特斯拉在中國起飛

|

如果你第一次乘坐特斯拉汽車,會發(fā)現(xiàn)車主總會忍不住炫耀愛車。這次在中國北京,春光明媚的一天,我坐上朱小姐的特斯拉就發(fā)現(xiàn)了這點。 “屏幕特別大,是吧?”她邊說邊在中控臺上選歌,特斯拉的中控臺比普通車上的大一倍,長得很像iPad。她手指輕盈劃動,直到車里響起阿黛爾的《送上我的愛》。隨后Model X鷗翼車門輕聲關上,車外景色透過全玻璃車頂一覽無遺。朱小姐供職于一家國際大型營銷機構,之前她開的是寶馬X5,由于中國路況混亂,偏愛SUV帶來的安全感,所以買了特斯拉。朱小姐是中國首批Model X車主,特斯拉還沒算出來價格時,她就交了預付款定金。 “現(xiàn)在把頭向后貼在靠枕上,”她向我建議。 兩車道的馬路上擁堵異常,路也不平整,突然出現(xiàn)一段平路,朱小姐迅速加速。我們疾馳超過一輛黑色的小現(xiàn)代車,快到旁邊那輛好像停著沒動一樣。有一瞬間,車主和乘客同時感覺一股眩暈。紅燈了,朱小姐踩了腳剎車,輕聲笑著換了另外一首阿黛爾的歌。 |

When you climb into a Tesla (tsla, +1.94%) as a first-time passenger, drivers turn giddy at the chance for show-and-tell—especially in China, where Vanessa Zhu is playing host on this sunny spring day in Beijing. “It’s huge, isn’t it?” she says, pressing the double-size, iPad-like control screen in the center console until the stereo blasts Adele’s “Send My Love.” Then comes the ceremonial closing of the gull-wing doors on Zhu’s Model X. We peer through an expansive glass roof. Zhu, the assistant to the chairman of a major marketing agency, likes SUVs for their safety on China’s chaotic roads—she upgraded from a BMW X5. One of the first Model X owners in China, Zhu paid a deposit before Tesla had even calculated how much a deposit should be. “Now put your head back against the seat,” she advises. The two-lane road we’re on is missing traffic lines, not to mention levelness, but as a section clears ahead, Vanessa floors it. We whir past a small black Hyundai so fast that the car seems to turn stationary. For a second, driver and passenger feel the same head rush. Then Vanessa slams on the brakes to respect a stop sign, chuckles, and changes Adele songs. |

|

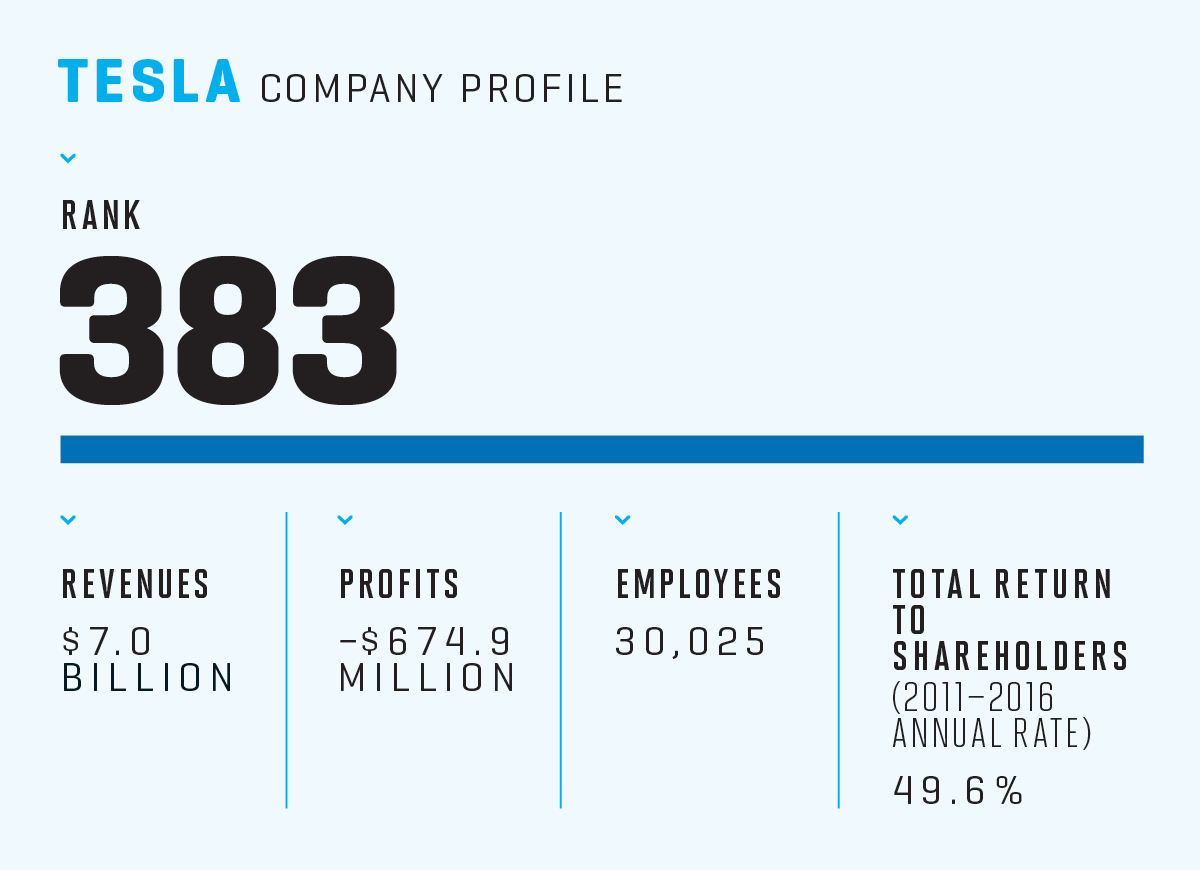

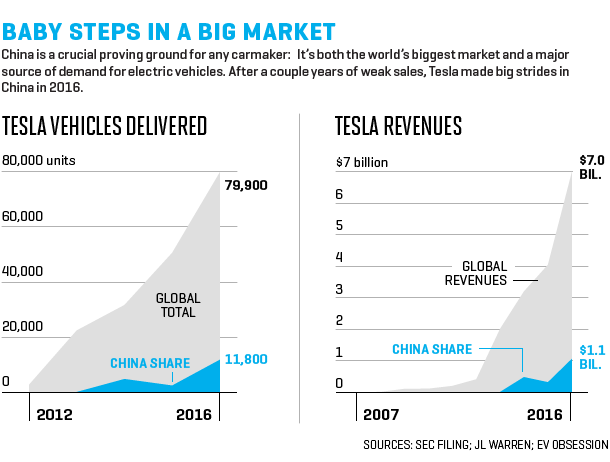

如今,在中國大都市里看到特斯拉呼嘯而過很正常,就跟在硅谷看到特斯拉差不多。 據(jù)研究公司JL Warren Capital 統(tǒng)計,2016年特斯拉在中國的銷量為前一年的三倍,達到10400輛。當年全球銷量80000輛,中國占13%。今年3月特斯拉宣布去年在中國銷售收入達11億美元,特斯拉也首次躋身《財富》500強榜單,2016年其全球總收入略超70億美元。而且特斯拉在中國的業(yè)績還在增長:從2017年前三個月進口數(shù)量來看,今年銷量翻倍易如反掌。中國各大主要城市里,富有的司機們紛紛涌入特斯拉的展廳,預交1200美元訂購Model 3的買家人數(shù)僅次于美國客戶。 |

The sight of Teslas whizzing down roads in China’s biggest cities is becoming as common as—well, the sight of Teslas whizzing down roads in Silicon Valley. In 2016, Tesla tripled its sales in China over the previous year’s, to 10,400 vehicles, according to research firm JL Warren Capital, or about 13% of the nearly 80,000 cars it delivered worldwide. The company reported in March that it earned $1.1?billion in revenue in China last year—a boost that helped Tesla join the ranks of the Fortune 500 for the first time, with just over $7 billion in revenue worldwide. And Tesla’s China news has only gotten better since then: Its imports in the first three months of 2017 have put it on pace to easily double sales this year. Wealthy drivers are crowding showrooms in China’s major cities, and Chinese buyers have put down $1,200 to preorder the company’s Model 3 sedan in numbers second only to those in the U.S. |

|

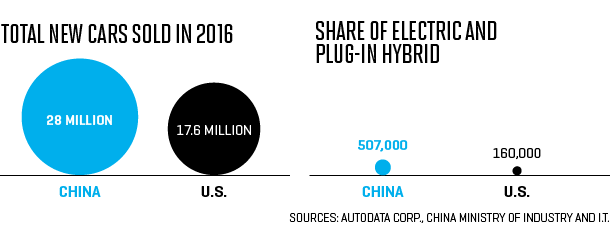

從亮眼的銷售業(yè)績來看,特斯拉已經(jīng)在全世界最大的汽車市場站穩(wěn)腳跟,而且出乎絕大部分人意料。就在去年夏天,人們還普遍認為特斯拉在中國做不好。特斯拉已經(jīng)連續(xù)第三年銷售疲軟。只有很少客戶了解特斯拉,卻不懂怎么充電。交錢預定了卻總是交貨延遲,售后服務也不完備。此外,特斯拉也不像其他外國車企一樣在中國成立合資公司。香港獨立咨詢公司Dunne Automotive負責人邁克爾·鄧恩去年9月曾寫過一篇專欄,預計埃隆·馬斯克打入中國市場估計會在征服火星之后。 如今再談去年的專欄,鄧恩只會不好意思地笑笑,其他看空者也都是一頭霧水。特斯拉為何能在中國市場突圍,其實沒有清晰的解釋。看起來特斯拉在熱愛SUV的中國推出了一款奢華SUV——Model X,銷量就開始大漲。其他原因還包括特斯拉建起了密集的充電站;中國買家受夠了經(jīng)銷商盤剝,而特斯拉采用直銷模式;此外特斯拉首席執(zhí)行官埃隆·馬斯克在科技圈是著名大佬。 特斯拉的技術恰好跟政府的工作重心吻合。聯(lián)合創(chuàng)始人馬丁·艾伯哈德表示特斯拉已開始應對氣候變化。而氣候變化在中國如今是頭等大事,中國是全世界最大的溫室氣體排放國,正大力推廣電動車發(fā)展:去年,中國電動車和混合動力車銷量超過50%,達到50.7萬輛,是美國同期銷量三倍還多。 |

The sales rush is the clearest sign yet that Tesla has turned a corner in the world’s largest auto market. And it has caught almost everyone by surprise. As recently as last summer, the narrative had been that Tesla just didn’t get China. The automaker was on track for its third consecutive year of weak sales. The few consumers who knew about Teslas didn’t know how to recharge one; those who preordered had faced delivery delays and iffy service. What’s more, Tesla lacked the joint-venture partners that helped other foreign carmakers break into China’s market. Michael Dunne, who runs independent advisory Dunne Automotive in Hong Kong, wrote a column in September predicting Elon Musk would reach Mars before cracking China. Today, Dunne is cheerfully sheepish about that column, and other naysayers are equally befuddled. There’s no single explanation for Tesla’s breakthrough. Sales got a lift from the introduction of the Model X, a luxury SUV for an SUV-mad country. The company also benefited from a critical mass of charging stations; from its direct-sales model, in a country where buyers feel fleeced by dealerships; and from CEO Elon Musk’s celebrity among the technorati. But chummy government relations also matter in a country where the state exerts enormous economic control, and Tesla’s technology just happens to align perfectly with government priorities. Cofounder Martin Eberhard has said Tesla was started to fight climate change. Nowhere is the climate fight more important than in China, the world’s largest spewer of greenhouse gases, which is in the midst of an unprecedented promotion of electric cars: Last year, sales of electric and plug-in hybrid vehicles in China rose 50% to 507,000, more than three times the U.S. figure. |

|

中國政府預計到2025年每年電動車銷量可達700萬輛。大力推動電動車行業(yè)不僅有助于環(huán)保,還可以促進中國車企擠進全球頂尖制造商行列。在電動車領域,中國車企不用受限于福特或梅賽德斯-奔馳的標準,可以迅速造出整車來。“在中國電動車領域,每兩年就會出現(xiàn)一套新技術模式,”中國汽車工業(yè)協(xié)會一位高層黨內(nèi)官員董揚表示,該組織主要代表汽車行業(yè)。 不過,目前幾乎所有中國國產(chǎn)電動車都是低成本產(chǎn)品,相對來說性能較差,沒有奢華內(nèi)飾,也沒有特斯拉車主熱愛的閃電加速快感。中國政府官員將特斯拉當成中國品牌的標桿,一直為國產(chǎn)企業(yè)加油鼓勁。還有不少中國企業(yè)和城市熱切希望能跟特斯拉合作成立合資公司,據(jù)《財富》雜志了解,馬斯克表示2018年底之前可能會在中國生產(chǎn)車輛。 如果真能成立合資公司,特斯拉在中國的發(fā)展會更順利,因為目前從加州直接進口實在太貴。加上關稅和其他稅之后,特斯拉轎車和SUV在中國售價比美國貴50%。在中國Model S價格是10.5萬美元起,Model X售價13萬美元起。所以雖然特斯拉能在美國極力吸引中產(chǎn)階級買家(今年秋天將推出的Model 3起家約為3.5萬美元),但在中國吸引的買家多是類似朱小姐的買家,他們較富有,將特斯拉當成奢侈品或是iPhone之類酷炫新科技產(chǎn)品。2016年特斯拉銷售主要區(qū)域是北京、上海和深圳,都是資本最集中有錢人扎堆的大都市。 |

The government estimates that as many as 7 million electric cars could be sold in China annually by 2025. It sees them as a way not only to clear smoggy skies, but to hack into the top rankings of the global auto industry. In electric, Chinese companies don’t have to match the quality of a Ford or Mercedes-Benz; they think they can quickly build a whole new car. “For electric vehicles in China, we have a new technology model every two years,” says Dong Yang, a high-ranking Communist Party official at the China Association of Automotive Manufacturers, the auto lobby. Still, virtually all Chinese electric cars are low-cost, relatively low-performance ones, without the luxury trimmings and lightning-fast acceleration that Tesla owners fetishize. Government officials consider Tesla a role model for these Chinese brands, and they’ve cheered the company from the sidelines. Today, a handful of Chinese companies and cities are feverishly courting Tesla for a joint venture, Fortune has learned, and Musk has said his company could begin building cars in China before the end of 2018. A joint venture could turn Tesla’s China growth stratospheric, because its current model of importing cars from California is costly. Chinese tariffs and taxes boost the price of Tesla’s sedans and SUVs in the country by 50% compared with the U.S.; the Model S sedan starts at the equivalent of $105,000, and the Model X at $130,000. So even as Tesla woos middle-class buyers in the U.S. (the Model 3, due to arrive this fall, will start at about $35,000) buyers in China have mostly resembled Vanessa Zhu: wealthy drivers who view Teslas as luxury vehicles, or at least as the coolest new piece of tech since the iPhone. Most of Tesla’s 2016 sales were concentrated in Beijing, Shanghai, and Shenzhen, China’s centers of capital and affluence. |

北京一家商場里,一位小朋友在特斯拉舉辦的活動上開著“兒童版Model S”(同樣裝有電池)。攝影師:亞當·迪恩——Panos Pictures為《財富》供圖

|

即便特斯拉不會成為大眾品牌,其在中國的銷量也很快就能達到每年10萬輛,中國這個14億人口的大國對特斯拉跟對可口可樂的影響差不多。“預計特斯拉可以擠占很多奧迪和梅賽德斯-奔馳的銷量,這兩款現(xiàn)在都滿大街,”鄧恩表示。 對于一家還在努力從過去錯誤中糾正的公司來說,這樣的成績已經(jīng)相當不錯。 特斯拉從2013年8月開始接受中國客戶預定。當時連每輛車價格多少都不確定,交貨時間長達8個月。但市場普遍預期很高。一方面馬斯克名聲很響,另一方面都在傳特斯拉的加速感覺堪比法拉利,再有人們對新科技也十分好奇,當年年底預定數(shù)為5000輛。 鬧得是沸沸揚揚,銷量和售后服務卻沒那么美。當時負責特斯拉中國業(yè)務的是鄭順景,原先負責豪車賓利的中國業(yè)務。據(jù)科技網(wǎng)站PingWest報道,鄭順景希望大規(guī)模拓展特斯拉的業(yè)務,包括客服中心、公共關系,以及充電網(wǎng)絡。但總部讓他先建起銷售團隊加強市場推廣,希望開新店和新充電樁之前先獲得大筆收入。特斯拉就在北京設了一個展廳,位置在一家華麗麗的購物中心里,對面是美國服裝品牌。 |

Even if Tesla doesn’t become a mass-market brand, sales in China alone could soon climb to 100,000 a year, impacting Tesla as intensely as a new, 1.4-billion-person market would Coca-Cola. “I could see a future where Tesla is displacing a lot of those Audis and Mercedes-Benz that are everywhere on Chinese roads,” says Dunne. Not bad for a company that, until recently, was digging out from under past mistakes. Tesla began taking preorders in China for the Model S in August 2013. The company didn’t know exactly how much each car would cost, and deliveries were eight months away. But anticipation ran high. The combination of Musk’s renown, stories comparing Tesla’s acceleration to a Ferrari’s, and intrigue over the new technology sent preorders above 5,000 by the end of the year. The hype was there, but the sales and support were not. The original head of Tesla’s China business was Kingston Chang, formerly of luxury automaker Bentley. Chang wanted to broadly expand Tesla’s operations, including customer service centers, public relations, and car-charging networks, according to tech news site PingWest. But Tesla headquarters told him to build a sales team first, betting that good marketing could bring in more revenue before more stores and charging stations were finished being built. Tesla opened just a single showroom in Beijing, opposite an American Apparel store in one of the city’s glitziest malls. |

|

2013年12月吳碧瑄加入特斯拉,戰(zhàn)略也隨之改變,此前吳碧瑄曾供職蘋果公司負責中國業(yè)務,在大企業(yè)銷售和教育促銷方面業(yè)績甚佳。加入特斯拉后,吳碧瑄希望增加傳統(tǒng)的經(jīng)銷商渠道,蘋果就在中國添了零售渠道。雖然總部不同意,但特斯拉還是很快在中國鼓勵汽車租賃公司和機構批量購買100輛以上,希望借此刺激需求。特斯拉在中國的員工由此猛增,當然主要是銷售人員,員工由10人增加到超百人,后來到600人。 當時,特斯拉的種種規(guī)定對個人買家并不友好。客戶下單買車之前,特斯拉為了確保良好體驗要求車主提供證明擁有車位,而且得有家庭充電樁。此外,如果買家所在城市里有售后服務中心,特斯拉才允許下單,然而到2014年中只有北京和上海才有符合條件。而且一些高層公寓物業(yè)并不許在樓里安裝充電樁。 特斯拉的銷售路子跟客戶需求出現(xiàn)很大錯位,卻給不少鉆空子經(jīng)銷商帶來好機會。這些經(jīng)銷商批量進貨,然后賣給不符合特斯拉標準無法通過官方渠道購買的客戶。特斯拉其實沒有官方經(jīng)銷商,但車輛還是經(jīng)過各種渠道到了經(jīng)銷商和購車中心,甚至阿里巴巴旗下的天貓上都有售,價格自然比官網(wǎng)要高。“沒想到出現(xiàn)這么多黃牛,”吳碧瑄感嘆道。也有人懷疑特斯拉是否真不知情:“大部分所謂的‘批量’銷售都是幌子,最后都到了經(jīng)銷商手里,”汽車行業(yè)網(wǎng)站Dailykanban.com的司博特總結(jié)說。所有流程都合法,只是能看出特斯拉不再堅守過去的高端銷售路線了。 特斯拉第一次在中國交付車輛是2014年春。吳碧瑄告訴路透社中國市場可以推動全公司銷量增長35%。但即便當時看來也有些異想天開。特斯拉急匆匆地建起了客服中心,但北京和上海以外的車主都收到通知,客服中心建完之前沒法交貨。一位買家的車輛延遲幾個月才到,憤怒地砸碎了擋風玻璃,這事還上了各大媒體。與此同時,中國的媒體也不像西方媒體總是大篇幅報道特斯拉,所以很多潛在客戶并不了解特斯拉的產(chǎn)品。很多人不知道可以每晚在家給車充電,就像給手機充電一樣;大部分人都以為還得靠城市里幾處超級充電站。 |

Tesla’s strategy shifted again after Veronica Wu came aboard in December 2013, after a successful stint in big enterprise and education sales for Apple in China. At Tesla, she discussed adding traditional outlets like dealerships to the mix, similar to the way Apple had added retail channels in China. Though headquarters balked, Tesla in China was soon encouraging fleet sales orders of 100 or more cars from car-rental agencies and institutions, to jump-start demand. Staff, especially salespeople, soared from 10 employees to more than 100, and later to 600. At the same time, Tesla imposed rules that frustrated individual buyers. Before customers could order a car, Tesla required that they prove they had a parking spot and a home charger, to ensure a good experience. The company also required that buyers live in a city that had a Tesla service center—even though, as of mid-2014, only Beijing and Shanghai had such centers. Some high-rise apartment managers, meanwhile, balked at having chargers installed in their buildings. The mismatch between Tesla’s approach and customer demand created a big opportunity for gray-market resellers—who bought in bulk and catered to buyers who didn’t meet Tesla’s criteria. The company had no official resellers, but the cars made their way to many, who sold in dealerships, car centers, and even on Alibaba’s TMall for more than the same models cost on Tesla’s website. “There were a lot more scalpers than we expected,” Wu now says. Others questioned whether the company was really in the dark: “Most ‘fleet’ sales were just a flimsy cover for sales to resellers,” concluded Bertel Schmitt of Dailykanban.com, an auto industry site. It was all legal, but also a sign that Tesla had strayed from the high-touch sales approach it used elsewhere. Tesla’s first China deliveries arrived in spring 2014; Wu later told Reuters that China sales could drive 35% of the company’s growth. But that was already sounding fanciful. Tesla was hurriedly building customer-service centers, and customers outside of Beijing and Shanghai were told they wouldn’t get their cars until those centers were finished. One buyer made national news when he smashed the windshield of his own Tesla, after it arrived months later than expected. Meanwhile, the Chinese press didn’t shower Tesla with as much coverage as the West’s did. As a result, most potential customers didn’t know much about Tesla’s product. Consumers didn’t know they could charge their car at home every night like a cell phone; most thought they had to rely on the still-small Supercharger network. |

麥克·范開著Model X從北京天安門廣場路過。特斯拉在中國銷售沒通過豪車經(jīng)銷商網(wǎng)絡,為買家省去一大筆費用。攝影師:亞當·迪恩——Panos Pictures為《財富》供圖

|

到2014年底,特斯拉的中國業(yè)務一團亂。運到中國的大概有4700輛,卻只有2500輛賣給了車主并且完成注冊。(去年特斯拉在美國的銷量是18500輛。)對于沒成功賣出的車,特斯拉公開譴責一些下了單但等運到又決定不買的投機者。但有幾位特斯拉前員工表示,真正的問題還是缺少客戶支持。曾負責傳播事務的理卡多·雷耶斯表示,“我覺得特斯拉好像感覺在中國市場成功理所應當一樣。” 到2014年底,鄭順景和吳碧瑄都離開了特斯拉。加州總部特斯拉高官們抱怨說,中國市場沒什么特別,用不著專門制定戰(zhàn)略。但沒過多久,特斯拉舉辦了一場抱歉之行,情況也出現(xiàn)轉(zhuǎn)機。2015年1月一個寒冬晚上,在底特律國際車展上,馬斯克承認中國市場銷售“比預期中疲軟”。當年春天,他親自到訪中國,與國家主席習近平和其他領導會見,還發(fā)推表示雖然“此前犯過錯”但仍然“非常看好”。2015年春天,特斯拉破天荒參加了中國車展,雷耶斯也公開道歉:“我們在中國市場有點不夠耐心。”不過特斯拉的悔悟很有效,之后情況持續(xù)好轉(zhuǎn)。 2015年,原先特斯拉超級充電站負責人,深受尊敬的工程師朱曉彤接手中國業(yè)務。截至當年年底銷量僅有3700輛,但轉(zhuǎn)機已現(xiàn)。首先,中國超級充電站搭建速度全球領先,解決了客戶的“充電焦慮”。如今中國有120個超級充電站,美國也只有370個,特斯拉表示到2017年底中國的充電站將超過800個。 |

By the end of 2014, Tesla’s business was a mess. About 4,700 cars had been shipped to China, but only 2,500 were sold and registered to drivers. (The company delivered 18,500 cars in the U.S. that year.) Publicly, Tesla blamed the gap on speculators who entered orders, then didn’t buy the Teslas once they shipped. But several former employees say the real problem was the lack of customer support. Says Ricardo Reyes, Tesla’s former communications chief: “I think Tesla took for granted that they were just going to succeed in China.” By December 2014, both Chang and Wu had left Tesla. Tesla executives in California griped privately that China wasn’t so unique that it demanded a different strategy. But not long afterward, the company began an apology tour that marked a turning point. On a frigid evening in January 2015, during the Detroit International Auto Show, Musk admitted China sales were “unexpectedly weak.” That spring, he traveled to China to meet with President Xi Jinping and other leaders, tweeting that he remained “very optimistic” despite “earlier mistakes.” Reyes offered a mea culpa at the Shanghai auto show in spring 2015, the first Chinese motor show that Tesla bothered attending: “I think we have been a little bit too impatient in the Chinese market.” It was as contrite as the company would get—and the news it was generating was about to get better. In 2015, Tom Zhu, a respected engineer responsible for China’s Supercharger network, became the top executive in the country. The company ended that year with a disappointing 3,700 cars sold, but there were slivers of optimism. For one thing, Tesla was building Supercharger locations in China at a faster pace than anywhere in the world, addressing consumers’ “charge anxiety.” About 120 Supercharger locations exist in China today, compared with 370 in the U.S., and Tesla says China will have more than 800 charging stations by the end of 2017. |

朱小姐開著特斯拉Model X穿過北京CBD。攝影師:亞當·迪恩——Panos Pictures為《財富》供圖

|

還有件事同樣重要:當時廣為傳播的信息是買特斯拉比買別的豪車容易。中國的汽車經(jīng)銷系統(tǒng)又稱“4S店”(4個S代表“服務、零部件、銷售和調(diào)研”),把持著寶馬、捷豹路虎和梅賽德斯-奔馳等奢侈品牌的渠道。4S店會以各種模糊的名目向顧客多收成千上萬美元費用。特斯拉的直銷展廳就跳出了這一系統(tǒng)。雖然進口關稅增加了成本,但調(diào)整匯率后其他方面特斯拉在中國的銷售跟在美國完全一樣。 朱小姐決定買Model X之前考察了其他三個品牌。她說,路虎經(jīng)銷商要多收30萬元(4.5萬美元)的標準費用;保時捷說要買凱宴SUV的多等三個月,還要多收10萬元。相反,特斯拉只是將她加入等待名單,沒有任何附加費用。“在中國,車象征著社會地位,所以大部分人都不在乎多花點錢,”朱小姐表示。“但我在意。我不喜歡白白多花錢。” 特斯拉車主還發(fā)現(xiàn)在車牌上也有優(yōu)勢。中國政府為解決擁堵污染的道路問題,決定限制車牌號發(fā)放。要想買車,司機得在搖號系統(tǒng)里等上好幾年。(2015年初北京有620萬人申請搖號,額度只有36757個。)即便搖到號,每周還有一天限行。 但由于政府鼓勵電動車,所以車牌要寬松得多。從2014年開始,上海允許電動車直接上牌,省下1.2萬牌照費,而且不用限行。其他城市也紛紛跟上,推動了中國電動車企業(yè)發(fā)展。如果沒有各地限制政策,“個人客戶才不會買電動車,”國企北京汽車工業(yè)控股有限公司新能源子汽車子公司副總經(jīng)理張勇表示。 各地限制政策對特斯拉也是大大好機會。前六個宣布電動車不受牌照限制的城市為:上海、北京、深圳、杭州、廣州和天津。據(jù)JL Warren Capital李君蘅分析,特斯拉銷量最高的城市為上海、北京、深圳、杭州、廣州和天津。 雖然政策有助于Model S轎車銷售,但特斯拉還是很快意識到Model X在中國前景更好。近十年來,中國人都很迷SUV,而且愈演愈烈。SUV之所以受歡迎有幾個原因:國產(chǎn)車有些型號不錯;車里空間大,能坐下一大家人;人們多認為SUV更安全;另外SUV更貴可以彰顯身份。德國豪車制造商保時捷在中國賣得最好的并不是運動超跑,而是Macan SUV。 到了2015年,SUV已成中國汽車市場上唯一增長的車型。2016年上半年,SUV占了乘用車銷量的35%;所以特斯拉2016年6月向中國交付第一輛Model X之后銷量同步增長,也就能解釋了。2016年下半年隨著SUV出廠,特斯拉銷量為7670輛,約為中國市場全年銷量四分之三。特斯拉的銷量終于跟上了聲勢。 在中國的外企都要跟政府搞好關系,特斯拉在這方面小心翼翼。跟蘋果一樣,特斯拉也因中國制造的零部件需求高而新建工廠,主要是汽車上的大觸摸屏。2015年,朱曉彤曾表示特斯拉將在中國制造的零部件上支出翻倍,承諾當年購買價值5億美元的產(chǎn)品;類似支出今后只會越來越多。 更重要的問題是特斯拉會不會,或者什么時候宣布在中國建廠。每一家在中國銷量高的汽車生廠商,包括梅賽德斯-奔馳和寶馬都跟本地企業(yè)成立了合資公司。幾十年來政府一直如此要求。進口車要支付高額費用,特斯拉車主都能深刻感受到。Model 3轎車在美國起售價為3.5萬美元,到中國加了25%的關稅和17%的增值稅后價格變成5萬美元,對中產(chǎn)階級買家來說是個不小的負擔。“如果不打算在本地生產(chǎn),想保持業(yè)績挺難的,”曾負責克萊斯勒東北亞地區(qū)事物,上海高峰咨詢董事總經(jīng)理比爾·魯索表示。 建廠問題上,特斯拉一直守口如瓶。汽車行業(yè)協(xié)會官員董揚表示,已經(jīng)有幾家潛在合作企業(yè)在找特斯拉談,也有多個省市希望特斯拉能合作建廠:“條件一個比一個開得好,”董揚說。今年5月,馬斯克表示到今年年底特斯拉會進一步明確在中國建廠的事宜。公司發(fā)言人拒絕透露更多信息。 特斯拉猶豫可能是因為現(xiàn)在的銷售數(shù)字略顯尷尬。常駐香港的彭博行業(yè)研究分析師史蒂夫·曼恩表示,如果每年制造汽車不到10萬輛,就沒必要在中國建廠。特斯拉在加州弗里蒙特的工廠每年可出產(chǎn)50萬輛。即便今年中國銷量翻倍,也就剛超過2萬輛。擺在眼前的是類似“第22條軍規(guī)”窘境:如果不在本地建廠就沒法降價推動銷售,按如果銷售上不去在本地建廠就不劃算。 知識產(chǎn)權保護也是個讓人頭疼的問題。批評中國商業(yè)界的人士表示,特斯拉如果在中國建廠,很快就會遇到知識產(chǎn)權失竊的問題。“是的,一定會有技術被偷走,”加州大學伯克利分校研究中國汽車市場的講師克里斯托兒·張表示。但張補充說技術失竊的風險也沒那么大。“只是盜走技術并不意味著(對手)能變成競爭者,”她表示,“還是要看品牌。” 現(xiàn)在已有十多家中國資本支持的電動車制造商(很多原本是美國創(chuàng)業(yè)公司,被中國人收購了)緊追慢趕,拼命推廣自家的電動車,比拼加速時間;Faraday Future、卡瑪汽車、蔚來汽車和Future Mobility只是其中幾家。不過未來幾年里大部分都會停留在概念車或者原型車階段,眼睜睜看著特斯拉搶占中國市場。 正是因為技術領先,特斯拉才有可能跟中國政府爭取到優(yōu)惠條件然后建廠造車。而中國不僅熱愛特斯拉的技術,還希望引進其管理經(jīng)驗。其實特斯拉已經(jīng)向申請者公開專利,所以馬斯克很有可能同意分享更多信息,推動特斯拉汽車在中國進一步拓展。 |

Just as important: Word was getting out that buying a Tesla was easier than buying other luxury cars. In China, dealerships known as “4S stores” (for “service, spare parts, sale, and survey”) largely corner the market for popular luxury brands like BMW, Jaguar Land Rover, and Mercedes-Benz. The stores inflate costs for consumers by tens of thousands of dollars with various vague fees. Tesla’s direct-sales showrooms eschew that system. And while import tariffs increase their overall cost, Tesla otherwise prices its cars in China at the same level that it does in the U.S. after currency adjustments. Vanessa Zhu visited three other brands before she settled on her Model X. The Range Rover dealership asked for an additional 300,000 yuan ($45,000) as its standard fee, she says; Porsche told her she had to wait three months for its Cayenne SUV and required a 100,000-yuan delivery fee. Tesla in contrast, put her on a one-size-fits-all waiting list and didn’t impose fees. “In China, a car is a symbol of your status, so most people don’t care what you pay in terms of those extra fees,” Zhu says. “But I do care. I don’t like it.” Tesla owners also found out they could beat China’s bureaucracy in the license-plate game. China’s local governments restrict the number of drivers on their clogged, polluted streets by controlling the number of plates issued. Drivers have to wait years to get one through a lottery system. (In early 2015, 6.2 million people applied for just 36,757 available Beijing plates.) And once drivers get a plate, they are barred from driving one day a week. But plates for electric cars now fall under different rules, thanks to the government’s push for electric vehicles. Beginning in 2014, Shanghai allowed electric-car drivers to get a license plate without facing a wait, a $12,000 plate fee, or driving restrictions. Other cities followed suit, and such policies became a boon for China’s electric-car makers. Without them, “there’s no possibility that private consumers would buy these vehicles,” says Zhang Yong, deputy general manager at the electric-car offshoot of state-owned Beijing Automotive Industry Holding Co. The policies were game changers for Tesla too. The first six cities in China to have exempted electric vehicles from license plate restrictions: Shanghai, Beijing, Shenzhen, Hangzhou, Guangzhou, and Tianjin. The cities with the highest Tesla sales, according to Junheng Li of JL Warren Capital: Shanghai, Beijing, Shenzhen, Hangzhou, Guangzhou, and Tianjin. While the policies helped sell Model S sedans, Tesla realized quickly that the Model X would be a much bigger story in China. China’s obsession with SUVs is 10 years old and going strong. Their popularity stems from a variety of factors: Domestic ?makers produce good models; their seating can accommodate an entire extended family; they’re widely believed to be safer; and their higher prices imbue status. German luxury-car maker Porsche’s bestselling vehicle in China isn’t a sports car but its Macan SUV. By 2015, SUV sales were the only growing part of the Chinese auto market; in the first half of 2016, SUVs accounted for 35% of passenger-vehicle sales. It’s no coincidence, then, that a spike in Tesla sales coincides exactly with the first Model X deliveries in China, in June 2016. In the second half of last year, with the SUV available, Tesla notched 7,670 sales—about three-quarters of its total for the year in China. Tesla’s sales had finally caught up to its hype. Close government relations are a must in China for foreign companies, and Tesla has carefully cultivated them. Like Apple, Tesla has created new businesses thanks to its demand for Chinese-made components, particularly its cars’ giant touch screens. In 2015, Tom Zhu said Tesla would double its spending on Chinese-made parts, committing to buying $500 million worth of supplies from Chinese companies that year; such spending has likely only skyrocketed. The far bigger question mark is whether, and when, Tesla will announce plans for a factory in the country. Every car brand with significant China sales—including luxury-auto makers like Mercedes-Benz and BMW—runs a joint venture with a local partner. The government has required as much for decades. Imported cars face hefty fees, as Tesla owners are painfully aware. A Model 3 sedan’s $35,000 starting price in the U.S. becomes $50,000 in China after a 25% tariff and 17% value-added tax—a heavy lift for a middle-class buyer. “If they don’t announce plans for local production, they will struggle to sustain this performance,” says Bill Russo, former head of Chrysler North East Asia and managing director of Gao Feng Advisory in Shanghai. Tesla remains cagey about what those plans could look like. Dong Yang, the auto lobby official, says several potential local partners are courting the company, and that multiple provinces and municipalities want Tesla to build a plant with them: “They all offer better and better options,” Dong says. In May, Musk said Tesla would more clearly define its plans for China production by the end of this year; a spokesman declined to give further details. Tesla may be hesitating because of today’s sales numbers. If you build fewer than 100,000 vehicles a year, it doesn’t make sense to manufacture in China, says Steve Man, analyst at Bloomberg Intelligence in Hong Kong. Tesla’s factory in Fremont, Calif., can churn out more than 500,000 vehicles annually. Even if it doubles China sales this year, Tesla will just pass 20,000 cars. It faces a catch-22: It won’t sell cars at lower prices that drive sales if it doesn’t produce them locally, but local production won’t be economical until sales rise drastically. Intellectual property is a looming headache as well. Critics of Chinese business practices argue that Tesla faces certain IP theft as soon as it brings manufacturing into China. “Yes, some of its tech will be stolen,” says Crystal Chang, a lecturer at University of California at Berkeley who studies China’s auto market. But Chang adds that the danger inherent in that theft is overstated. “Just stealing tech does not make [a rival] a competitor,” she says. “It’s all about brand.” Today more than a dozen Chinese-backed manufacturers (many of them American startups that now have Chinese owners) are tripping over one another to promote their electric cars and acceleration times; Faraday Future, Karma Automotive, NextEV, and Future Mobility are but a few. But most are likely to be stuck in the concept or prototype phase for the next several years—even as Teslas zip across China. That’s one reason Tesla may be able to reach an agreement to produce cars in the country on favorable terms. China lusts after Tesla’s technology but also its management practices. And Tesla already offers its patents to anyone who asks—making it highly plausible that Musk would agree to more information-sharing in return for a vastly expanded market for Tesla’s cars. |

|

有一家中國巨頭看起來極為看好特斯拉的前景。3月底,跟政界聯(lián)系緊密的科技巨頭騰訊宣布斥資18億美元買入特斯拉的股票,騰訊最近躋身全球十大上市公司之列。之后不久,特斯拉市值超越通用汽車,成為美國最值錢的汽車公司。 最近一個周日晚,三十多位潛在買家齊聚北京特斯拉展廳品酒。這些人大部分三十多歲,非常富有而且關心環(huán)境,但多數(shù)對特斯拉品牌比較敬畏。特斯拉的買家圈子正日益擴大,從富裕人群拓展到富豪。杰夫·于家里做酸奶生意,原本打算買輛梅賽德斯-奔馳SUV或瑪莎拉蒂,感覺太浮華了。“特斯拉很有科技感,符合我的口味,”他說。 做音響設備生意的艾文·曲身材頎長,穿著一件設計師襯衫,手上戴著手串。他認為,如果下次跟大客戶中央電視臺高層談生意時開著特斯拉去,散發(fā)的環(huán)保氣質(zhì)會有幫助。“開這種車能幫我多談成生意,”他說。他在特斯拉官網(wǎng)上定制了海藍色的Model X,總價120萬元(17.5萬美元)。 一位侍者往曲的酒杯里斟滿酒,背后循環(huán)播放著特斯拉的廣告,跟他的遠大抱負交相輝映。廣告里一遍遍說著,“選擇特斯拉綠色汽車,享受未來更美好的生活。”(財富中文網(wǎng)) 本文節(jié)選自2017年6月15日出刊的《財富》雜志。 譯者:Charlie 審稿:夏林 |

One big Chinese corporate player seems to have no doubt about Tesla’s prospects. In late March, Tencent, the politically connected technology giant that recently became one of the world’s 10 largest publicly traded companies, said it spent $1.8 billion buying Tesla stock. Not long afterward, Tesla’s market capitalization edged past that of General Motors, making it the most valuable American automaker. On a recent Sunday night, three dozen prospective buyers gather in a Tesla showroom in Beijing for a wine tasting. The crowd of mostly thirtysomethings skews wealthy, and cares some about the environment, but they’re mostly in awe of the brand. Tesla’s buyers’ circle has expanded to include the rich along with the very rich. Jeff Yu, whose family runs a yogurt business, thought about buying an SUV from Mercedes-Benz or Maserati, but was put off by their glitz. “Tesla is a tech thing. That’s my taste,” he says. Evan Qu, a slim man sporting a designer shirt and Buddhist wrist beads, sells audio equipment; he thinks executives at his biggest customer, CCTV, the central broadcaster, will appreciate the environmentalist aura of the Tesla when he rolls up to their next meeting. “This car helps you get more deals,” he says. On Tesla’s website, he’s customized his Model X—color: ocean blue—for a total cost of 1.2 million yuan ($175,000). A waiter refills Qu’s glass as a promotional video on a loop in the background underscores his aspirations. Choose a Tesla green vehicle, it says, over and over, to advance a better life in the future.? A version of this article appears in the June 15, 2017 issue of Fortune with the headline "Tesla Makes a U-Turn in China." |