Airbnb與Uber,誰更強?

|

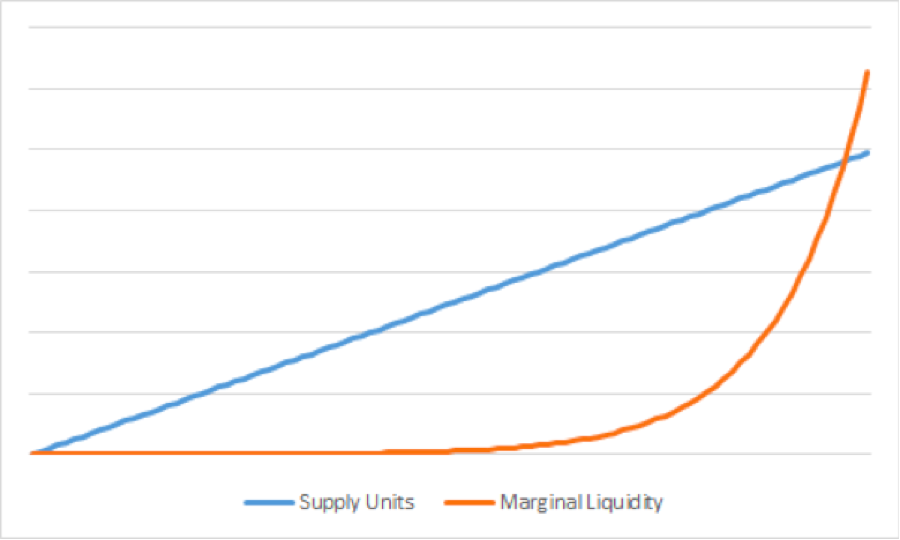

2017年年初以來,公關問題一直讓叫車服務提供商Uber頭疼不已,而這只是一種溫和的說法。從網上的卸載Uber運動,到數量猛增的性騷擾索賠,再到該公司躲避執法調查的Greyball軟件遭曝光,Uber發現自己一反常態地不穩定。同時,受到批評的不光是Uber的文化。泄露的財務信息顯示,該公司2016年虧損高達30億美元,這體現出了Uber在美國以及海外叫車服務市場遇到的困難。 盡管如此,Uber仍是互聯網上最大的交易場所之一,而且就其規模和成熟度將要觸及的拐點而言,大多數處于這種狀態的公司都會在2018年上市。 有意思的是,Airbnb有可能沿著類似路徑前進,但這兩家在按需經濟中取得了驚人進展的年輕公司可能有著天壤之別。 2008年成立以來,Airbnb的成長一直都沒遇上什么真正的競爭。隨著一間間新的房屋加入Airbnb平臺,對初來乍到的競爭對手來說,成長和從前者手中奪取市場份額的難度已經顯著增大。2011年至今,Airbnb的地位一直沒有受到過真正的挑戰。在這一年,Airbnb完成了B輪融資,最接近它的競爭對手HomeAway則首發上市。 與之相反,雖然Uber在叫車軟件領域處于主導位置,但在它進入的所有主要市場中,Uber實際上都面臨著激烈競爭。在美國,Lyft仍和Uber齊頭并進。同時,Uber已經牢牢把握的主導性市場份額仍不足遏制新生力量的出現,比如紐約市的叫車服務軟件Juno。在國外,Uber的仗更難打,特別是在中國——Uber和滴滴出行那場頗為公開的爭奪以Uber敗北告終。 雖然不再和滴滴開戰,但Uber仍在和其他主要競爭對手抗衡,比如印度的Ola Cabs、東南亞的Grab和拉美的Easy Taxi。此外,旨在征服全球市場的Uber預計還會出現巨額虧損。 Airbnb和Uber的差異對今天的創業者來說是重要的一課。投資者也可以從中窺見兩家公司今后幾年的表現。Airbnb面臨的競爭比Uber少,主要原因在于所提供產品和服務的獨特性。就Airbnb來說,這個平臺上的公寓或住宅基本上各不相同,比如所在位置、家具、裝飾、價格和服務質量等。換句話說,Airbnb提供的是差異化的產品和服務。 Uber則相反,和大多數叫車軟件一樣,它提供的是大體類似的,或者說同質化服務,因此不像Airbnb那樣在市場上有競爭力。比如,就怎樣把顧客從A點送到B點來說,Uber的車輛和司機較為相似。雖然一些細微差別偶爾會變得很重要,比如車子是否夠大,可以坐下五名乘客而不是一、兩名,或者它是否方便坐輪椅的乘客上下,但Uber的單位產品/服務基本上如出一轍。 在今天的投資者和消費者眼中,Airbnb和Uber在市場地位和未來增長潛力上的主要差距正是源于二者在供應層面的這個基本區別。 更廣義地說,如果市場上的產品和服務存在明顯差異,起步就極為困難,因為消費者提出的要求可能相當多樣。舉例來說,如果Airbnb想讓一位消費者實施交易,就需要在后者的預算范圍內于恰當的時間,在恰當的城市和社區提供帶有恰當家具而且可供住宿的場所。 匹配供需是個棘手問題,但Airbnb拿出了很好的解決方案。理論上,一個市場可進行匹配的水平被稱為流動性,如果房東和租客所在的城市不同,情況就會變得更復雜。最初,Airbnb面臨的困難在于讓合適的房東(打算出租房屋的人)找到合適的租客,原因是雙方經常住在不同的城市。為做到這一點,Airbnb必須在一個城市取得供應,同時預測另一個城市的需求。剛剛成立時,Airbnb得以完成這項任務的途徑是關注住宿需求高度集中的事件,比如2008年在丹佛召開的民主黨全國代表大會(DNC)。當時,丹佛大多數酒店都預定一空,而且消費者的住宿意愿很強烈,具體表現就是他們在Airbnb搜索和DNC、住宿以及丹佛有關的出租信息。Airbnb提供的解決辦法很完美。 隨著Airbnb吸納的供應(住宅)不斷增多,匹配房東和租客的可能性緩慢上升,從而加大了競爭對手的追趕難度。從下圖可以看出,隨著Airbnb供應的增長,每一單位新增供應都會提高流動性,競爭對手追趕起來就會難得多。因此,對于Airbnb這樣的供應異質化交易場所來說起步也許很難,但隨著供應增多,回報將不斷上升,達到一定規模后就會具有難以想象的防御性。 |

So far, 2017 has been a non-stop PR headache for Uber, and that’s putting it mildly. From the online #DeleteUber campaign to explosive sexual harassment claims against the ride hailing company to the public discovery of Uber’s Greyball program, the company finds itself on uncharacteristically shaky grounds. And it’s not just Uber’s culture that’s under attack. Leaked financial information that Uber lost as much as $3 billion in 2016 reflects the difficulties Uber has faced in the ride-hailing market in the U.S. and abroad. Nonetheless, Uber is one of the largest Internet marketplaces ever created — and it’s hitting a scale and maturity inflection point that would, for most companies, point toward a public offering in 2018. Interestingly, Airbnb could head toward a similar trajectory, but these two young companies that have made incredible headway across the on-demand economy couldn’t be more different. Since its creation in 2008, Airbnb has been able to grow without much real competition. With every new property or unit entering the Airbnb platform, it becomes that much harder for an ankle-biter competitor to grow and take share from the company. Airbnb hasn’t experienced a real challenge to its position since 2011, when it raised its Series B and its closest competitor, HomeAway, went public. By contrast, while Uber dominates the market for ride-hailing apps, it has actually experienced fierce competition in just about every major market it has entered. In the U.S., Lyft continues to give it a run for its money. And Uber’s established, dominant market share still hasn’t been enough to prevent newer entrants, like Juno in New York City, from popping up. Internationally, the battle has been even harder-fought, particularly in China, where Uber lost a much publicized battle with Didi Chuxing. While Uber is no longer battling Didi, it is still butting up against major competitors like Ola Cabs in India, Grab in Southeast Asia, and Easy Taxi in Latin America — and major financial losses are expected to continue in its quest to conquer global markets. The contrasts between Airbnb and Uber serve as important lessons for today’s startup entrepreneurs. It also offer investors a glimpse for how both companies will perform years from now. The main reason Airbnb faces less competition than Uber comes down to the uniqueness of products and services both offer. In Airbnb’s case, each apartment or house on the platform is largely unique based on factors like location, furniture, design, price point, quality of service, etc. In other words, Airbnb offers a heterogenous supply of products and services. Conversely, Uber, like most ride-hailing apps, offers a largely similar or homoegenous set of services and therefore aren’t as competitive in the marketplace. For instance, Uber’s cars and drivers are relatively similar in terms of how they get the customer from point A to point B. While there are some subtle variances that become important from time to time, like whether the car is large enough to fit five passengers instead of one or two, or whether it has wheelchair access, Uber’s unit of product/service is basically the same. And it’s this basic difference in supply that accounts for the majority of differences investors and consumers see today with respect to Airbnb and Uber’s market positions, and their future growth potential. More broadly, a marketplace in which the products and services offered vary widely can be extremely hard to jump-start because the demands from costumers can be quite diverse. For example, if Airbnb wants a customer to transact, they need a space available in the right city and neighborhood, at the right time, with the right furnishings, and within the budget a customer has set. Matching supply and demand is tricky, but Airbnb has offered a good solution. Conceptually, the degree to which a match can be made in a marketplace is known as liquidity, and this gets more complicated when the host and renter are often located in different cities. Initially, the challenge for Airbnb was matching the right hosts (people looking to rent their properties) with the right renters, since both were often based in different cities. To do that, Airbnb had to acquire supply in one city, while predict demand in another. Airbnb was able to figure this out in its early days by focusing on events with a high degree of concentrated lodging demand, such as the 2008 Democratic National Convention in Denver. Most of the hotels in Denver at the time were booked, and consumers demonstrated high intent by searching on Airbnb for terms related to the DNC, lodging and Denver. Airbnb offered the perfect solution. As Airbnb continued to onboard more supply (properties), the likelihood of matching hosts with renters grew slowly, making it harder for competitors to catch up. Below, the chart shows that as Airbnb’s supply grew, each new unit of supply provided more liquidity, making it that much more difficult for competitors to catch up. So, while marketplaces with heterogeneous supply like Airbnb may be difficult to jump-start, they yield increasing returns as their supply increases, which make them incredibly defensible at scale. |

Airbnb的供應規模(藍線)和邊際流動性。

?

|

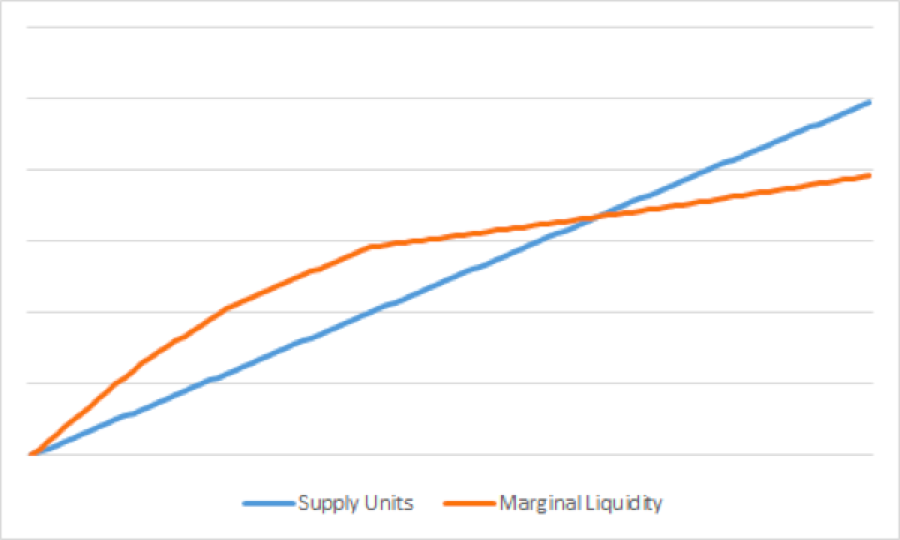

相反,競爭對Uber的同質化供應產生影響要容易得多。剛起步時,服務和產品基本相同的交易場所不那么復雜,建立的難度可能要小得多,資金效率也可能要高的多。就Uber而言,它負擔的司機數量有可能達到臨界規模,從而在供應(上路的車輛)上實現高點起步,需求也在緩慢增長。由于單位供應大致相同,匹配司機和乘客的可能性就較高。這就意味著流動性迅速上升,原因是消費者需要的只是一輛來接他們,然后安全并及時地將其送到目的地的汽車。 每增加一輛車和一名司機,Uber就可以縮短等待時間并降低價格。但在某個點上,它的流動性就不再產生回報,因為等待時間不再縮短,價格也不再下降。出現這種情況后,市場就會對所有小型競爭對手敞開大門,前提是它們的服務有競爭力,能為消費者提供有吸引力的替代出行方案。下圖就展示了這樣的情況。 |

By contrast, Uber’s homogeneous supply is much more vulnerable to competition. In the early days, a marketplace that generally offered the same services and products is less complicated and can be much easier and more capital-efficient to build. In the case of Uber, the company could afford to pay a critical mass of drivers to jump-start its supply (cars on the road) and slowly build up demand. Since each unit of supply is largely similar, the likelihood of matching a driver with a passenger is relatively high. This means liquidity improves quickly, since a consumer just needs ANY car to pick them up and safely take them to the final destination in a timely manner. With every car and driver Uber adds to its fleet, it is able to reduce wait times and prices. But at a certain point, its liquidity stops paying off, as wait times and prices stop falling. When this happens, the market opens for any small competitor to offer a competing service and an attractive alternative for consumers. Below, the graph shows how this could look. |

Uber的供應規模(藍線)和邊際流動性。

|

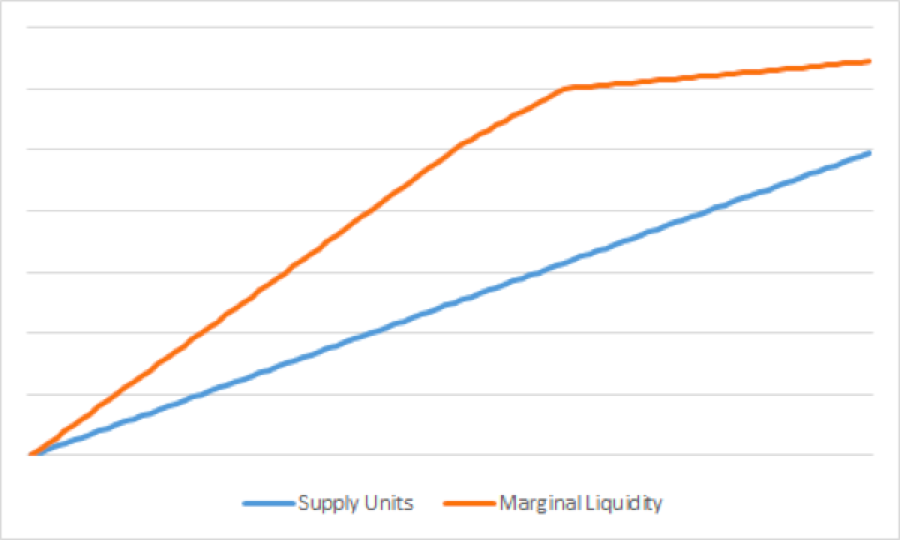

現在把多人拼車服務Uber Pool考慮進來,它讓陌生人一起拼車,也讓流動性曲線有所改變。這項服務在規模較大時效果較好,原因是Uber需要比如說三個人,而不是一個人,而且這三個人要同時去差不多同一個地方才能拼車。在這種情況下,競爭者更難以讓每輛車的乘客人數達到Uber的水平。Uber Pool提高了流動性門檻,競爭對手需要燒更多的錢才能達到圖中桔黃色流動性曲線變平的那個點。 |

Factor in the Uber Pool service, through which strangers carpool together, and it changes the liquidity curve a bit. This service works better at scale, since Uber needs, say, three people—not just one—headed to roughly the same place at the same time to create a carpool. In this scenario, it’s harder for competitors to generate the same amount of riders per vehicle as Uber. The liquidity bar is raised with Uber Pool, requiring competitors to burn more capital to get to the point in the graph where the orange liquidity line flattens out. |

Uber Pool的供應規模(藍線)和邊際流動性。

?

|

上述分析表明Airbnb的交易場所比Uber的交易場所更有防御性。如果競爭對手想推出可以與之抗衡的服務,就必須在全球范圍內積累同樣數量的供應(房屋),這樣才能對租客要去的那個城市中的待出租房屋進行匹配。然而,就Uber來說,競爭對手只需在當地市場具備與之相當的供應,就可以達到邊際流動性開始變平的那個點。 我們認為,Uber將面臨持續的全球性競爭,在它進入的每一個大城市都是如此;Airbnb則有可能以相對壟斷的方式實現增長。在競爭非常激烈的市場中,Uber仍然可以獲勝,原因是它擁有令人望而卻步的資金和規模。在一段時間里,Uber仍然可以保持較高的顧客和供應獲取成本以及較低的毛利潤率,其競爭對手則無法做到這一點。不過,Uber已經陷入混戰,今后需要使用所有可以調動的武器。 作者:Deepak Ravichandran、Jeff Lu、Roger Lee 譯者:Charlie 審稿:夏林 杰夫·盧是硅谷投資機構Battery Ventures副總裁。迪帕克·拉維奇安德蘭和羅杰·李分別是該公司合伙人和普通合伙人。三位作者及Battery Ventures均未對Uber、Airbnb以及本文提到的其他公司投資。 |

What this shows is that Airbnb’s marketplace is more defensible than Uber’s. If a competitor wants to offer a service that is competitive, it would have to accumulate the same amount of supply (properties) on a global scale as Airbnb so that it is able to match host properties located in a city that the renter is looking to visit. With Uber, however, a competitor only needs to have as much supply on a local scale to get to the point where the marginal liquidity starts to flatten. We think Uber will experience sustained global competition in every major city it enters, while Airbnb could grow relatively monopolistically. Uber can still win in its most competitive markets because of its formidable cash position, and its scale. The company can sustain high customer- and supply- acquisition costs, and low gross margins for a period of time that its competitors will not be able to match. Nonetheless, Uber is in a dog fight and will need to use every weapon it has at its disposal. |