的“我們”指的是寶潔高層領導和董事,佩爾茨用戴懷德的話反諷他)。戴懷德則回應稱,“不不不,你說的不對。” 表面上來看,我們看的是一場勝負難分的董事會席位大戰,但實際上關系著美國最大企業之一寶潔的命運。現在這場代理權大戰結果已揭曉,但特利安基金管理公司的佩爾茨究竟能不能推動寶潔走上巨大變革之路還是未知數。雖然佩爾茨手握35億美元的股票,多少說話有些分量,但從戴懷德“我們可以談”的口氣就能感覺到,佩爾茨在11或12個人的董事會里必將單打獨斗。從兩人簡短交談情況也能看出,哪怕只說幾句也會因為根本理念不同吵起來,也說明兩人對寶潔未來的看法存在巨大的沖突。佩爾茨為了進董事會花了至少2500萬美元,寶潔為了阻止他花了至少3500萬美元。現在雙方終于擱置了爭議,但佩爾茨還是進了董事會。 說實話,戴懷德跟佩爾茨在很重要的一點上還是有共識的,就是寶潔需要改。只是兩人屬意的方式不一樣。佩爾茨一直在指責“寶潔持續十年表現不佳。”戴懷德則更強調正面因素,即“我們處于巨大轉型過程中。”但背后的現實是寶潔已持續低迷多年。 |

At the end of Procter & Gamble’s historic annual shareholders’ meeting in October, the climax of the biggest, most expensive proxy fight in corporate history, the two antagonists shook hands. “We’ll talk,” said CEO David Taylor, who thought he had won by a slim margin, though a careful count of paper ballots showed some five weeks later that he’d lost. To which activist investor Nelson Peltz replied, “We’ll talk, but we don’t listen!” (the “we” referring to P&G’s top leaders and directors). Taylor responded, “No, no, no, that’s not true.” And there we have in microcosm the surprisingly inconclusive outcome of a bitter battle ostensibly over a single board seat, but in reality over the future of one of America’s greatest companies. We know who won the proxy fight, but we have no idea whether Trian Fund Management’s Peltz will succeed in his campaign for major change at P&G. Though his $3.5 billion of company stock gives his views extra heft, as Taylor’s “We’ll talk” indicates, Peltz will be only one director on a board of 11 or 12. The two men’s brief conversation suggests they can’t exchange even a few words without disagreeing fundamentally—reflecting the larger conflict between their sharply different views of P&G’s future. Peltz spent at least $25 million to get himself elected to the board, and P&G spent at least $35 million trying to keep him off. Now they’ll resume their dispute, but with Peltz in the boardroom. Truth be told, Taylor and Peltz agree on one big thing: P&G needs fixing. They spin it differently. Peltz rails about “P&G’s decade-long history of underperformance.” Taylor sells the upside—that “we’re in a major transformation.” But the underlying reality is that this company has been sputtering for years. |

|

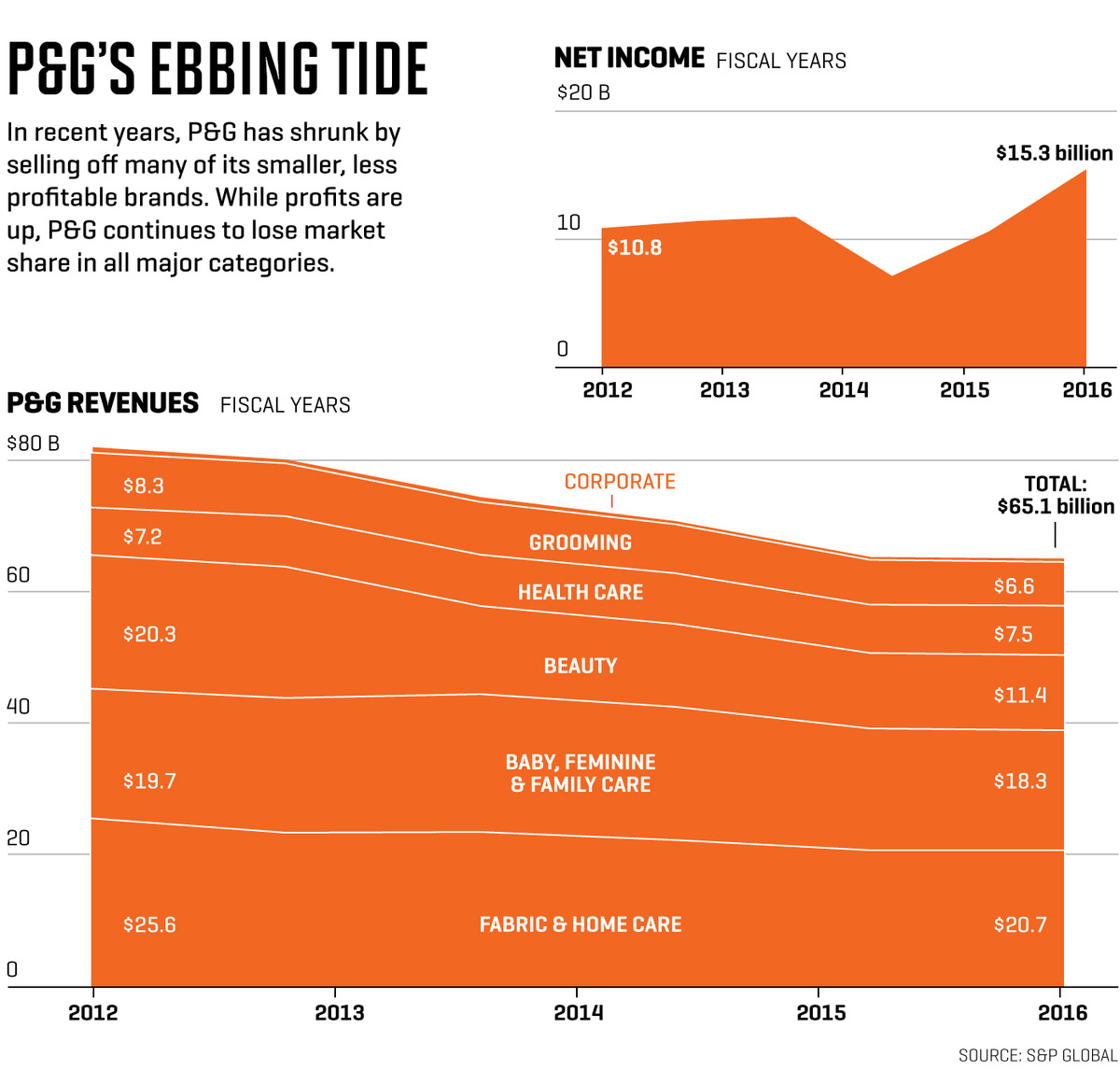

寶潔的問題不只是業務低迷。之前我們也見過類似情況,即鼎盛的美國企業仿佛過了氣,面臨著追回往日榮光還是步入長期衰退的問題。大概25年前,IBM、通用汽車、希爾斯和柯達也面臨過類似的轉折點。重返高峰并非不可能,IBM就做到了,至少有段時間做到了,但歷史經驗證明機會真的很小。戴懷德現在59歲,納爾遜·佩爾茨75歲,兩人都很清楚自己在做什么,雖然策略相差很大。所有證據都表明,至少未來幾年里兩人都會堅持自己的計劃。所以就要看,到底誰能拯救公司? 首先分析下挑戰的難度。自從美國經濟達到衰退前頂點以來,寶潔的股價(也包括股利)表現一直比標普500指數企業平均水平差。隨著大眾消費品整體增速放緩,行業內最大的巨頭寶潔也漸漸落在競爭對手身后——包括聯合利華、高露潔、德國漢高等等。寶潔旗下很多大品牌,包括吉列、佳潔士和潘婷市場份額都在下跌。過去一個財年里(截至6月30日)五大主要品類市場份額都出現大幅下降。上個財年里自然增長率,即不考慮收購、剝離資產和外匯兌換等因素的增長率僅為2%,預計今年增長率為2%至3%。該數字低于大部分競爭對手,如果算上通脹調整因素的話,寶潔實際自然增長率幾乎為零。 數字看起來很差,非財務指標則更不妙。現在的年輕人找工作時,寶潔的吸引力遠比不上過去。一位寶潔出身的人士就對其如今的頹勢非常難過,他回憶道,“我進公司的時候,寶潔就像現在的谷歌和亞馬遜,是當時最光鮮的地方。讓人感覺‘我們是全世界最強的企業,我們的產品是最好的,我們改善人們的生活,而且培養出全世界最優秀的領導者。’想進寶潔非常難。面試的時候就會鎮住你。當時公司真的很強。現在再也沒有那樣的氣勢了。” 數據也能證明這點。1996年《財富》雜志調研企業領導、董事會成員和股票分析師排出年度榜單里,寶潔是美國最受尊重的企業(僅次于可口可樂)。2009年,寶潔還能排第六,之后一路下滑,如今已經落到第19名,就在佩爾茨發動代理權大戰之前做的調研。 當然了,對很多企業來說,能在全世界最受尊重的企業榜單上排名第19,市值2200億美元,還能當上道瓊斯成分股已經很不錯。這些都是成功的標志,但也孕育著巨大的問題,因為可以得出以下結論:寶潔沒有遇到危機。如果屈從慣性思維,寶潔完全可以像所有走下坡路的企業一樣安慰自己,只想著維護現狀,不用太考慮趨勢。寶潔可以列舉出在各個國家做得非常好的產品當證據。然而事實擺在眼前,剛剛結束的三年里,董事會給高管層定下的指標都沒有完成。接下來的三年,董事會稱自然增長率要達到年均2.8%,雖然戴懷德表示市場增速可能為3%到3.5%。感覺就是落水之人勉強掙扎而已。正如一位寶潔前高管總結的,“按他們制定的目標,市場份額只會越來越低。” |

P&G (PG, +1.16%) isn’t just a business in the doldrums. It’s in a troubling situation we’ve seen before—an aristocrat of American enterprise seemingly past its prime, now facing the profound question of whether it can regain lost glory or continue into a long, slow decline. IBM, General Motors, Sears, and Kodak were at that same turning point about 25 years ago; some would put General Electric in that category today. A comeback isn’t impossible—IBM did it, for a while at least—but history says the odds are heavily against it. David Taylor, 59, and Nelson Peltz, 75, both think they know what needs doing, though their strategies are radically different. All evidence suggests they’ll both remain on this project for a long time to come, maybe several years. So who, if either, can save this company? Consider the magnitude of the challenge. Since the U.S. economy’s pre-recession peak, P&G stock (including dividends) has badly underperformed the S&P 500. As the whole consumer packaged goods business slows down, P&G, the industry’s biggest player, has been falling behind major competitors—Unilever, Colgate-Palmolive, Henkel, and others. Dozens of major P&G brands, including Gillette, Crest, and Pantene, have been losing market share; all five of its product categories lost significant share in the past fiscal year (ended June 30). Organic growth, a company-calculated measure that strips out the effects of acquisitions, divestitures, and foreign currency translation, was just 2% last fiscal year, and the company forecasts 2% to 3% this year. Those numbers are below most competitors’, and since they aren’t adjusted for inflation, they mean P&G’s actual organic growth is around zero. The numbers are damning, and nonfinancial indicators are even more ominous. Today’s best young people might never imagine that P&G was once as glamorous an employer as any company in the world. An alumnus, one of many distressed by its slide, recalls, “When I joined, it was the Google, the Amazon, the Goldman of its day. Its message was, ‘We’re the best company in the world. We create the best products, we improve people’s lives, we export great leaders to the whole world.’ It was hard to get into. They crushed you in the interviews. It was just great. They don’t have that edge anymore.” Data supports the assertion. Back in 1996, P&G was America’s second-most-admired company (after Coca-Cola) in Fortune’s annual survey of corporate leaders, board members, and stock analysts. As recently as 2009, it was the sixth-most-admired company in the world. It has been falling steadily since, today ranking 19th based on a survey conducted before Peltz launched his proxy fight. Of course most companies would be thrilled to rank 19th among the world’s most admired, to boast a market cap of $220 billion, to be a Dow component. These are the marks of a champion—and that’s a big problem, which can be summarized as follows: P&G is not in crisis. It can, if it succumbs to the temptation, console itself the way declining organizations have always consoled themselves, by focusing on its current state rather than on the trends. It can point to a hundred ways in which it’s doing well with various products in various countries. The fact remains, however, that the company missed most of the targets the board set for top executives in the just-ended three-year performance period. For the next three-year bonus period, the board declared an organic growth target of 2.8% a year, though Taylor has said he expects market growth of 3% to 3.5% a year. That’s barely treading water. As one former P&G executive sums up, “They set a goal to lose market share.” |

|

文化不再是加速器,反而成了制動閘。 寶潔稱四年前就意識到挑戰存在,從那時起就開始轉型。戴懷德發誓大力推動,舉措之一就是引入更多外部人才加入高層。很有道理,但會陷入第22條軍規的困境:寶潔的企業文化向來拒絕外來者,基本只招聘初級員工,原因就是再往上級別的外人就沒法接受企業文化。近年來寶潔通過收購引入了部分外人,但很少有管理層能留下。“寶潔文化排斥他們,”一位前高管稱,他口中的“寶潔文化”是指完全同化的寶潔員工。實際上,佩爾茨說戴懷德在去年春天一次會上告訴他,“我們沒法請層級較高的外人,他們肯定待不下去。”寶潔并未否認這句話,只是表示單獨看有些斷章取義。一位發言人列舉了幾位外部請來的高管,但外部人士還是極少。總體來看,寶潔稱去年從外部聘請了200位初級以上員工,幾年前還只有50位。 然而,聘請外部人士由內部高層領導沒什么用。“光是招聘銷售人員改變不了文化,”1998年至2008年曾擔任首席執行官的克萊頓·達利表示,他現在跟佩爾茨合作。“寶潔得從外部聘請高管才行。如果過去十年美妝業務沒起色,為什么不從歐萊雅或者聯合利華挖人呢?” |

P&G claims it recognized the challenge four years ago and has been transforming its culture since then. Taylor vows to turbocharge the change, in part by bringing in more outsiders at high levels. Makes sense, except for a perfect catch-22: The culture has a long history of rejecting outsiders brought in much above entry level—because they don’t understand the culture. P&G has brought in hordes of outsiders over the years through acquisitions, especially its biggest one, Gillette, but few executives remain. “The Proctoids rejected them,” recalls a former exec, using the term for thoroughly acculturated employees. In fact, Peltz says Taylor told him at a meeting last spring that “we cannot bring in outside people at too senior a level or they will fail.” P&G doesn’t deny the quote but says it was taken out of context. A spokesman points to several senior staff executives who have been brought in from outside, though few high-level line managers are outsiders. Overall, P&G says it brought in 200 outsiders above entry level last year, up from 50 a few years ago. Yet bringing them in below senior levels achieves little. “You don’t change the culture by hiring salespeople,” says Clayton Daley, the company’s CFO from 1998 through 2008, who is now working with Peltz. “The company must hire senior line management from the outside. If your beauty line has been suffering for a decade, why wouldn’t you want to get someone from L’Oréal or Unilever?” |

|

還有一點很重要,跟企業文化也差不多,就是組織架構。寶潔內部一直像個大迷宮,布滿各種枝枝蔓蔓,如果畫出來可能就像東京地鐵圖一樣復雜。幾十年來,寶潔首席執行官以下沒有一個人全盤掌控過,或者負責過盈虧。既然沒有責任,業績也就沒有那么重要,人們更愿意逃避。佩爾茨稱現在仍是如此,但戴懷德表示在簡化“復雜架構”,就是內部周知幾乎不可穿透的組織結構。他讓業務部門負責人“全盤”負責盈虧,雖然相關負責人對支出和推廣決策并不能全面掌控。在小一些的市場里,團隊可以“在一定框架內自由決定”支出和定價。與此同時,戴懷德也將業績獎金發放權下移,鼓勵更多擔責。這是個過程。至于夠不夠還有待觀察。 如果戴懷德真能理順企業文化和架構,就有機會解決寶潔最頭疼的問題之一:創新文化衰退。寶潔有全球聞名的兩板斧,一是經過多年研究發明新產品,二是打造強勢品牌并大力推廣。最突出的例子就是汰漬,這是世界上第一個合成洗衣粉,也是最暢銷的洗衣粉,僅2017年預計銷售額就超過60億美元。 但突破性創新和新的強勢品牌現在越來越少了。寶潔最近兩個大突破是速易潔產品線下的拖把、清掃機、抹布等產品,另一個就是紡必適系列家庭除臭劑,都是1998年研發的。(2012年推出的汰漬洗衣丸是很成功的品牌延伸。)為了回應質疑,戴懷德還引入了“精簡創新”系統,現在很多公司都在積極應用。這也是個好主意,只要企業文化能容下就行。 更重要的是戴懷德承認了寶潔存在問題,還表示正在積極解決。他引用了股價為證,在圖A可以看到。他擔任首席執行官兩年來,寶潔股價加股利已經回升20.4%,還是比不上標普500的23%漲幅。業績平平可能沒什么好吹噓,但比起之前兩年表現已經好多了。 問題在于,最近股價表現回升部分原因是佩爾茨的積極參與,還有他作為激進投資者擅長提升公司業績的名聲。2月佩爾茨宣布持股時股價上升,6月傳出佩爾茨提名自己加入董事會時股價上揚幅度更大。不管寶潔愿不愿意接受,佩爾茨還是幫了忙,然后寶潔又用股價上揚為自己辯解。 此外,寶潔為了支撐股價也使用了不少財技。上次公布收益情況時,寶潔驕傲地稱上一季度持續經營每股收益增幅達5.8%。但只要深挖一點就能發現實際上持續經營每股收益沒有增長。寶潔只是回購了不少股份,所以每股收益數字看上去漲了。如果看過去四個季度也差不多: 持續經營每股收益上升6%,但根本原因是股份數降低;實際持續經營每股收益只上升了0.6%。 用小招數提升每股收益并不能提升公司價值。最后還是要借來數十億美元還給股東,公司資本結構改變,但對業績毫無影響。這種做法本身并無問題。多年來寶潔一直在回購股票。但十年前二十年前實際年增長率能達到10%甚至更多,回購只會小幅影響收益情況。現在卻成了提升持續經營每股收益唯一的手段。 這種行為并不可持續,寶潔自己也打算收手,表示希望本財年通過“核心業務利潤增長”,而不是通過股份回購,“推動核心業務每股收益增長”。與此同時,寶潔還承諾以股利形式向股東發放更多現金,很多股東都非常虔誠地多年追隨。127年來寶潔每年都派發股利,而且61年來持續提升。“我們現金的主要用途就是派發股利,”寶潔在提交美國證券交易委員會的文件中稱。此舉并無錯,但前提是不要影響將錢用在更有效率的地方,比如收購創新型新品牌,畢竟競爭對手都在這么做,佩爾茨就很支持收購。過去四個季度里,寶潔的現金流超過100%以股份回購和股利形式流回股東手中。 實際上,戴懷德的轉型計劃是漸進的,雖然用的語言比較激進,說什么打造“面目全新的企業。”像大多數需要創新的優秀老企業首席執行官一樣,他似乎最擔心催得太緊導致崩潰。這可以理解,但像寶潔一樣文化根深蒂固的企業其實非常善于排斥根本性變化。佩爾茨的計劃顯然更激進,但比起他對其他企業的手段還是比較克制,對寶潔他比其他激進投資者更注重長期發展。他都沒有建議換掉戴懷德,也沒提削減研發計劃或發債。 有些投資者稱,不管是戴懷德還是佩爾茨都沒搞清寶潔真正的問題。他們認為唯一的解決方案就是激進投資者(包括佩爾茨)經常提出的建議:拆分公司。 桑福德·C·伯恩斯坦公司明星分析師阿里·迪巴迪最近被《機構投資者》評為全美頂尖研究團隊,近兩年他一直呼吁拆分寶潔。“我認為戴懷德為了寶潔已經拼勁全力,”他表示。“不幸的是,寶潔十年前就應該大轉型。我相信對股東來說拆分仍然是最佳選擇。” 大企業總是稱通過結合多項業務可以實現價值協同和規模經濟,但迪巴迪表示所謂的優勢“看來不過是幻覺。”大企業拆分出來的品牌,例如寶潔賣給科蒂的美妝品牌(伊卡璐、威娜、封面女郎等等)在小集團里活得一樣很好。“如果仔細算算利潤和成本的話,寶潔并不比規模小些的競爭對手更高效。反而更復雜。對當下的寶潔來說是并無協同效果的規模經濟。” 寶潔內部人士懷疑,雖然佩爾茨沒有提到拆分,但私下里可能也在考慮。他希望寶潔重整10項全球業務部門,變成“一家簡潔高效控股公司”旗下三家“獨立”業務。從這種架構走向拆分只是一步之遙。總部位于英國的利潔時是寶潔競爭對手之一,旗下有來蘇兒和護麗洗滌劑等品牌,最近宣布明年1月1日起將采用精簡架構(分成兩個部門而不是三個),分析師推測此舉是為全面拆分鋪路。 分拆可能會推動創新和提升效率。但現在來看除非業績進一步下滑,否則可能性并不大。不管對寶潔來說最佳方案可能是什么,業績都是最大的問題,因為業績下滑是緩慢衰退的根本原因。大型成功企業跟不上變化時很少會突然倒閉,更常見的是停滯不前。這些企業也會改,但力度不夠。他們也會制定策略解決問題,但效率不高,要么就是沒法執行。“我最擔心的是他們把自然銷售增長率提升回3%的水平,然后宣布轉型成功,”一位前寶潔員工表示。不過寶潔堅稱其雄心壯志不會這么小。 兩年前的年度股東大會上,就在戴懷德出任首席執行官幾個星期前,一位名叫凱倫·梅耶爾的股東問當時即將卸任的首席執行官雷富禮,“您如何向我這樣的股東保證,曾將企業帶入泥潭的主管和負責人能成功將企業拽出泥潭?”今年的股東大會上,凱倫的丈夫彼得提醒了戴懷德這個問題,還給出了自己的答案:“從當前的數據看答案已經很明顯。他們做不到。” 彼得這個答案也不一定對。戴懷德再次肯定了近幾年全公司付出的艱苦努力,向梅耶爾保證領導者和董事們都在努力追求優秀的業績。即便寶潔無法重現往日榮光,也可以說戴懷德獲得了成功。“我認為寶潔成不了未來的谷歌或亞馬遜,”迪巴迪表示,“但為了股東寶潔也得奮起。” 然而,凱倫·梅耶爾的問題到現在仍有意義,未來幾年就能得出分曉。現在寶潔還在努力掙扎沒有徹底沒落,對改變的需求雖然強大但還沒到生死關頭,也正是做出關鍵決策影響命運的時刻。寶潔并沒有出現危機。很快我們就會知道寶潔是不是真的需要來一場危機來推動變革。但如果真到那一步,恐怕為時已晚。(財富中文網) 本文另一版本將發表于2017年12月1日出版的《財富》雜志,標題是《寶潔是不是該拆分了?》本文已根據最新消息更新。 譯者:Pessy 審校:夏林 |

Closely related, and just as important, is the organizational structure, which at P&G has long been impossibly Byzantine, a sprawling matrix of dotted lines that would look like a map of the Tokyo subway if anyone charted the whole thing. For decades, virtually no one below the CEO held full control and responsibility for any profit-and-loss result. And without accountability, performance became less important than blame-shifting. Peltz says it’s still that way, but Taylor says he is thinning “the thicket,” as the near-?impenetrable structure is known internally. He has given business unit heads “end-to-end” responsibility for profit and loss, though they still lack full control over spending and marketing decisions. In small markets, teams have “freedom within a framework” to control spending and pricing. Accordingly, Taylor is extending performance bonuses further down into the organization to enforce accountability. That’s progress. Whether it’s enough remains to be seen. If Taylor can fix the culture and structure, he has a shot at reversing one of P&G’s most vexing problems: the decline of its vaunted innovation machine. The company was long the world’s greatest at the twin skills of creating new consumer products, often after years of scientific research, and then building superpowerful brands under which to market them. The outstanding example is Tide, the first synthetic detergent and the global bestselling detergent by a mile with estimated 2017 sales of over $6 billion. But breakthrough innovations and new blockbuster brands have been getting rarer. P&G’s last two major hits were the Swiffer line of mops, sweepers, dusters, and related products, and the Febreze brand of household odor eliminators, both introduced in 1998. (Tide Pods, introduced in 2012, have been a highly successful brand extension.) Taylor is responding in part by introducing the “lean innovation” system, which many companies are using enthusiastically. It’s another good idea—if the culture doesn’t reject it. More broadly, Taylor acknowledges P&G’s problems and says the company is fixing them. Exhibit A in his argument is the stock price. In the two years since he became CEO, P&G stock including dividends has returned 20.4%, not quite matching the S&P 500’s 23%. Middling performance may not seem like much to crow about, but it’s a great deal better than the stock had been doing over the previous two years. The trouble with this argument is that at least some of the stock’s recent vim is a response to Peltz’s involvement and his reputation as an activist who spurs better performance. The stock price jumped in February when Peltz disclosed his stake, and it jumped even more in June when word leaked that Peltz had nominated himself for the P&G board. The company seems to be getting help from Peltz whether it wants it or not, then citing the stock’s rise in its own defense. In addition, P&G has been performing financial acrobatics to buoy the stock. The company reported proudly in its latest earnings release that earnings per share from continuing operations had risen a respectable 5.8% in the most recent quarter. But a bit of digging shows that actual earnings from continuing operations hadn’t risen at all. P&G simply bought back a large number of shares, so the per-share number increased. It’s a similar story over the past four quarters: Earnings per share from continuing operations rose 6%, but virtually all of that increase merely reflects a shrunken share count; actual earnings from continuing operations rose just 0.6%. Increasing EPS in this way does not make the company more valuable. It returns billions of dollars, much of it borrowed, to the shareholders, and the company’s capital structure changes, but that change has no effect on operating performance. There’s nothing improper about any of this. P&G has been buying back stock for many years. But a decade or two ago, when actual annual earnings growth reached 10% or more, buybacks added just a smidgen of extra EPS. Now they’re virtually the only source of increased EPS from continuing operations. That practice isn’t sustainable, and the company plans to scale it back, saying it expects “core operating profit growth”—not share buybacks—“to be the primary driver of core EPS” this fiscal year. At the same time, it has promised to send even more cash back to shareholders in the form of dividends, to which it is almost religiously devoted. The dividend has been paid annually for 127 years and increased annually for 61 years. “Our first discretionary use of cash is dividend payments,” P&G states in an SEC filing. That’s fine unless it interferes with more productive uses of money, such as the acquisition of innovative new brands, a move that competitors are making and that Peltz advocates. Over the past four quarters, P&G has sent more than 100% of its free cash flow back to shareholders via share buybacks and dividends. The truth is that Taylor’s transformation plan is incremental, despite the bold language about creating “a profoundly different company.” Like most insider CEOs of great, old companies in need of renovation, he seems concerned about breaking the organization by pushing too hard. That’s understandable, but cultures like P&G’s are astoundingly effective at repelling fundamental change. Peltz’s plan certainly pushes harder, yet it’s restrained, even by comparison with his own proposals at other companies, which have typically been more long-term-oriented than other activists’. He is not suggesting that Taylor be replaced or R&D be cut or debt be taken on. Some investors argue that neither Taylor nor Peltz understands how troubled P&G really is. They say the only solution is a remedy that activists (including Peltz) have often demanded elsewhere: breaking up the company. Ali Dibadj, a star analyst at Sanford C. Bernstein who was recently named to Institutional Investor’s All-America Research Team, has been advocating a breakup for over two years. “I think David Taylor is doing his best to change the company,” he says. “Unfortunately, he’s been given a company that should have been changed 10 years ago. I believe breaking up is still the best option for shareholders.” Big companies argue that they achieve valuable synergies and economies of scale by combining many businesses, but Dibadj says those advantages “appear to be illusory.” Brands that giant companies divest, such as the beauty brands (Clairol, Wella, Covergirl, and others) that P&G sold to Coty last year, do just as well in smaller organizations, he says. “If one does the math on their margins and costs, and compares with smaller competitors, P&G is not more lean. It’s more complex. There are dissynergies of scale for P&G at this point.” P&G insiders suspect that while Peltz hasn’t called for a breakup, he may secretly favor one. He wants P&G reorganized from 10 global business units into just three “stand-alone” businesses within “a lean holding company.” From that structure to a breakup would be only a small step. A P&G competitor, U.K.-based Reckitt Benckiser, marketer of Lysol, Woolite, and other brands, recently announced it will adopt just such a structure (with two parts rather than three) as of Jan. 1, and analysts speculate the move was a prelude to full separation. A breakup might well unleash waves of innovation and productivity. But for now, it looks unlikely to happen unless performance gets much worse. That’s a problem regardless of what the best solution for P&G may be, because it supports the slow-decline scenario. Big, successful incumbents rarely flame out when they fail to adapt. More often they stagnate. They change, but not enough. They usually have a strategy for addressing their issues, but it isn’t sufficient, or they can’t execute it. “My biggest fear is that they’ll get organic sales growth back to 3% and will declare victory,” says one alum. P&G insists its ambitions are far greater than that. At the annual shareholders’ meeting two years ago, a few weeks before Taylor took over as CEO, a shareholder named Karen Meyer asked outgoing P&G chief A.G. Lafley, “What assurance can you give me, the shareholder, that the officers and directors who drove the company bus into the ditch are the ones to get us out?” At this year’s meeting, her husband, Peter, reminded Taylor of that question and then gave his own response to it: “I think the answer has been made abundantly clear by the current data. They can’t.” That answer may not be correct. Taylor, repeatedly acknowledging the company’s travails of the past several years, assured Meyer that the leaders and directors are utterly committed to outstanding results. And Taylor can succeed even without returning P&G to its full former glory. “I don’t think it can be the Google or Amazon of tomorrow,” says Dibadj. “But it owes it to shareholders to get better.” Nonetheless, Karen Meyer’s question is undoubtedly the right one, and the answer will become clear in just the next couple of years. Now, when P&G is treading water but not sinking—when the need for change is powerful but not desperate—is when this great institution’s fate is being determined. Procter & Gamble is not in a crisis. We’ll know soon whether it requires one in order to make the needed changes. If it does, it will be too late. A version of this article appears in the Dec. 1, 2017 issue of Fortune under the headline “Is It Time for P&G to Break Up?” The story has been updated to reflect breaking news. |